New Chapter 11 Bankruptcy Filing - FULLBEAUTY Brands Holdings Corp.

FULLBEAUTY Brands Holdings Corp.

February 3, 2019

We’re going to regurgitate our report about FULLBEAUTY Brands Holdings Corp. from January 6th after the company publicly posted its proposed plan of reorganization and disclosure statement and issued a press release about its proposed restructuring. What follows is what we wrote then:

FULLBEAUTY Brands Inc., an Apax Partners’ disaster…uh, “investment”…will, despite earlier reports of an out-of-court resolution to the contrary, be filing for bankruptcy after all in what appears to be either a late January or an early February filing after the company completes its prepackaged solicitation of creditors. Back in May in “Plus-Size Beauty is a Plus-Size Sh*tfest (Short Apax Partners’ Fashion Sense),” we wrote:

Here’s some free advice to our friends at Apax Partners: hire some millennials. And some women. When you have 23 partners worldwide and only 1 of them is a woman (in Tel Aviv, of all places), it’s no wonder that certain women’s apparel investments are going sideways. Fresh off of the bankruptcies of Answers.com and rue21, another recent leveraged buyout by the private equity firm is looking a bit bloated: NY-based FullBeauty Brands, a plus-size direct-to-consumer e-commerce and catalogue play with a portfolio of six brands (Woman Within, Roamans, Jessica London, Brylane Home, BC Outlet, Swimsuits for All, and Eilos).

Wait. Hold up. Direct-to-consumer? Check. E-commerce? Check. Isn’t that, like, all the rage right now? Yes, unless you’re levered to the hilt and have a relatively scant social media presence. Check and check.

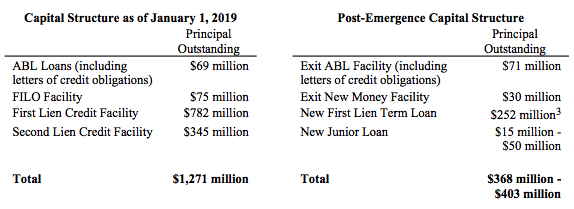

Per a press release on Thursday, the company has an agreement with nearly all of its first-lien-last out lenders, first lien lenders, second lien lenders and equity sponsors on a deleveraging transaction that will shed $900mm of debt from the company’s balance sheet. It also has a commitment for $30mm in new liquidity in the form of a new money term loan with existing lenders. Per Bloomberg:

About 87.5 percent of the common reorganized equity would go to first-lien lenders, 10 percent to second liens, and 2.5 percent to the sponsor, according to people with knowledge of the plan who weren’t authorized to speak publicly.

Which, in English, means that Oaktree Capital Group LLC, Goldman Sachs Group Inc., and Voya Financial Inc. will end up owning this retailer. Your plus-sized clothing, powered by hedge funds. Apax and Charlesbank Capital, the other PE sponsor, stand to maintain 2.5% of the equity which, from our vantage point, appears rather generous (PETITION Note: there must be a decent amount of cross-holdings between the first lien and second lien debt for that to be the case). Here is the difference in capital structure:

What’s the story here? Simply put, it’s just another retail with far too much leverage in this retail environment.

Of course, there’s the obligatory product strategy, inventory control, and e-commerce excuses as well. Not to mention…wait for it…Amazon Inc ($AMZN)!

“In addition to these operational hurdles, FullBeauty has also faced competition from online retail giant Amazon, Inc. and retail chains, including Walmart Inc. and Kohl’s Corporation, that have recently entered the plus-size clothing space.”

Kirkland & Ellis LLP, PJT Partners ($PJT) and AlixPartners represent the company.

We give bankruptcy professionals grief all of the time for what often appears to be fee extraction in various cases. In our view, there have been some pretty egregious examples of inefficiency in the system and, considering a number of our readers are management teams of distressed companies, we feel it’s imperative that we cure for a blatant information dislocation and help educate the masses. This, though, appears to be an extraordinary case. In the other direction.

