📺 New Chapter 11 Bankruptcy Filing - Frontier Communications Inc. ($FTR) 📺

Frontier Communications Inc.

April 14, 2020

We often highlight how, particularly in the case of oil and gas companies, capital intensive companies end up with a lot of debt and a lot of debt often results in bankruptcy. In the upstream oil and gas space, exploration and production companies need a lot of upfront capital to, among other things, enter into royalty interest agreements with land owners, hire people to map wells, hire people to drill the earth, secure proper equipment, procure the relevant inputs and more. E&P companies literally have to shell out to pull out.

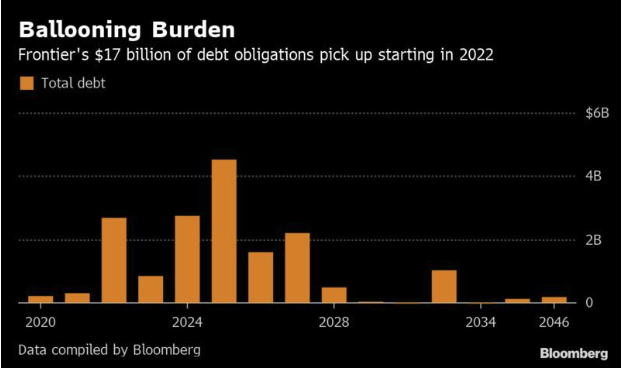

Similarly, telecommunications companies that want to cover a lot of ground require a lot of capital to do so. From 2010 through 2016, Connecticut-based Frontier Communications Inc. ($FTR) closed a series of transactions to expand from a provider of telephone and DSL internet services in mainly rural areas to a large telecommunications provider to both rural and urban markets across 29 states. It took billions of dollars in acquisitions to achieve this. Which, in turn, meant the company took on billions of dollars of debt to finance said acquisitions. $17.5b, to be exact. Due, in large part, to the weight of that heavy debt load, it, and its 28922932892 affiliates (collectively, the “debtors”), are now chapter 11 debtors in the Southern District of New York (White Plains).*

The debtors underwrote the transactions with the expectation that synergistic efficiencies would be borne out and flow to the bottom line. PETITION readers know how we feel about synergies: more often than not, they prove elusive. Well:

Serving the new territories proved more difficult and expensive than the Company anticipated, and integration issues made it more difficult to retain customers. Simultaneously, the Company faced industry headwinds stemming from fierce competition in the telecommunications sector, shifting consumer preferences, and accelerating bandwidth and performance demands, all redefining what infrastructure telecommunications companies need to compete in the industry. These conditions have contributed to the unsustainability of the Company’s outstanding funded debt obligations—which total approximately $17.5 billion as of the Petition Date.

Shocker. Transactions that were meant to be accretive to the overall enterprise ended up — in conjunction with disruptive trends and intense competition — resulting in an astronomical amount of value destruction.

As a result of these macro challenges and integration issues, Frontier has not been able to fully realize the economies of scale expected from the Growth Transactions, as evidenced by a loss of approximately 1.3 million customers, from a high of 5.4 million after the CTF Transaction closed in 2016 to approximately 4.1 million as of January 2020. Frontier’s share price has dropped … reflecting a $8.4 billion decrease in market capitalization.

😬😬😬😬😬😬😬😬😬😬😬😬😬😬😬😬😬😬😬😬😬😬😬😬😬😬😬😬😬😬

Consequently, the debtors have been in a state of liability management ever since the end of 2018. Subsequently, they (i) issued new secured notes to refinance a near(er)-term term loan maturity, (ii) amended and extended their revolving credit facility, and (iii) agreed to sell their northwest operations and related assets for $1.352b (the “Pacific Northwest Transaction”). The Pacific Northwest Transaction has since been hurdling through the regulatory approval process and seems poised to close on April 30, 2020.**

While all of these machinations were positive steps, there were still major issues to deal with. The capital structure remained robust. And “up-tier” exchanges of junior debt into more senior debt to push out near-term maturities were, post-Windstream***, deemed too complex, too short-term, and too likely to end up the subject of fierce (and costly) litigation**** As the debtors’ issued third quarter financials that were … well … not good, they announced a full drawn down of their revolver, instantly arming them with hundreds of millions of dollars of liquidity.

The company needed reconstructive surgery. Band-aids alone wouldn’t be enough to dam the tide. In many respects, the company ought to be commended for opting to address the problem in a wholesale way rather than piecemeal kick, kick, and kick the can down the road — achieving nothing but short-term fixes to the enrichment of really nobody other than its bankers (and Aurelius).

