We give bankruptcy professionals grief all of the time for what often appears to be fee extraction in various cases. In our view, there have been some pretty egregious examples of inefficiency in the system and, considering a number of our readers are management teams of distressed companies, we feel it’s imperative that we cure for a blatant information dislocation and help educate the masses. This, though, appears to be an extraordinary case. In the other direction.

The company’s professionals here propose to confirm the company’s plan of reorganization at the first day hearing of the case. As Bloomberg noted on Monday, this would “set a new record for emerging from court protection in under 24 hours.” Bloomberg reports:

The previous record for the fastest Chapter 11 process is held by Blue Bird Body Co., which exited bankruptcy in 2006 in less than two days. Fullbeauty and its advisers aim to beat that mark.

“We structured this deal as if bankruptcy never happened for our trade creditors, vendors and employees to avoid further disruption to the company,” attorney Jon Henes at Kirkland & Ellis, the company’s legal counsel, said in an interview. “In this situation, every day in court is another day of costs without any corresponding benefit.”

In fact, this case would be so quick that, as you read this (on Wednesday), Judge Drain may have already given the plan his blessing. This makes Roust Corporation Inc. (6 days) and Southcross Holdings (13 days) look like child’s play. For that reason — and that reason alone — we’ll forgive the company’s professionals for their blatant victory lap: it’s curious that Bloomberg had a completed interview ready to go at 9:26am on the morning of the company’s bankruptcy filing. Clearly Kirkland & Ellis LLP, PJT Partners LP ($PJT) and Houlihan Lokey Capital ($HL) want to milk this extraordinary result for all it’s worth. We can’t really blame them, truthfully. That is, unless and/or until the company violates the “Two Year Rule” a la Charlotte Russe.

Anyway, why so quick? Well, because they can: the entire capital structure is on board with the proposed plan and trade will ride through unimpaired and paid. All contracts will be assumed. There are no brick-and-mortar stores to deal with: this is a web and catalogue-based business. Like we said, this case is extraordinary. Per the Company:

It is in the best interest of the estates that the Debtors remain in bankruptcy for as short a time-period as possible. If FullBeauty is forced to remain in chapter 11 longer than necessary, it may be required to seek debtor in possession financing, which would cost the Debtors unnecessary bank fees and professional expenses. In addition, although January has been relatively smooth in terms of vendor outreach, FullBeauty expects that trade could contract very quickly if the company remains in chapter 11 longer than necessary—particularly because many vendors are in foreign jurisdictions and they do not understand the nuances of prepackaged cases versus longer prearranged or traditional chapter 11 cases. Every day that FullBeauty remains in chapter 11 results in cash spent that could go to developing the business.

Indeed, for once, it appears that the best interests of the debtor company were, indeed, heeded.*

*Which is not to say that we believe the out-of-court bills will be light.

Jurisdiction: S.D. of New York (Judge Drain)

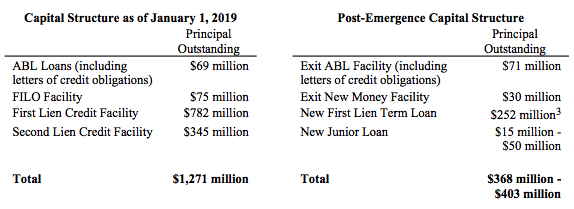

Capital Structure: $mm debt

Company Professionals:

Legal: Kirkland & Ellis LLP (Jonathan Henes, Emily Geier, George Klidonas, Rebecca Blake Chaikin, Nicole Greenblatt)

Independent Director: Mohsin Meghji

Financial Advisor: AlixPartners LLC

Investment Banker: PJT Partners LP (Jamie Baird)

Claims Agent: Prime Clerk LLC (*click on company name above for free docket access)

Other Parties in Interest:

Financial Sponsor (69.6%): Apax Partners LLP

Financial Sponsor (26.4%): Charlesbank Capital Partners LLC

ABL Agent & FILO Agent: JPMorgan Chase Bank NA

First Lien Agent & Second Lien Agent: Wilmington Trust NA

Ad Hoc Group of First Lien Term Loan Lenders

Legal: Milbank Tweed Hadley & McCloy LLP (Dennis Dunne, Gerard Uzzi, Nelly Almeida)

Financial Advisor: Ducera Partners

Ad Hoc Group of Second Lien Term Loan Lenders

Legal: Paul Weiss Rifkind Wharton & Garrison LLP (Paul Basta, Elizabeth McColm, Christopher Hopkins)

Financial Advisor: Houlihan Lokey Capital Inc. (Saul Burian)

Updated 2/4/19 at 7:03 CT