The company’s professionals here propose to confirm the company’s plan of reorganization at the first day hearing of the case. As Bloomberg noted on Monday, this would “set a new record for emerging from court protection in under 24 hours.” Bloomberg reports:

The previous record for the fastest Chapter 11 process is held by Blue Bird Body Co., which exited bankruptcy in 2006 in less than two days. Fullbeauty and its advisers aim to beat that mark.

“We structured this deal as if bankruptcy never happened for our trade creditors, vendors and employees to avoid further disruption to the company,” attorney Jon Henes at Kirkland & Ellis, the company’s legal counsel, said in an interview. “In this situation, every day in court is another day of costs without any corresponding benefit.”

In fact, this case would be so quick that, as you read this (on Wednesday), Judge Drain may have already given the plan his blessing. This makes Roust Corporation Inc. (6 days) and Southcross Holdings (13 days) look like child’s play. For that reason — and that reason alone — we’ll forgive the company’s professionals for their blatant victory lap: it’s curious that Bloomberg had a completed interview ready to go at 9:26am on the morning of the company’s bankruptcy filing. Clearly Kirkland & Ellis LLP, PJT Partners LP ($PJT) and Houlihan Lokey Capital ($HL) want to milk this extraordinary result for all it’s worth. We can’t really blame them, truthfully. That is, unless and/or until the company violates the “Two Year Rule” a la Charlotte Russe.

Anyway, why so quick? Well, because they can: the entire capital structure is on board with the proposed plan and trade will ride through unimpaired and paid. All contracts will be assumed. There are no brick-and-mortar stores to deal with: this is a web and catalogue-based business. Like we said, this case is extraordinary. Per the Company:

It is in the best interest of the estates that the Debtors remain in bankruptcy for as short a time-period as possible. If FullBeauty is forced to remain in chapter 11 longer than necessary, it may be required to seek debtor in possession financing, which would cost the Debtors unnecessary bank fees and professional expenses. In addition, although January has been relatively smooth in terms of vendor outreach, FullBeauty expects that trade could contract very quickly if the company remains in chapter 11 longer than necessary—particularly because many vendors are in foreign jurisdictions and they do not understand the nuances of prepackaged cases versus longer prearranged or traditional chapter 11 cases. Every day that FullBeauty remains in chapter 11 results in cash spent that could go to developing the business.

Indeed, for once, it appears that the best interests of the debtor company were, indeed, heeded.*

*Which is not to say that we believe the out-of-court bills will be light.

Jurisdiction: S.D. of New York (Judge Drain)

Capital Structure: $mm debt

Company Professionals:

Legal: Kirkland & Ellis LLP (Jonathan Henes, Emily Geier, George Klidonas, Rebecca Blake Chaikin, Nicole Greenblatt)

Independent Director: Mohsin Meghji

Financial Advisor: AlixPartners LLC

Investment Banker: PJT Partners LP (Jamie Baird)

Claims Agent: Prime Clerk LLC (*click on company name above for free docket access)

Other Parties in Interest:

Financial Sponsor (69.6%): Apax Partners LLP

Legal: Simpson Thatcher & Bartlett LLP (Elisha Graff, Nicholas Baker)

Financial Sponsor (26.4%): Charlesbank Capital Partners LLC

Legal: Goodwin Proctor LLP (William Weintraub, Joseph Bernardi Jr.)

ABL Agent & FILO Agent: JPMorgan Chase Bank NA

Legal: Davis Polk & Wardwell LLP (Darren Klein, Aryeh Falk)

First Lien Agent & Second Lien Agent: Wilmington Trust NA

Legal: Shipman & Goodman LLP (Nathan Plotkin, Eric Goldstein, Marie Pollio)

Ad Hoc Group of First Lien Term Loan Lenders

Legal: Milbank Tweed Hadley & McCloy LLP (Dennis Dunne, Gerard Uzzi, Nelly Almeida)

Financial Advisor: Ducera Partners

Ad Hoc Group of Second Lien Term Loan Lenders

Legal: Paul Weiss Rifkind Wharton & Garrison LLP (Paul Basta, Elizabeth McColm, Christopher Hopkins)

Financial Advisor: Houlihan Lokey Capital Inc. (Saul Burian)

Updated 2/4/19 at 7:03 CT