😷New Chapter 11 Filing - Joerns WoundCo Holdings Inc.😷

Joerns WoundCo Holdings Inc.

June 24, 2019

We scoured far and wide to see whether there might be some businesses that get harmed by the uptick in healthcare distress we’ve witnessed of late. In early June, we took a bit of a stab in the dark (Members’-only access):

There has been notable bankruptcy activity in the healthcare industry this year — from continuing care retirement communities to the acute care space. When end users capitulate and need to streamline operations and cut costs, who gets harmed farther down the chain? It’s a good question: after all, there’s always some trickle down effect.

Our internal search for answers to this question recently brought us to Charlotte-based Joerns Healthcare, a “premier supplier and service provider in post-acute care.” The company sells supportive care beds, transport systems, respiratory care solutions and more.

Among other things, we noted how the company’s term loan maturing in May 2020 “was among one of the worst performing loans in the month of May — quoted in the low 70s, down approximately 15% since April.” We insinuated that a bankruptcy filing may not be too far afield.

We didn’t expect it to be in six weeks later.

On Monday, June 24, 2019, Joerns WoundCo Holdings Inc. and 13 affiliated entities filed a prepackaged bankruptcy in the District of Delaware. Among other reasons provided to explain its capitulation into bankruptcy court is “post acute sector disruption.” Now that’s music to our ears. Per the company:

The Company has been adversely impacted by the challenges faced by the postacute sector, which is a key end market. Post-acute providers have experienced multi-year occupancy rate declines while simultaneously seeing increases in the costs of providing patient care and structural changes in reimbursement instituted by the Centers for Medicare and Medicaid Services not yet offset by countervailing demographic trends. These structural changes include, among other things, higher operational costs driven by increasing regulatory burdens, lower reimbursement rates instituted by Centers for Medicare and Medicaid Services for patients, and patient migration to home health care. The decline in occupancy rates has led to reduced demand for the Company’s products and services, particularly in the rental segment, which is a major component of the Company’s business.

Further, the general post-acute sector disruption has placed many of the Company’s Customers under significant financial pressure, resulting in several bankruptcy filings, increased mergers and acquisition activity to divest under-performing facilities, and proactive cost reduction efforts, as well as fewer equipment purchases. (emphasis added).

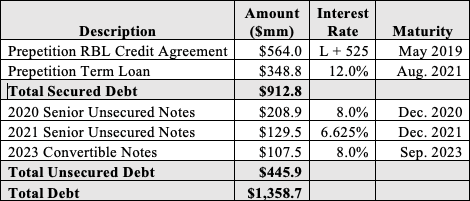

Trickle down indeed. The provision of healthcare has simply changed: the debtors served fewer patients not only because of the reduction in the number of facilities served but because patients don’t fill facility beds like they used to. And when they do, the duration is much shorter than years past. The demand side simply wasn’t there* and, yet, the costs associated with the supply side of the business persisted. The debtors were caught between a rock and a hard place. Compounding matters was the company’s balance sheet:

$272 first lien term loan (+ $3.2mm LOCs)(Ankura Trust Company)

$80 tranche A second lien notes (US Bank NA)

$45.5mm tranche B second lien notes

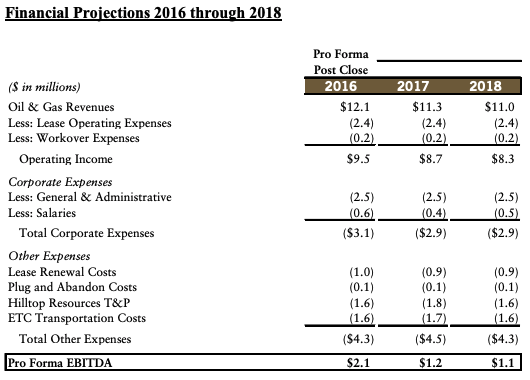

In early June, we noted that one problem with understanding the full extent of Joerns’ trouble was that the company was private. In fact, the debtors had been in default of their covenants under their first and second lien agreements since 2018 and have been operating under a perpetual state of waivers since. In the midst of this, the debtors plunged deeper into default when they breached a financial covenant in March 2019: the debtors’ EBITDA plunged below the $40mm and $36.4mm thresholds required by the first and second lien agreements, respectively. On May 31, 2019, the company skipped a $5.9mm interest payment which, five days later, constituted an event of default.