And so now the company is at the restructuring support agreement stage. Seventy-five percent of the holders of unsecured notes have agreed to an equitization transaction — constituting an impaired consenting class for a plan of reorganization to be put on file within 30 days. Said another way, the debtors are taking the position that the value breaks within the unsecured debt. That is, that the value is at least $6.6b making the $10.949b of senior unsecured notes the “fulcrum security.” Unsecured noteholders reportedly include Elliott Management Corp., Apollo Global Management LLC, Franklin Resources Inc., and Capital Group Cos. They would end up the owners of the reorganized company.

What else is the RSA about?

Secured debt will be repaid in full on the effective date;

A proposed DIP (more on this below) would roll into an exit facility;

The unsecured noteholders would, in addition to receiving equity, get $750mm of seniority-TBD take-back paper and $150mm of cash (and board seats);

General unsecured creditors would ride through and be paid in full; and

Holders of secured and unsecured subsidiary debt will be reinstated or paid in full.

The debtors also obtained a fully-committed new money DIP of $460mm from Goldman Sachs Bank USA. This has proven controversial. Though the DIP motion was not up for hearing along with other first day relief late last week, the subject proved contentious. The Ad Hoc First Lien Committee objected to the DIP. Coming in hot, they wrote:

Beneath the thin veneer in which these so-called “pre-arranged” cases are packaged, lies multiple infirmities that, if not properly addressed by the Debtors, will ultimately result in the unraveling of these cases. While the Debtors seek to shroud themselves in a restructuring support agreement (the “RSA”) that enjoys broad unsecured creditor support, the truth is that underlying that support is a fragile house of cards that will not withstand scrutiny as these cases unfold. Turning the bankruptcy code on its head, the Debtors attempt through their RSA to pay unsecured bondholders cash as a proxy for their missed prepetition interest payment, postpetition interest to yet other unsecured creditors of various subsidiaries, and complete repayment to prepetition revolver lenders that are attempting, through the proposed debtor-inpossession financing (the “DIP Loan”), to effectively “roll-up” their prepetition exposure through the DIP Loan, all while the Debtors attempt to deprive their first lien secured creditors of contractual entitlements to default interest and pro rata payments they will otherwise be entitled to if their debt is to be unimpaired, as the RSA purports to require. While those are fights for another day, their significance in these cases must not be overlooked.

Whoa. That’s a lot. What does it boil down to? “F*ck you, pay me.” The first lien lenders are pissed that everyone under the sun is getting taken care of in the RSA except them.

You want to deny us our default interest. F+ck you, pay me.

You want a DIP despite having hundreds of millions of cash on hand and $1.3b of sale proceeds coming in? F+ck you, pay me.

You want a 2-for-1 roll-up where, “as a condition to raising $460 million in debtor-in-possession financing, the Debtors must turn around and repay $850 million to their prepetition revolving lenders, thus decreasing the Debtors’ overall liquidity on a net basis”? F+ck you, pay me.

You shirking our pro rata payments we’d otherwise be entitled to if our debt is to be unimpaired? F+ck you, pay me.

You want to pay unsecured senior noteholders “incremental payments” of excess cash to compensate them for skipped interest payments without paying us default interest and pro rata payments? F+ck you, pay me.

You want to use sale proceeds to pay down unsecureds when that’s ours under the first lien docs? F+ck you, pay me.

You want to pay interest on the sub debt without giving us default interest? F+ck you, pay me.

You want to do all of this without a proper adequate protection package for us? F+ck you, pay me.

The second lien debtholders chimed in, voicing similar concerns about the propriety of the adequate protection package. For the uninitiated, adequate protection often includes replacement liens on existing collateral, super-priority claims emanating out of those liens, payment of professional fees, and interest. In this case, both the first and second liens assert that default interest — typically several bps higher — ought to be included as adequate protection. The issue, however, was not up for hearing on the first day so all of this is a preview of potential fireworks to come if an agreement isn’t hashed out in coming weeks.

The debtors hope to have a confirmation order within four months with the effective date within twelve months (the delay attributable to certain regulatory approvals). We wish them luck.

______

*Commercial real estate is getting battered all over the place but not 50 Main Street, Suite 1000 in White Plains New York. Apparently Frontier Communications has an office there too. Who knew there was a speciality business in co-working for bankrupt companies? In one place, you’ve got FULLBEAUTY Brands Inc. and Internap Inc. AND Frontier Communications. We previously wrote about this convenient phenomenon here.

**The company seeks an expedited hearing in bankruptcy court seeking approval of it. It is scheduled for this week.

***Here is a Bloomberg video from June 2019 previously posted in PETITION wherein Jason Mudrick of Mudrick Capital Management discusses the effect Windstream had on Frontier and predicted Frontier would be in bankruptcy by the end of the year. He got that wrong. But did it matter to him? He also notes a CDS-based short-position that would pay out if Frontier filed for bankruptcy within 12 months. For CDS purposes, looks like he got that right. By the way, per Moody’s, here was the spread on the CDS around the time that Mudrick acknowledged his CDS position:

Here it was a few months later:

And, for the sake of comparison, here was the spread on the CDS just prior to the bankruptcy filing last week:

Clearly the market was keenly aware (who wasn’t given the missed interest payment?) that a bankruptcy filing was imminent: insurance on FTR got meaningfully more expensive. Other companies with really expensive CDS these days? Neiman Marcus Group (which, Reuters reports, may be filing as soon as this week), J.C. Penney Corporation Inc., and Chesapeake Energy Corporation.

