Empire Generating Co LLC

May 19, 2019

We love when companies that have been circling around the bankruptcy bowl finally get flushed into bankruptcy court. Empire Generating Company is a name that has been kicking around distressed circles for some time now: The Wall Street Journal wrote about it a year ago, back in May 2018. Alas, it now sits within the Southern District of New York. It is the latest in a line of power producers to file for bankruptcy in recent years.

The company owns and operates a (now) dual-fuel power plant in Rensselaer New York; as a merchant power plant, it sells electricity in the wholesale market that ultimately helps power New York’s electrical grid. Very soon, it will likewise be able to generate revenue in New England. In fiscal year 2017, the company generated $91.8mm of revenue and $16.77 of EBITDA. EBITDA decreased to $11.05mm in 2018. The company also has a meaningful amount of debt. As of the petition date, its outstanding owed amounts under its credit facility total $353.4mm. Its $20mm revolver matured in March 2019.

The company cites some interesting causes for its filing. First, it gives an economics 101 lesson, saying that coal and nuclear facilities in New York haven’t been retired quickly enough to limit electricity supply and put upward pressure on prices. Second, it blames progressives (Cuomo!!): New York’s Clean Energy Standard requires that 50% of NY’s electricity come from renewables by 2030, creating yet another supply/demand imbalance that has placed “downward pressure on the price for energy generated by other sources.” Third, unlike retailers who blame bad weather for under performance all of the time, this company actually has a viable excuse: the abnormally cold winter of 2017/2018 increased natural gas prices, compressing the company’s margins. At the time, the company wasn’t yet “dual-fuel” and, therefore, relied exclusively on natural gas whereas competitors could toggle to more economical fuel oil instead. This confluence of factors ultimately led the company to default under its loan docs.

The company has since been in a state of perpetual forbearance with an ad hoc group of pre-petition lenders. It was on the verge of a prepackaged solution to its balance sheet but time ticked away and the company’s pesky lenders traded out of their respective positions. Per the company:

Once the debt trades settled, approximately 55% of the Credit Facility was held by the Consenting Lenders (Black Diamond and MJX), and approximately 34% of the Credit Facility was held by funds managed by Ares Capital (“Ares”).

For the uninitiated, debtors need 2/3 of the amount of a particular tranche of debt to approve a deal for a plan of reorganization to be confirmed by the bankruptcy court. As you can see from the percentages above, Ares Capital and the “Consenting Lenders” (Black Diamond Capital Management LLC & MJX Asset Management LLC) had “blocking positions,” eliminating the possibility of surpassing the required threshold. Months of negotiations ensued and, apparently, Ares and Black Diamond simply couldn’t get along. Uh, yeah, bros: Black Diamond is kinda known for not getting along. Just sayin.

In lieu of an agreement with those parties, the company has secured, pursuant to a restructuring support agreement, a commitment by Black Diamond Capital Management LLC & MJX Asset Management LLC to credit bid — subject to higher and better offers — their debt in exchange for a 100% interest in the reorganized company. The company has, in turn, rejected a proposal from Ares Capital that would confer $37.8mm in cash and 89.75% equity of an acquisition vehicle as consideration for the company’s assets (which it values at a total of $369mm). Why? It concluded that the offer was neither higher nor better than the credit bid; it also had concerns about valuation, approval and feasibility (feasibility!!!!!). Otherwise, the company be like, “PEACE, B*TCHES, WE DON’T WANT NO PART OF THIS INTERCREDITOR DISPUTE.”

And an intercreditor dispute there is! Ares objected right away to the company’s proposed cash collateral, among other things, saying that Black Diamond is steering the company like a meek little sheep. The objection is too lengthy to recant here but, suffice it to say, it looks like we can expect an old school private equity battle over the course of the case. Judge Drain more or less shot down Ares at the hearing, questioning, even, whether they had standing to object; he then went on to amend the proposed cash collateral order.

Absent a settlement between the funds, this will not be the last fight in the case. Pop the popcorn.

Jurisdiction: (Judge Drain)

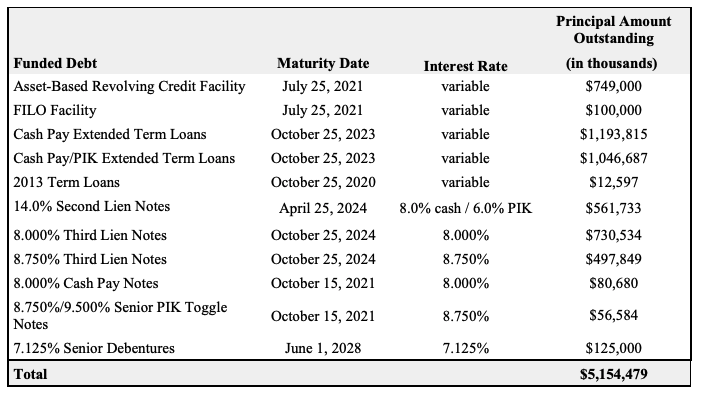

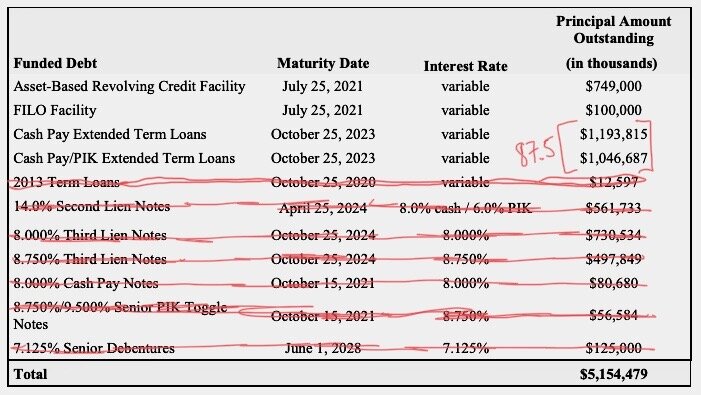

Capital Structure: $20mm RCF, $430mm Term B loan, $30mm Term C loan

Professionals:

Legal: Steinhilber Swanson LLP (Michael Richman) & Hunton Andrews Kurth LLP (Peter Partee Sr., Robert Rich, Michael Legge)

Financial Advisor: RPA Advisors (Chip Cummins)

Investment Banker:

Claims Agent: Omni Management Group (*click on the link above for free docket access)

Other Parties in Interest:

Secured Lenders: Black Diamond Capital Management LLC & MJX Asset Management LLC

Secured Lender: Ares Capital LP

Legal: Kirkland & Ellis LLP (James Sprayragen, Brian Schartz, Anup Sathy, Stephen Hackney, Alexandra Schwarzman)

Secured Lender: Starwood

Ad Hoc Group

Agent: Ankura Trust Company