New Chapter 11 Bankruptcy Filing - LBI Media Inc.

LBI Media Inc.

November 21, 2018

Happy Thanksgiving y’all!! LBI Media Inc. and several affiliates FINALLY filed for bankruptcy today in the District of Delaware after years of questions about its financial health. The company is a privately held minority-owned Spanish-language broadcaster that owns or licenses 27 Spanish-language television and radio stations in the largest US markets; it services the largest media markets in the nation, including Los Angeles, New York City, Chicago, Miami, Houston and Dallas. It is also a victim of disruption.

The company notes that it has “faced the market pressures that have broadly affected U.S. television and radio broadcasters, including the 2008 recession and the diversion of advertising spend by companies to digital media.” Insert Facebook Inc. ($FB) here. That’s not all, though, of course: the company is also hampered by “a substantial debt load and corresponding interest expense obligations” which has stunted LBI’s financial performance, ability to invest and grow, and liquidity.

To address this situation, the company obtained an investment from its now-DIP lender, HPS Investment Partners, in April 2018 for a new first lien credit facility. This provided the company with much needed liquidity and, in turn, briefly extended the company’s runway out of bankruptcy court. The “make-whole” provision attached to the facility, however, became the subject of much controversy and an ad hoc group of second lien noteholders sued in New York state court for an injunction to hinder the transaction. Ultimately, the state court denied the noteholders.

But…but…the noteholders persisted. And this, apparently, left a bitter taste in the mouth’s of company management (and its counsel). Junior Noteholders, meet bus. 🚌🚌 The company notes:

Following the closing of the transaction, LBI sought to continue its growth efforts. However, such efforts were weakened by the Junior Noteholder Group, which continued to litigate against the Company, its founder and CEO, and HPS, the Company’s sole senior lender. The Junior Noteholder Group commenced multiple lawsuits, and threatened several more, distracting management from operations. These actions and threats not only hindered the Debtors’ efforts to improve their operations, but certain actions, including seeking to enjoin the first lien financing, risked pushing LBI into a precipitous freefall bankruptcy.

When coupled with the Debtors’ tightening liquidity (which was exacerbated by the expense of the Junior Noteholder Group litigation), the Junior Noteholder Group’s actions made it substantially more difficult for LBI to achieve the growth it had hoped for, and the Company determined that a comprehensive reorganization may be necessary.

Thereafter, settlement talks with the Junior Noteholders proved unsuccessful and, now, therefore, the company marches into bankruptcy court with a Restructuring Support Agreement (“RSA”) in hand with HPS whereby, subject to a “fiduciary out,” HPS will serve as (prearranged but hardly set in stone) Plan sponsor and swap its $233mm first lien senior secured notes for a majority equity interest in the company. The Plan — which at the time of this writing isn’t on the docket yet — reportedly provides for recoveries for other “supporting” constituencies. What’s that we hear? IT’S A (DEATH) TRAP!?!

(PETITION NOTE: for the uninitiated, a “death trap plan” is an inartful term for when the Debtor proposes and the senior lenders allows a recovery to trickle down the “priority waterfall” to junior lenders but only on account of said junior lenders’ support of, or vote for, the proposed Plan. In essence, its consideration for dispensing with “holdup value.” A “fiduciary out” gives the Debtor flexibility to, despite the RSA, agree to an alternative transaction that bests the HPS transaction without penalty or the need to pay a “break-up fee.”).

The plan provides the company with 75-day period to run a marketing process. While the company will market the company to potential strategic and financial investors, it is also making overtures to the Junior Noteholders to take out HPS’ claim(s) (without needing to satisfy the make-whole) and become the Plan sponsor such that it could walk away with 100% equity in the company.

All of which is to say: don’t let the terms “RSA” and “Plan” fool you. This is far from a consensual case being presented to the Bankruptcy Court Judge wrapped up in a shiny bow. The Junior Noteholders have been fighting the company and HPS for months: there is no reason to suspect that that will stop now merely because the company is a chapter 11 debtor.

Jurisdiction: D. of Delaware (Judge Lane)

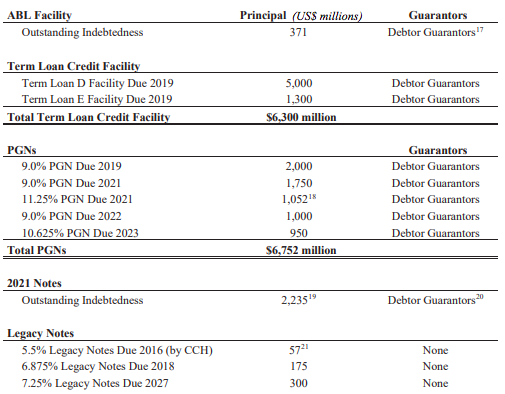

Capital Structure: $233mm 10% ‘23 senior secured notes, $262mm 11.5/13.5 ‘20 PIK toggle second priority secured notes, $27.95mm 11% ‘22 PIK unsecured Intermediate senior Holdco notes (TMI Trust Company), $8.46mm 11% ‘17 unsecured Holdco notes (U.S. Bank NA)

Company Professionals:

Legal: Weil Gotshal & Manges LLP (Ray Schrock, Garrett Fail, David J. Cohen) & (local) Richards Layton & Finger PA (Daniel DeFranceschi)

Board of Directors: Jose Liberman, Lenard Liberman, Winter Horton, Rockard Delgadillo, Peter Connoy, Neal Goldman

Financial Advisor: Alvarez & Marsal North America LLC

Investment Banker: Guggenheim Securities LLC

Claims Agent: Epiq Corporate Restructuring LLC (*click on company name above for free docket access)

Other Parties in Interest:

Prepetition First Lien & DIP Lender: HPS Investment Partners LLC ($38mm)

Legal: Paul Weiss Rifkind Wharton & Garrison LLP (Paul Basta, Jeffrey Safferstein, Sarah Harnett) & (local) Young Conaway Stargatt & Taylor LLP (Pauline Morgan, M. Blake Cleary)

First Lien Trustee: Wilmington Savings Fund Society FSB

Legal: Morrison & Foerster (Jonathan Levine) & (local) Ashby & Geddes PA (William Bowden)

Collateral Trustee for First Lien Notes: Credit Suisse AG

Legal: Locke Lorde LLP (Juliane Dziobak)

Ad Hoc Group of (Junior) Second Lien Noteholders

Legal: Willkie Farr & Gallagher LLP (Rachel Strickland)

Ad Hoc Group of Holdco Noteholders

Legal: Landis Rath & Cobb LLP (Matthew McGuire)

Updated 11/21/18 at 8:27 CT