🍿New Chapter 11 Bankruptcy Filing - VIP Cinema Holdings Inc.🍿

VIP Cinema Holdings Inc.

February 18, 2020

VIP Cinema Holdings Inc. and four affiliates (the “debtors”) filed prepackaged chapter 11 bankruptcy cases in the District of Delaware; they are manufacturers of luxury seating products for movie theaters. Here’s the problem: end user customers stopped ordering their stuff. Yup, that’s right, there’s a finite market for luxury seating in movie theaters. Who knew?

Here are some of the problems this company confronted:

They made chairs that were too good. That’s right. Too good. The chairs had a longer lifecycle than the company likely wanted. Either that or people are engaging in too much Netflixing and chilling and not enough movie-going.

Movie theaters slowed down their renovation activities and construction of new locations. Perhaps people are engaging in too much Netflixing and chilling and not enough movie-going.

Movie theaters reduced capital investment — mostly because they haven’t exactly performed very well themselves and have their own debt and equityholders to contend with. Also, people are engaging in too much Netflixing and chilling and not enough movie-going.

They conquered the total addressable market, securing 70% market share with little to no room to grow thanks to all of the foregoing bulletpoints.

Are we being too flip about $NFLX? Well, don’t take our word for it. Here’s the company explaining one of the reasons why it’s in trouble:

“Continued proliferation of online streaming services and alternative viewing experiences, which has led to declining movie attendance, a poor outlook sentiment for the overall U.S. movie theatre industry and particularly put significant pressure on the stock price of AMC, a key customer for the Company.”

Because of all of the foregoing factors, the debtors triggered an event of default under their first lien credit agreement and have been in a state of forbearance with their lenders ever since — all with the hope of negotiating an out-of-court restructuring transaction.

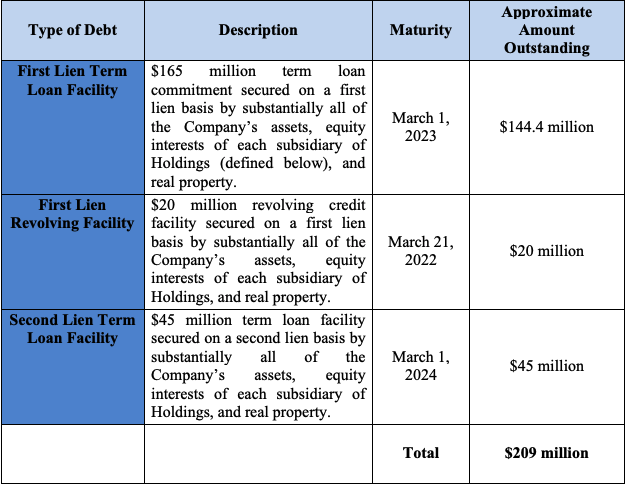

That hope was extinguished when Odeon reduced seating orders, napalming everyone’s financial models upon which the proposed out-of-court transaction was premised. Now we’re in prepackaged bankruptcy territory with a restructuring support agreement that will shed $178mm of debt and infuses the company with a $33mm DIP credit facility — of which $13mm is new money and $20mm is a roll-up of prepetition debt. Here is the pre-petition capital structure:

The liquidity is highly necessary. The debtors are burning cash like Rick Dalton burns interlopers bursting into his Hollywood Hills mansion. The debtors filed for bankruptcy with just $1mm in liquidity remaining.

Speaking of burning cash, that’s pretty much what you can say about the $200-or-so-million that previously went into these debtors. The restructuring support agreement will (a) convert first lien loans to preferred and common equity, (b) donut the second lien claims, and (c) donut the general unsecured claimants (unless they opt-in to a release, in which case they’ll get $5k). Critical to everything is the fact that HIG Capital LLC, the existing shareholder in the company, will write a new-money check of $7mm and enter in a management services agreement with the reorganized newco. In exchange for this investment, HIG will get preferred equity and 51% of the common equity.* Everyone is going to be holding their breath for the next 6 weeks, hoping that no other large chains cancel or downsize orders. If that happens, this deal could blow up.

*Suffering PTSD from the last-minute collapse of the out-of-court deal, HIG also negotiated the ability to walk if the debtors have less than $1.5mm of available unrestricted cash on the “Exit Date.”

Jurisdiction: D. of Delaware (Judge Walrath)

Capital Structure: see above.

Professionals:

Legal: Ropes & Gray LLP (Gregg Galardi, Christine Pirro Schwarzman) & Bayard PA (Erin Fay, Daniel Brogan, Gregory Flasser)

Independent Director: Michael Foreman

Financial Advisor/CRO: AlixPartners LLP (Stephen Spitzer)

Investment Banker: UBS Securities LLC

Claims Agent: Omni Agent Solutions Inc. (*click on the link above for free docket access)

Other Parties in Interest:

First Lien Agent: Wilmington Savings Fund Society FSB

Legal: Wilmer Cutler Pickering Hale and Dorr LLP (Andrew Goldman, Benjamin Loveland) & Morris Nichols Arsht & Tunnell LLP (Robert Dehney, Joseph Barsalona II, Tamara Mann, Andrew Workman)

Ad Hoc Group of First Lien Lenders

Legal: Davis Polk & Wardwell LLP (Damian Schaible, Adam Shpeen) & Morris Nichols Arsht & Tunnell LLP (Robert Dehney, Joseph Barsalona II, Tamara Mann, Andrew Workman)

Financial Advisor: M-III Partners LP

Second Lien Agent & Second Lien Lenders: Oaktree Fund Administration LLC

Legal: Stroock & Stroock & Lavan LLP (Jayme Goldstein, Daniel Ginsburg, Joanne Lau) and Young Conaway Stargatt & Taylor LLP (Matthew Lunn, Edmon Morton, Betsy Feldman)

Sponsor: HIG Capital LLC & HIG Middle Market LBO Fund II LP

Legal: McDermott Will & Emery LLP (Brooks Gruemmer, Jay Kapp)