⛽️New Chapter 11 Bankruptcy Filing - Nine Point Energy Holdings Inc.⛽️

Nine Point Energy Holdings Inc.

Colorado-based Nine Point Energy Holdings Inc. (along with three affiliates, the “debtors”) is and independent oil and gas exploration and production company focused on the Williston Basin in North Dakota and Montana. It is the successor to Triangle USA Petroleum Corporation, which filed for chapter 11 bankruptcy in June 2016 and confirmed a plan in March 2017. Four years later, it’s back in bankruptcy court. 😬

Followers of E&P bankruptcies have become accustomed to disputes relating to E&P companies and their midstream gathering, transportation and processing providers. Here, Caliber Midstream Partners LP was the debtors’ largest midstream services provider — “was” being the operative word after the debtors terminated the long-term midstream services agreements on the eve of bankruptcy. The story, however, doesn’t end there.

The debtors are willing to enter into a new arrangement with Caliber going forward. It’s unclear how the new arrangement might differ from the existing arrangement because redaction, redaction, redaction. The economic terms of the contract have not been disclosed. 🤔

And so here we are with another potential “running with the land” scenario. If you’re unfamiliar with what this is, you clearly haven’t been paying attention to E&P bankruptcy cases. Just Google it and you’ll pull up probably 8928394829248929 law firm articles on the topic. As this will be a major driver in the case, it probably makes sense to refresh your recollection.

Why are the debtors in bankruptcy? All of the usual reasons, e.g., the big drop in oil prices thanks to COVID-19 and Russia/OPEC. Nothing really new there.

So what does this filing achieve? For starters, it will give the debtors an opportunity to address the Caliber contracts. Moreover, it will avail the debtors of a DIP facility from their pre-petition lenders in the amount of ~$72mm — $18mm in new money and $54mm on a rollup basis (exclusive of an additional $16.1mm roll-up to account for pre-petition secured swap obligations)(8% interest with 2% commitment fee). Finally, the pre-petition-cum-DIP-lenders have agreed to serve as the stalking horse purchaser of the debtors’ assets with a credit bid floor of $250mm.

Date: March 15, 2021

Jurisdiction: D. of Delaware (Judge Walrath)

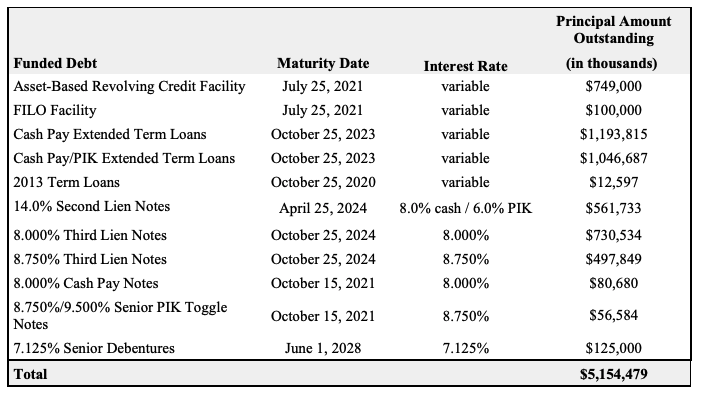

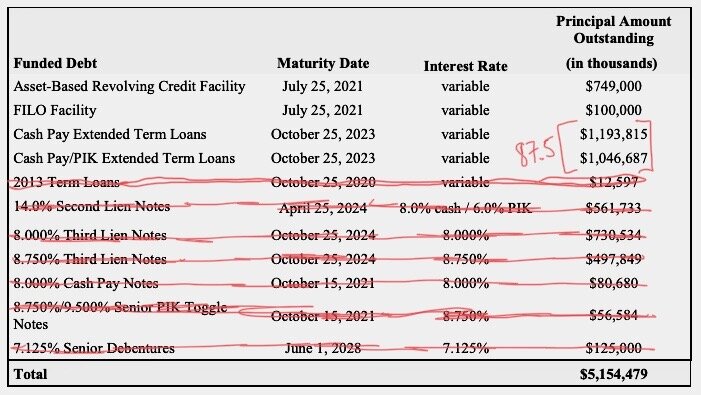

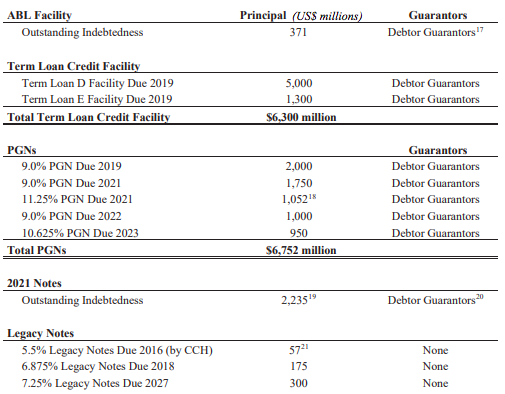

Capital Structure: $256.9mm credit facility, $16.1mm swap obligations

Company Professionals:

Legal: Latham & Watkins LLP (Richard Levy, Caroline Reckler, Jonathan Gordon, George Davis, Nacif Taousse, Alistair Fatheazam, Jonathan Weichselbaum, Andrew Sorkin, Heather Waller, Amanda Rose Stanzione, Elizabeth Morris, Sohom Datta) & Young Conaway Stargatt & Taylor LLP (Michael Nestor, Kara Hammond Coyle, Ashley Jacobs, Jacob Morton)

Board of Directors: Patrick Bartels Jr., Dominic Spencer, Frederic Brace, Gary Begeman, Alan Dawes

Financial Advisor: AlixPartners LLP (John Castellano)

Investment Banker: Perella Weinberg Partners LP (John Cesarz)

Claims Agent: Stretto (Click here for free docket access)

Other Parties in Interest:

Pre-petition & DIP Agent: AB Private Credit Investors LLC

Legal: Proskauer Rose LLP (Charles Dale, David Hillman, Michael Mervis, Megan Volin, Paul Possinger, Jordan Sazant) & Landis Rath & Cobb LLP (Adam Landis, Kerri Mumford, Matthew Pierce)

Ad Hoc Group of Equityholders: Shenkman Capital Management, JP Morgan Securities LLC, Canyon Capital Advisors LLC, Chambers Energy Capital

Legal: Willkie Farr & Gallagher LLP (Jeffrey Pawlitz, Matthew Dunn, Mark Stancil) & Richards Layton & Finger PA (John Knight, Amanda Steele, David Queroli)

Midstream Counterparty: Caliber Measurement Services LLC, Caliber Midstream Fresh Water Partners LLC, and Caliber North Dakota LLC

Legal: Weil Gotshal & Manges LLP (Alfredo Perez, Brenda Funk, Tristan Sierra, Edward Soto, Lauren Alexander) & Morris Nichols Arsht & Tunnell LLP (Curtis Miller, Taylor Haga, Nader Amer)