December 12, 2018

On November 11 and then, in a more fulsome manner in November 18’s “😬Biopharma is in Pain😬,” we noted that Synergy Pharmaceuticals Inc. ($SGYP) “appears to be on the brink of bankruptcy.” Looks like we were right on. This morning (12/12/18) at 4:37am (PETITION Note: remember that if you think that being a biglaw attorney is glamorous), the company and an affiliate filed for bankruptcy in the Southern District of New York.

Synergy is a biopharmaceutical company that develops and commercializes gastrointestinal therapies; its primary speciality revolves around uroguanylin, “a naturally occurring and ednogenous human GI peptide, for the treatment of GI diseases and disorders” Geez…bankers and lawyers have nothing on scientists when it comes to the vernacular. The company has one commercial product (TRULANCE) and one product in development. The company owns 33 patents.

We previously noted:

The company has a $200mm 9.5% ‘25 secured term loan with CRG (~$100mm funded plus PIK interest) that has been amended a bazillion times to account for the fact that its revenues suck, its market cap sucks, and that its on the verge of tripping, or has tripped, numerous covenants including, a “minimum market capitalization” covenant and a “minimum revenue covenant.” In its most recent 10-Q, the company noted:

To date the Company has been unable to further amend the agreement with respect to the financial and revenue covenants. The Company is continuing discussions with CRG and has received a temporary waiver on the minimum market cap covenant through November 12, 2018. The Company is currently pursuing alternatives that better align with its business, but there is no assurance that Synergy can secure CRG’s consent or otherwise achieve a transaction to refinance or otherwise repay CRG on commercially reasonable terms, in which case we could default under the term loan agreement. If CRG does not grant a further waiver beyond November 12, 2018 the Company will likely be in default of the minimum market cap covenant.

In its bankruptcy filing, however, the company takes a decidedly less aggressive posture vis-a-vis CRG (which makes sense…CRG is, after all, its proposed DIP lender) when explaining the factors leading to the commencement of its chapter 11 cases. While the company does highlight lack of access to capital markets (which, at least as far as we read it, is an implicit jab at CRG), the company primarily blames TRULANCE’s slow sales growth, market access, competitive landscape and a smaller-than-anticipated total addressable market for its travails.

For its part, Centerview Partners has been engaged in a less than ideal sellside process here. According to the company’s papers, Centerview has been trying to sell the company since 2015. Now, unless there is some crazy element to this engagement, most bankers are compensated on the basis of success fees. They want to a large purchase price and a short marketing process to get the best of both worlds: a huge payday without huge utilization. That does not appear to be the case here. 3 years!

Still, they located a buyer. Bausch Health Companies (“BHC”) has agreed to be the stalking horse purchaser of the company’s assets. BHC would get substantially all of the company’s assets — including its IP, certain customer and vendor contracts, A/R, and goodwill. In exchange, they would pay approximately $185mm in cash (minus certain deductions and adjustments) and $15mm in severance obligations.

CRG is the company’s proposed DIP lender with a $155mm facility, of which $45mm represents new money.

Jurisdiction: S.D. of New York (Judge Garrity)

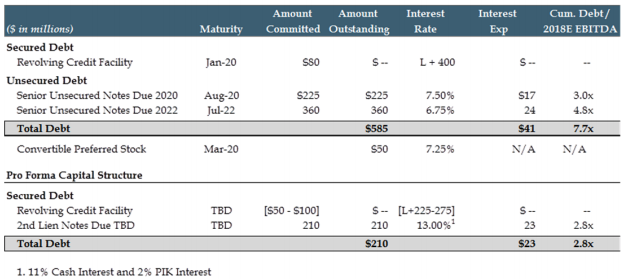

Capital Structure: $110mm 9.5% ‘25 secured term loan, $19mm 7.5% ‘19 senior convertible notes (Wells Fargo NA)

Company Professionals:

Legal: Skadden Arps Slate Meagher & Flom LLP (Ron Meisler, Lisa Laukitis, Christopher Dressel, Jennifer Madden, Christine Okike) & (special counsel) Sheppard Mullin Richter & Hampton LLP

Legal Conflicts Counsel: Togut Segal & Segal LLP (Albert Togut, Neil Berger, Kyle Ortiz)

Board of Directors

Independent Director: Joseph Farnan

Financial Advisor: FTI Consulting Inc. (Michael Katzenstein, Sean Gumbs, Heath Gray, Om Dhavalikar, Tom Sledjeski, John Hayes, Andrew Kopfensteiner)

Investment Banker: Centerview Partners Holdings LP (Samuel Greene, Josh Thornton, Ercument Tokat)

Claims Agent: Prime Clerk LLC (*click on company name above for free docket access)

Other Parties in Interest:

Prepetition Agent & DIP Lender: CRG Servicing LLC

Stalking Horse Bidder: Bausch Health Companies Inc.

Ad Hoc Committee of Equity Holders

Official Committee of Equity Security Holders

Legal: Gibson Dunn & Crutcher LLP (David Feldman, Matthew Kelsey, Alan Moskowitz, J. Eric Wise)

Financial Advisor: Houlihan Lokey Capital, Inc. (Christopher Di Mauro, Geoffrey Coutts)

Official Committee of Unsecured Creditors (Highbridge Capital Management, 1992 MSF International Ltd., 1992 Tactical Credit Master Fund LP)

Legal: Latham & Watkins LLP (Richard Levy, Jeffrey Mispagel, Matthew Warren, Blake Denton, Christopher Harris)

Financial Advisor: Alvarez & Marsal LLP (Mark Greenberg, Richard Newman, Jason Ivy, Martin McGahan, Allison Hoeinghaus, Seth Waschitz, Sean Skinner, Michael Sullivan)

Investment Bank: Jefferies LLC (Leon Szlezinger, Jeffrey Finger)