🍦New Chapter 11 Bankruptcy Filing - Ample Hills Holdings Inc.🍦

Ample Hills Holdings Inc.

March 15, 2020

“Hey, honey. Things are really tense right now with coronavirus spreading and the market imploding. I could really use some comfort food.”

“How about some of your favorite ice cream?”

“Ooooh, yeah, that’s an excellent call. Ample Hills Creamery has some sick-a$$ flavors. In!!”

BOOM. Bankrupt. Because there can’t be any good news this week, folks.

We know what you’re thinking: the coronavirus has claimed ice cream as a victim. That nasty virus has taken our sweet SWEEEET snack, the godforsaken beast!

But no. What claimed Brooklyn-based Ample Hills — and sent it reeling into chapter 11 bankruptcy — was an off-the-rails expansion. After becoming a favorite darling of A-listers like Bob Iger and Oprah Winfrey, the company experienced a nightmare shared by every New Yorker who has ever tried to do a reno project in their apartment: extensive and ridiculous time and cost overruns. That’s right, this story is ALL TOO FAMILIAR. It’s a homeowner’s lament:

Ample Hills estimated that it would take one year to build out the Factory. In all, it took a full year and a half longer than estimated before the Factory was operational. Ample Hills’ total investment in the Factory was roughly $6.7 million, which was $2.7 million higher than its original budget. Because the Factory delays impacted Ample Hills’ expansion strategy, the Factory has not been as fully utilized as Ample Hills originally planned, which has led to continuing operating losses.

So cliche, folks, so cliche. To finish the build-out and expand shops, the company raised an $8mm Series A round in late 2017 and subsequently expanded to LA and Miami to bring its total to 16 shops in 4 states.

What, on the outside, looked like a lot of successful growth belied the reality: the factory delays were creating significant liquidity problems.

In the 52 weeks ending December 31, 2019, Ample Hills reported approximately $10.8 million in sales and gross profit of $7.5 million. At the store level, Ample Hills’ shops generated positive cash flow. On average the shops generated 15% EBIDTA in 2019. Ample Hills, however, lost approximately $6.9 million during the same period as a result of depreciation, amortization, interest expense, payroll and other operating costs associated with supporting the Factory.

Alarm bells went off. The company went searching for fresh capital but all attempts to secure additional financing fell flat. Thereafter, the company sought a strategic buyer. That, too, failed. This chapter 11 filing is meant to give the company a platform by which to find a bidder (with time funded via a limited duration use of cash collateral). Absent one surfacing, the company acknowledges that it will be left with no choice but to liquidate the business.

Jurisdiction: E.D. of New York (Judge Lord)

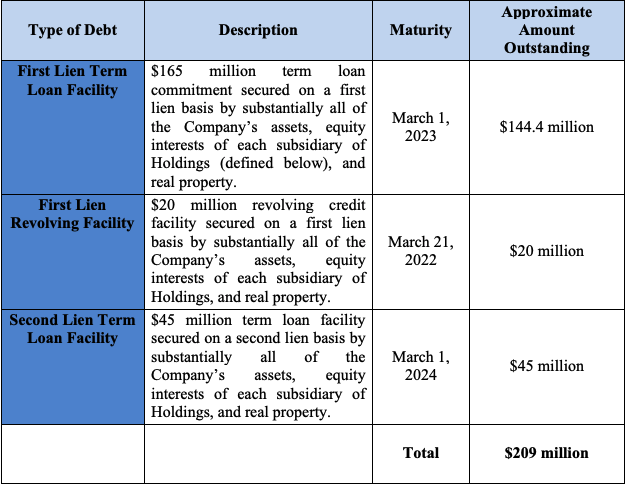

Capital Structure: $3.5mm (Flushing Bank), $1.75mm (SBA Loan), $6.4mm convertible notes

Professionals:

Legal: Herrick Feinstein LLP (Stephen Selbst, Steven Smith, George Utlik, Silvia Stockman, Rachel Ginzburg)

Financial Advisor/CRO: Scouler Kirchhein LLC (Daniel Scouler)

Investment Banker: SSG Capital Advisors LLC

Claims Agent: Stretto (*click on the link above for free docket access)

Other Parties in Interest:

Lender: Flushing Bank

Legal: Certilman Balin Adler & Hyman LLP (Richard J. McCord)