August 16, 2019

Retail, retail, retail.

Brutal. Absolutely B.R.U.T.A.L.

Avenue Stores LLC, a speciality women’s plus-size retailer with approximately 2,000 employees across its NJ-based HQ* and 255 leased stores,** is the latest retailer to find its way into bankruptcy court. On Friday, August 16, Avenue Stores LLC filed for chapter 11 bankruptcy in the District of Delaware. Like Dressbarn, another plus-size apparel retailer that’s in the midst of going the way of the dodo, any future iteration of the Avenue “brand” will likely exist only on the interwebs: the company intends to shutter its brick-and-mortar footprint.

What is Avenue? In addition to a select assortment of national brands, Avenue is a seller of (i) mostly “Avenue” private label apparel, (ii) intimates/swimwear and other wares under the “Loralette” brand and (iii) wide-width shoes under the “Cloudwalkers” brand. The company conducts e-commerce via “Avenue.com” and “Loralette.com.” All of this “IP” is the crux of the bankruptcy. More on this below.

But, first, a digression: when we featured Versa Capital Management LP’s Gregory Segall in a Notice of Appearance segment back in April, we paid short shrift to the challenges of retail. We hadn’t had an investor make an NOA before and so we focused more broadly on the middle market and investing rather than Versa’s foray into retail and its ownership of Avenue Stores LLC. Nevertheless, with the benefit of 20/20 hindsight, we can now see some foreshadowing baked into Mr. Siegel’s answers — in particular, his focus on Avenue’s e-commerce business and the strategic downsizing of the brick-and-mortar footprint. Like many failed retail enterprises before it, the future — both near and long-term — of Avenue Stores is marked by these categorical distinctions. Store sales are approximately 64% of sales with e-commerce at approximately 36% (notably, he cited 33% at the time of the NOA).

A brand founded in 1987, Avenue has had an up-and-down history. It was spun off out of Limited Brands Inc. and renamed in 1989; it IPO’d in 1992; it was then taken private in 2007. Shortly thereafter, it struggled and filed for bankruptcy in early 2012 and sold as a going-concern to an acquisition entity, Avenue Stores LLC (under a prior name), for “about $32 million.” The sale closed after all of two months in bankruptcy. The holding company that owns 100% of the membership interests in Avenue Stores LLC, the operating company, is 99%-owned by Versa Capital Management.

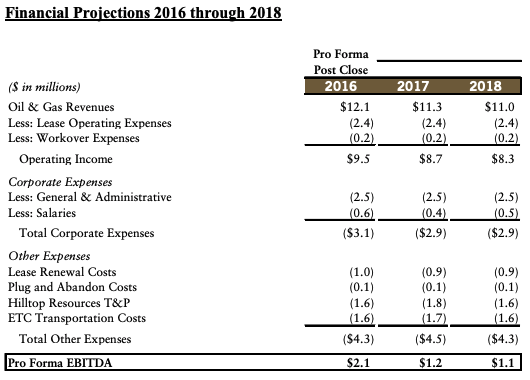

Performance for the business has been bad, though the net loss isn’t off the charts like we’ve seen with other recent debtors in chapter 11 cases (or IPO candidates filing S-1s, for that matter). Indeed, the company had negative EBITDA of $886k for the first five months of 2019 on $75.3mm in sales. Nevertheless, the loss was enough for purposes of the debtors’ capital structure. The debtors are party to an asset-backed loan (“ABL”) memorialized by a credit agreement with PNC Bank NA, a lender that, lately, hasn’t been known for suffering fools. The loan is for $45mm with a $6mm first-in-last-out tranche and has a first lien on most of the debtors’ collateral.

The thing about ABLs is that availability thereunder is subject to what’s called a “borrowing base.” A borrowing base determines how much availability there is out of the overall credit facility. Said another way, the debtors may not always have access to the full facility and therefore can’t just borrow $45mm willy-nilly; they have to comply with certain periodic tests. For instance, the value of the debtors’ inventory and receivables, among other things, must be at a certain level for availability to remain. If the value doesn’t hold up, the banks can close the spigot. If you’re a business with poor sales, slim margins, diminishing asset quality (i.e., apparel inventory), and high cash burn, you’re generally not in very good shape when it comes to these tests. With specs like those, your liquidity is probably already tight. A tightened borrowing base will merely exacerbate the problem.