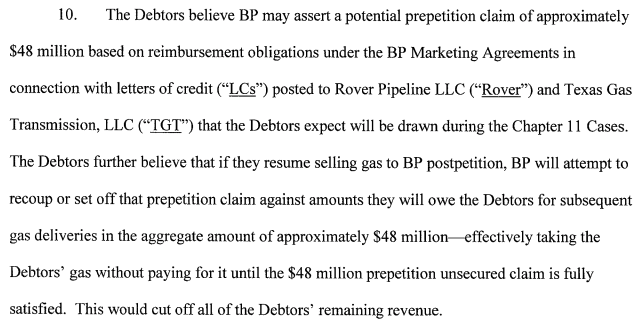

The debtors then dove headfirst into a proposed sale process. It didn’t work: while dozens of parties signed NDAs and took a peek at marketing materials, none of the parties that the debtors and their banker, Moelis & Co. LLC ($MO), spoke to expressed interest in bidding.

This is where value really comes in to play in a restructuring transaction. And the value calculus for the existing lenders is different than that of outside strategics or sponsors who, seeing a distressed company hobbling, have no incentive to make a generous offer — if they’re even interested in making an offer at all.

The lack of market interest and the declining performance made clear that the value of the company doesn’t clear the first lien debt — making that part of the capital structure the “fulcrum security.” Accordingly, the debtors entered into a restructuring support agreement for a prepackaged plan of reorganization that would confer 95% of the equity in the reorganized debtors to the first lien lenders and the remainder to the second lien lenders (both subject to dilution). Said differently, the debtors’ value dictated that the second lien lenders had limited leverage in negotiations: the best they could achieve was a limited recovery of their positions and play out the option that, on a de-levered basis, the company can optimize their businesses and wade through the storm currently pounding the healthcare space. To aid with that, the lenders all agreed to pay general unsecured claimants in full so as to eliminate any additional unnecessary risk to the business. The debtors private sponsors also support the plan — not surprising given that they will want full exculpation and release provisions. To effectuate the deal, the debtors seek approval of a $40mm new money DIP (in addition to a roll-up portion of certain pre-petition amounts).

In the end, the company will eliminate $320mm of funded debt and have a new exit facility to lean on for post-emergence liquidity. The debtors hope to be out of bankruptcy before the end of summer.

*Even when demand WAS there, the debtors’ customers had liquidity issues of their own, preventing the debtors from collecting accounts receivable and causing bad debt expenses in each of 2016, 2017, 2018 and the first half of 2019.

Jurisdiction: D. of Delaware (Judge Dorsey)

Capital Structure: $272 first lien term loan (+ $3.2mm LOCs)(Ankura Trust Company), $80 tranche A second lien notes, $45.5mm tranche B second lien notes (US Bank NA)

Professionals:

Legal: White & Case LLP (David Turetsky, Philip Abelson, Richard Graham, John Ramirez, Fan He, Elizabeth Feld) & (local) Fox Rothschild LLP (Jeffrey Schlerf, Courtney Emerson, Katelyn Crawford)

Board of Directors: Frank Winslow, Anthony Ignaczak, Terrence Daniels, John Mapes, Terry Sutter, Todd Dunn

Financial Advisor: Conway MacKenzie Inc.

Investment Banker: Moelis & Company

Claims Agent: Epiq Corporate Restructuring LLC (*click on the link above for free docket access)

Other Parties in Interest:

Large Equityholders: Quad-C Partners VII LP, Aurora Equity Partners III LP

First Lien Agent: Ankura Trust Company

Legal: King & Spalding LLP

Financial Advisor: FTI Consulting Inc.

Second Lien Noteholders: PineBridge, Cetus Funds