****Notably, Aurelius Capital Management LP pushed for an exchange of its unsecured position into secured notes higher in the capital structure — a proposal that would achieve the triple-frontier-heist-like-whammy of better positioning their debt, protecting the CDS they sold by delaying bankruptcy, and screwing over junior debtholders like Elliott (PETITION Note: we really just wanted to squeeze in a reference to the abominably-bad NFLX movie starring Ben Affleck, an unfortunate shelter-in indulge). On the flip side, funds such as Discovery Capital Management LLC and GoldenTree Asset Management LP pushed the company to file for bankruptcy rather than engage in Aurelius’ proposed exchange.

Jurisdiction: S.D. of New York (Judge Drain)

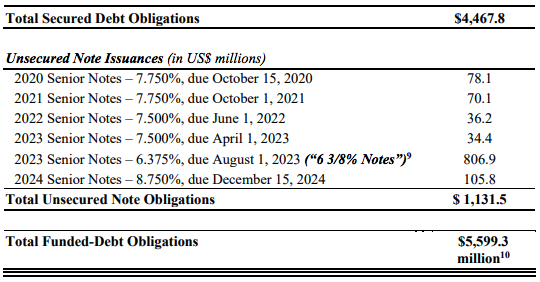

Capital Structure: $850mm RCF, $1.7b first lien TL (JP Morgan Chase Bank NA), $1.7b first lien notes (Wilmington Trust NA), $1.6b second lien notes (Wilmington Savings Fund Society FSB), $10.95mm unsecured senior notes (The Bank of New York Mellon), $100mm sub secured notes (BOKF NA), $750mm sub unsecured notes (U.S. Bank Trust National Association)

Professionals:

Legal: Kirkland & Ellis LLP (Stephen Hessler, Chad Husnick, Benjamin Rhode, Mark McKane, Patrick Venter, Jacob Johnston)

Directors: Kevin Beebe, Paul Keglevic, Mohsin Meghji

Financial Advisor: FTI Consulting Inc. (Carlin Adrianopoli)

Investment Banker: Evercore Group LLC (Roopesh Shah)

Claims Agent: Prime Clerk LLC (*click on the link above for free docket access)

Other Parties in Interest:

Major equityholders: BlackRock Inc., Vanguard Group Inc., Charles Schwab Investment Management

Unsecured Notes Indenture Trustee: Bank of New York Mellon

Legal: Reed Smith LLP (Kurt Gwynne, Katelin Morales)

Indenture Trustee and Collateral Agent for the 8.500% ‘26 Second Lien Secured Notes

Legal: Riker Danzig Scherer Hyland & Perretti LLP (Joseph Schwartz, Curtis Plaza, Tara Schellhorn)

Credit Agreement Administrative Agent: JPMorgan Chase Bank NA

Legal: Simpson Thacher & Bartlett LLP (Sandeep Qusba, Nicholas Baker, Jamie Fell)

DIP Agent: Goldman Sachs Bank USA

Legal: Davis Polk & Wardwell LLP (Eli Vonnegut, Stephen Piraino, Samuel Wagreich)

Ad Hoc First Lien Committee

Legal: Paul Weiss Rifkind Wharton & Garrison LLP (Brian Hermann, Gregory Laufer, Kyle Kimpler, Miriam Levi)

Financial Advisor: PJT Partners LP

Second lien Ad Hoc Group

Legal: Quinn Emanuel Urquhart & Sullivan LLP (Susheel Kirpalani, Benjamin Finestone, Deborah Newman, Daniel Holzman, Lindsay Weber)

Ad Hoc Senior Notes Group

Legal: Akin Gump Strauss Hauer & Feld LLP (Ira Dizengoff, Philip Dublin, Naomi Moss)

Financial Advisor: Ducera Partners LLC

Ad Hoc Committee of Frontier Noteholders

Legal: Milbank LLP (Dennis Dunne, Samuel Khalil, Michael Price)

Financial Advisor: Houlihan Lokey Inc.

Ad Hoc Group of Subsidiary Debtholders

Legal: Shearman & Sterling LLP (Joel Moss, Jordan Wishnew)

Official Committee of Unsecured Creditors

Legal: Kramer Levin Naftalis & Frankel LLP (Amy Caton, Douglas Mannal, Stephen Zide, Megan Wasson)

Financial Advisor: Alvarez & Marsal LLC (Richard Newman)

Investment Banker: UBS Securities LLC (Elizabeth LaPuma)