⛽️New Chapter 11 Filing - Legacy Reserves Inc.⛽️

Legacy Reserves Inc.

June 18, 2019

Even at 95 years old, you can’t get one past Charlie Munger. #Legend.

The Permian Basin in West Texas is where it’s at in the world of oil and gas exploration and production. Per Wikipedia:

As of 2018, the Permian Basin has produced more than 33 billion barrels of oil, along with 118 trillion cubic feet of natural gas. This production accounts for 20% of US crude oil production and 7% of US dry natural gas production. While the production was thought to have peaked in the early 1970s, new technologies for oil extraction, such as hydraulic fracturing and horizontal drilling have increased production dramatically. Estimates from the Energy Information Administration have predicted that proven reserves in the Permian Basin still hold 5 billion barrels of oil and approximately 19 trillion cubic feet of natural gas.

And it may be even more prolific than originally thought. Norwegian research firm Rystad Energy recently issued a report indicating that Permian projected output was already above 4.5mm barrels a day in May with volumes exceeding 5mm barrels in June. This staggering level of production is pushing total U.S. oil production to approximately 12.5mm barrels per day in May. That means the Permian now accounts for 36% of US crude oil production — a significant increase over 2018. Normalized across 365 days, that would be a 1.64 billion barrel run rate. This is despite (a) rigs coming offline in the Permian and (b) natural gas flaring and venting reaching all-time highs in Q1 ‘19 due to a lack of pipelines. Come again? That’s right. The Permian is producing in quantities larger than pipelines can accommodate. Per Reuters:

Producers burned or vented 661 million cubic feet per day (mmcfd) in the Permian Basin of West Texas and eastern New Mexico, the field that has driven the U.S. to record oil production, according to a new report from Rystad Energy.

The Permian’s first-quarter flaring and venting level more than doubles the production of the U.S. Gulf of Mexico’s most productive gas facility, Royal Dutch Shell’s Mars-Ursa complex, which produces about 260 to 270 mmcfd of gas.

The Permian isn’t alone in this, however. The Bakken shale field in North Dakota is also flaring at a high level. More from Reuters:

Together, the two oil fields on a yearly basis are burning and venting more than the gas demand in countries that include Hungary, Israel, Azerbaijan, Colombia and Romania, according to the report.

All of which brings us to Legacy Reserves Inc. ($LGCY). Despite the midstream challenges, one could be forgiven for thinking that any operators engaged in E&P in the Permian might be insulated from commodity price declines and other macro headwinds. That position, however, would be wrong.

Legacy is a publicly-traded energy company engaged in the acquisition, development, production of oil and nat gas properties; its primary operations are in the Permian Basin (its largest operating region, historically), East Texas, and in the Rocky Mountain and Mid-Continent regions. While some of these basins may produce gobs of oil and gas, acquisition and production is nevertheless a HIGHLY capital intensive endeavor. And, here, like with many other E&P companies that have recently made their way into the bankruptcy bin, “significant capital” translates to “significant debt.”

Per the Company:

Like similar companies in this industry, the Company’s oil and natural gas operations, including their exploration, drilling, and production operations, are capital-intensive activities that require access to significant amounts of capital. An oil price environment that has not recovered from the downturn seen in mid-2014 and the Company’s limited access to new capital have adversely affected the Company’s business. The Company further had liquidity constraints through borrowing base redeterminations under the Prepetition RBL Credit Agreement, as well as an inability to refinance or extend the maturity of the Prepetition RBL Credit Agreement beyond May 31, 2019.

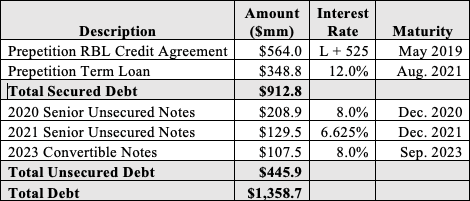

This is the company’s capital structure:

The company made two acquisitions in mid-2015 costing over $540mm. These acquisitions proved to be ill-timed given the longer-than-expected downturn in oil and gas. Per the Company:

In hindsight, despite the GP Board’s and management’s favorable view of the potential future opportunities afforded by these acquisitions and the high-caliber employees hired by the Company in connection therewith, these two acquisitions consumed disproportionately large amounts of the Company’s liquidity during a difficult industry period.

