New Chapter 11 Bankruptcy Filing - Golden Eagle Entertainment $ENT

Golden Eagle Entertainment

July 22, 2020

Suffice it to say, high correlation to the airline and cruiseline industries is a credit negative these days. A few months ago Speedcast — a provider of information technology services and (largely satellite-dependent) communications solutions (i.e., cybersecurity, content solutions, data and voice apps, IoT, network systems) to customers in the cruise, energy, government and commercial maritime businesses — discovered this the hard way and free fell into bankruptcy court. There’s still no resolution of that case. Similarly, Global Eagle Entertainment Inc. ($ENT), a business that generates revenue by (i) licensing and managing media and entertainment content and providing related services to customers in the airline, maritime and other “away-from-home” nontheatrical markets, and (ii) providing satellite-based Internet access and other connectivity solutions to airlines, cruise ships and other markets, couldn’t avoid trouble once COVID-19 shutdown its core end users. No monthly recurring revenue model can save a company when its clients are effectively closed for business AND there’s $855.6mm of funded debt to service. Not to state the obvious.

Things may get worse before they get better. The company’s largest customer is Southwest Airlines Co. ($LUV) (21% of overall revenue) and it has a pretty bearish take on …

TO READ THE REST OF THIS POST, YOU MUST BE A PETITION MEMBER. YOU CAN BECOME ONE HERE.

Jurisdiction: D. of Delaware (Judge Dorsey)

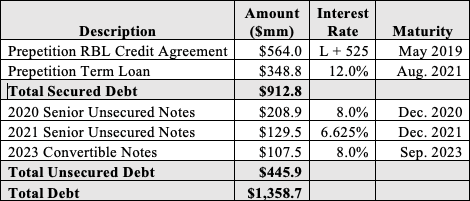

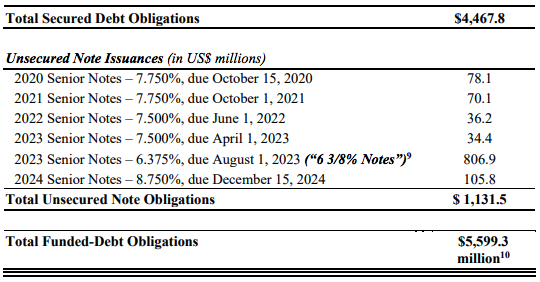

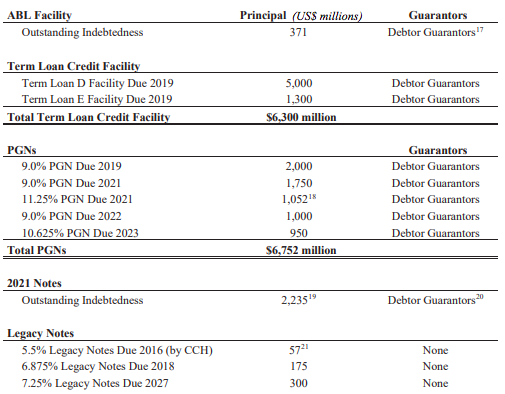

Capital Structure: $85mm RCF, $503.3mm TL, $188.7mm second lien notes, $82.5mm unsecured convertible notes.

Professionals:

Legal: Latham & Watkins LLP (George Davis, Madeleine Parish, Ted Dillman, Helena Tseregounis, Nicholas Messana, Eric Leon) & Young Conaway Stargatt & Taylor LLP (Michael Nestor, Kara Hammond, Betsy Feldman)

Financial Advisor: Alvarez & Marsal LLC

Investment Banker: Greenhill & Co. Inc.

Claims Agent: Prime Clerk LLC (*click on the link above for free docket access)

Other Parties in Interest:

Prepetition First Lien Admin Agent & DIP Agent: Citibank NA

Legal: Weil Gotshal & Manges LLP (David Griffiths, Bryan Podzius)

Ad Hoc DIP & First Lien Lender Group: Apollo Global Management, L.P., Eaton Vance Management, Arbour Lane Capital Management, Sound Point Capital Management, Carlyle Investment Management LLC, Mudrick Capital Management, BlackRock Financial Management, Inc.

Legal: Gibson Dunn & Crutcher LLP (Scott Greenberg, Michael Cohen, Jason Goldstein) & Pachulski Stang Ziehl & Jones LLP (Laura Davis Jones, TImothy Cairns)

Second Lien Agent: Cortland Capital Market Services LLC

Second Lien Noteholders: Searchlight Capital Partners LP

Legal: Paul Weiss Rifkind Wharton & Garrison LLP (Alan Kornberg, Michael Turkel, Irene Blumberg, Elizabeth Sacksteder) & Richards Layton & Finger PA (Daniel DeFranceschi, Zachary Shapiro)

Southwest Airlines Inc.

Legal: Vinson & Elkins LLP (William Wallander, Paul Heath, Robert Kimball, Matthew Struble) & Saul Ewing Arnstein & Lehr LLP (Lucian Murley)

AT&T Corp.

Legal: Arnold & Porter Kaye Scholer LLP (Brian Lohan) & Morris Nichols Arsht & Tunnell LLP (Derek Abbott, Brett Turlington)

Terry Steiner International

Legal: Loeb & Loeb LLP (Daniel Besikof, Geneva Shi)

Telesat International Limited

Legal: Hodgson Russ LLP (Garry Graber)

Nantahala Capital Management LLC

Legal: King & Spalding LLP (Arthur Steinberg, Scott Davidson) & The Rosner Law Group LLC (Frederick Rosner, Jason Gibson)