⛽️New Chapter 22 Filing - Hilltop Energy LLC⛽️

Hilltop Energy LLC

May 16, 2019

Hilltop Energy LLC, a Dallas-based E&P company with assets in Texas, has filed for bankruptcy in the District of Delaware, its second bankruptcy in four years. The company also filed its wholly-owned subsidiary, Hilltop Asset LLC (together, the “Debtors”).

The company’s predecessor, Cubic Energy Inc., filed for bankruptcy in late 2015, confirmed a prepackaged plan of reorganization in February 2016 and never emerged from bankruptcy (due to an ongoing adversary proceeding involving the chapter 11 debtors’ CEO and prior operator). Nevertheless, pursuant to the confirmed plan, secured noteholders swapped their notes for membership interests in the reorganized Cubic Energy and 14% first priority senior secured takeback paper due 2021. This is how these chapter 22 Debtors came to be owned by Anchorage Capital Group LLC and Corbin Opportunity Fund LP. General unsecured creditors and equity otherwise got wiped out.

This is the company’s capital structure:

$5mm Superpriority Notes + $30mm 14% First Priority Senior Secured Notes

$$18.5mm Superpriority PIK Notes + First Priority PIK Notes

Why is the company in bankruptcy? Let’s break this down into its component parts:

The Company has been cash flow negative every year since its formation following the chapter 11 cases of Cubic and its affiliates, as the revenue generated by producing wells is not sufficient to cover operating expenses and "workover" expenses, which is maintenance capex to keep the wells flowing.

Ugh. Here we go again. Flashback to the finding in this Delaware order from February 2016:

“The valuation analysis contained in the Disclosure Statement (x) is reasonable, persuasive, credible, and accurate as of the date such analysis or evidence was prepared, presented, or proffered, (y) utilizes reasonable and appropriate methodologies and assumptions and (z) has not been controverted by other evidence.”

Source: Cubic Energy Disclosure Statement

Ok, sure. The court finding may have been right — “as of the date.” But the assumptions proved to be dramatically askew. Take, for instance, the workover expense line-item. The company indicates an aggregate $600k hit there. What does the company have to say about this now?

Although production declines are expected in the oil and gas industry, the Debtors have faced several unanticipated challenges since emerging from the Cubic Chapter 11 Cases. Since emergence, over 20% of the Debtors’ producing gas wells have stopped producing due to downhole operational and/or technical issues. During this same time period, the Debtors also invested in production uplift projects—including an estimated $4 million on workover and/or recompletion projects for three wells—but the efforts to increase production from those wells were unsuccessful. The effects of these production problems on the Debtors’ revenue have been compounded by the weak natural gas market over the past few years.

That’s quite a miss. But it’s not the only one. Significantly, the company also notes:

The Debtors’ gross production has declined from approximately 10.5 million cubic feet per day ("mmcfd"), in March 2016 to roughly 5.0 mmcfd as of the date hereof. (emphasis added)

That is what it is but it begs the question: out of whose a$$ did the company pull the assumptions behind the company’s chapter 11 projections? Per the Disclosure Statement:

Daily Production of natural gas is forecast based upon anticipated January 2016 daily production of 15,500 mcf per day and calculated on a 1% month-over-month decline curve on existing drilled and producing wells.

So, uh, we’re not math experts, but a 1% decline month-over-month doesn’t get you to 10.5 mcf per day A MERE TWO MONTHS LATER. Which begs the question: were the projections actually accurate and credible “as of the date”? This certainly seems to indicate otherwise.

Consequently, the Debtors saw an impending maturity and were like, “oh sh*t”:

Although the Debtors have been able to service their debt obligations (primarily by paying interest in the form of additional notes), over time, the yield of the Debtors' producing oil and gas wells has been and may continue to be in constant decline.

This is top notch spin. Yeah, sure, we suppose issuing PIK debt is a form of debt “service” but c’mon. Really??

Consequently, the Debtors anticipate that they will generate less revenue and cash flow and, ultimately, be unable to satisfy their debt obligations before or at maturity.

Which is in 2021. So, here we are again: cue up the CHAPTER 22!!

The prepackaged plan will give 100% of the membership interests in the reorganized debtors and $1.47mm of cash to its senior secured noteholder, eliminating the $53mm of debt. The Debtors’ prepetition operator, Rivershore, will get 55% of the equity in the Hilltop Asset.

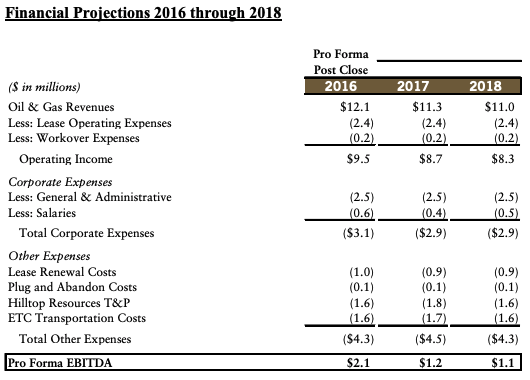

And we’re all left to wonder whether this is just a chapter 33 waiting in the wings. According to the new projections, that’s entirely up to Rivershore’s willingness to make an equity contribution in 2021:

Source: Chapter 22 Disclosure Statement

Jurisdiction: D of Delaware (Judge Sontchi)

Capital Structure: $5mm superpriority senior secured notes, $30mm first priority senior secured notes, PIK notes (Wilmington Trust Company NA).

Professionals:

Legal: Cole Schotz PC (Norman Pernick, J. Kate Stickles, Katherine Monica Devanney)

Claims Agent: Stretto (*click on the link above for free docket access)

Other Parties in Interest:

Senior Secured Noteholder: J.P. Morgan Securities LLC and Lender: Chase Lincoln First Commercial Corporation

Legal: Landis Rath & Cobb LLP (Adam Landis, Richard Cobb, Holly Smith)

Company Operator: Rivershore Operating LLC

Legal: Gray Reed & McGraw LLP (Jason Brookner, Ryan Sears)