WHOOPS. It’s a good thing there were no public investors in this thing who were in it for the high yield and favorable tax treatment.*

Yet, the company was able to avoid a prior bankruptcy when various other E&P companies were falling like flies. Why was that? Insert the “drillco” structure here: the company entered into a development agreement with private equity firm TPG Special Situations Partners to drill, baby, drill (as opposed to acquire). What’s a drillco structure? Quite simply, the PE firm provided capital in return for a wellbore interest in the wells that it capitalized. Once TPG clears a specified IRR in relation to any specific well, any remaining proceeds revert to the operator. This structure — along with efforts to delever through out of court exchanges of debt — provided the company with much-needed runway during a rough macro patch.

It didn’t last, however. Liquidity continued to be a pervasive problem and it became abundantly clear that the company required a holistic solution to its balance sheet. That’s what this filing will achieve: this chapter 11 case is a financial restructuring backed by a Restructuring Support Agreement agreed to by nearly the entirety of the capital structure — down through the unsecured notes. Per the Company:

The Global RSA contemplates $256.3 million in backstopped equity commitments, $500.0 million in committed exit financing from the existing RBL Lenders, the equitization of approximately $815.8 million of prepetition debt, and payment in full of the Debtors’ general unsecured creditors.

Said another way, the Permian holds far too much promise for parties in interest to walk away from it without maintaining optionality for the future.

*Investors got burned multiple times along the way here. How did management do? Here is one view (view thread: it’s precious):

😬

Jurisdiction: S.D. of Texas (Judge Isgur)

Capital Structure: See above.

Professionals:

Legal: Sidley Austin LLP (Duston McFaul, Charles Persons, Michael Fishel, Maegan Quejada, James Conlan, Bojan Guzina, Andrew O’Neill, Allison Ross Stromberg)

Financial Advisor: Alvarez & Marsal LLC (Seth Bullock, Mark Rajcevich)

Investment Banker: Perella Weinberg Partners (Kevin Cofsky)

Claims Agent: KCC (*click on the link above for free docket access)

Other Parties in Interest:

Official Committee of Unsecured Creditors (Wilmington Trust NA, Dalton Investments LLC, Paul Drueke, John Dinkel, Nicholas Mumford)

GSO Capital Partners LP

Legal: Latham & Watkins LLP (George Davis, Adam Goldberg, Christopher Harris, Zachary Proulx, Brett Neve, Julian Bulaon) & (local) Porter Hedges LLP (John Higgins, Eric English, M. Shane Johnson)

DIP Lender: Wells Fargo Bank NA

Legal: Orrick LLP (Raniero D’Aversa, Laura Metzger)

Prepetition Term Agent: Cortland Capital Market Services LLC

Legal: Arnold & Porter Kaye Scholer LLP (Gerardo Mijares-Shafai, Seth Kleinman)

Indenture Trustee: Wilmington Trust NA

Legal: Pryor Cashman (Seth Lieberman, Patrick Sibley, Andrew Richmond)

Ad Hoc Group of Senior Noteholders (Canyon Capital Advisors LLC, DoubleLine Income Solutions Fund, J.H. Lane Partners Master Fund LP, JCG 2016 Holdings LP, The John C. Goff 2010 Family Trust, John C. Goff SEP-IRA, Cuerno Largo Partners LP, MGA insurance Company Inc., Pingora Partners LLC)

Legal: Davis Polk & Wardwell LLP (Brian Resnick, Stephen Piraino, Michael Pera) & (local) Rapp & Krock PC (Henry Flores)

Updated 7/7/19 #188