Lo and behold, PNC declared the debtors in default on July 22; in turn, they imposed default interest on the debtors and initiated daily cash sweeps of the debtors’ bank accounts. Like we said. Suffer. No. Fools.*** The debtors owe $15.2mm on the facility.

The debtors also have outstanding a subordinated secured note to the tune of $37.8mm. The note pays interest at 15% but is paid in kind.**** The lender on the note is an affiliate of Versa, and per the terms of the note, Versa had continued, at least through April 2019, to fund the business (and letters of credit for the debtors’ benefit) with millions of dollars of capital.

If this sounds like a hot mess, well, yeah, sure, kudos. You’re clearly paying attention. It’s a dog eat dog world out there. Per the company:

The Debtors operate in an extremely competitive retail environment, facing competition from other specialty-retail stores, including Lane Bryant, Ashley Stewart, and Torrid, and mass-market retailers such as Walmart and Target, many of which are located in close proximity to Avenue stores. In addition to long-standing, traditional competitors within the plussize segment, there has been a recent influx of many other iconic fashion retail brands expanding their range of size offerings into the plus-size range, as well as a proliferation of new entrants targeting this same plus-size fashion market. Due to increased competition, the Debtors have faced significant pressure to maintain market share, which has directly and negatively affected their profitability.

Not that this is anything new. We all know this by now: competition is fierce (Stitch Fix Inc. ($SFIX), Neiman Marcus, Kohl’s Corporation ($KSS), Macy’s Inc. ($M) and others are now going after it hard), B&M sucks because leases carry higher expenses, store traffic is down, blah blah f*cking blah. The company continues:

…changes in consumer spending habits have necessitated many retailers to increase promotional activities and discounting, leading to thinner profit margins. Onerous brick-and-mortar lease terms and increased operating costs, during a period of downturn in the retail sector and deep discounting, have intensified retail losses.

Interestingly, in the face of surging U.S. retail sales in July,***** the company also notes that “a review of historic customer data indicates that Avenue customers are shopping less frequently than they once were….” They blame this on a “[s]hifts in consumer preferences” and the debtors’ emphasis on “fashion basics.” DING DING DING. No wonder customers are shopping there less frequently. “Basic” is the antithesis of Instagram-based retail these days. Basics can be purchased at any big box retailer; basics are now available via Amazon’s private label. Basics don’t create an influencer and, on the flip side, no influencer will market “basic.” Maybe Avenue could get away with “fashion basics” if it had brand-equity like SUPREME and was perceived as a luxury brand. But far from it.

Speaking of basic, that pretty much describes the go-forward game plan. We’ll lay it out for you:

Engage an independent director to explore strategic alternatives;

Engage professionals (Young Conaway is legal and Berkeley Research Group as restructuring advisor and CRO)******;

Consider whether there’s going concern value, conclude, like, basically, “nope,” and then hire a consultant******* to solicit bids from liquidators for the B&M piece and an investment banker (Configure Partners) for the IP and e-commerce business;

Issue WARN notices, RIF employees, and start shuttering stores (with intent to file a rejection motion on day 1 of the bankruptcy);

Select a stalking horse bidder for the B&M assets from the pool of interested liquidators (in this case, Gordon Brothers and Hilco Merchant Resources LLC);

Continue to search for a stalking horse bidder for the IP and e-commerce (at filing, there wasn’t one yet); and

Secure DIP financing (here, $12mm from PNC) to fund the cases while the B&M liquidation transpires and the banker searches under every rock under an extremely compressed timeframe (by 9/24/19) for that e-commerce/IP buyer.********

So we’ll know in the next 60 days what the future is for Avenue.

If there is one.