🍎New Chapter 11 Bankruptcy Filing - Lucky's Market Parent Company LLC🍎

Lucky's Market Parent Company LLC

January 27, 2020

In Sunday’s Members’-only a$$-kicking briefing entitled “🔥Like No Other Newsletter🔥,” we took a deeeeeeeeep dive into the Fairway Group Holdings Corp. chapter 11 bankruptcy filing. We relegated to a mere footnote, the following:

*Two more local grocers to watch out for: Lucky’s Market (not PE-backed) and Earthfare (PE-backed). The former announced, on the heals of losing its sponsorship from Kroger Inc., that it would close 32 of 39 stores. The latter is quietly shuttering stores (e.g., Gainesville and Indianapolis). This is telling:

“Stern said Lucky's could potentially be acquired, but he said logical choices like Sprouts Farmers Market and The Fresh Market are also retrenching and not in expansion mode right now.”

The pain in grocery is pervasive.

Lucky’s Market Parent Company LLC be like:

And so the Colorado-based company and 21 affiliated entities filed for chapter 11 bankruptcy in the District of Delaware. Because, like, f*ck it: the pain in grocery IS pervasive so it might as well become a chapter 11 debtor like everyone else.

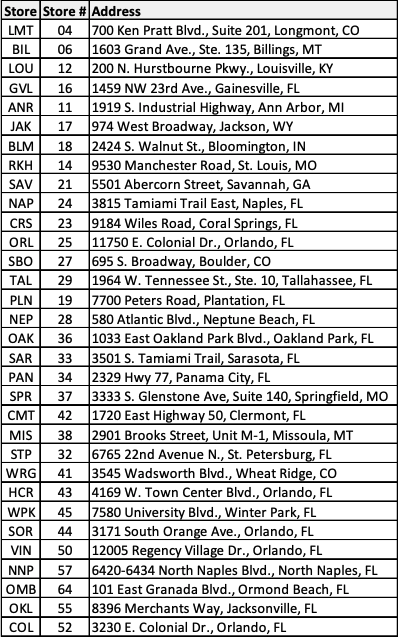

This one swims upstream. The debtors focus on affordable organic and locally-grown produce, naturally raised meats and seafood, and fresh daily prepared foods. Which, we thought, was supposed to be all the rage. “Organic for the 99%” was their mission. They even have private label goods. AND they have a millennial-pleasing “giving” element to their business: 10% of profits from private label sales are reinvested into the local communities they service. They have no unions. And they’re not even private equity owned!! Kroger Inc. ($KR) is the debtors’ secured lender and largest equity holder and, while obviously not PE bros, it seems that maybe(?) Kroger pushed the Colorado-based founders to grow too fast too soon?? In the midst of a number of grocery bankruptcies. In April 2016, they had 17 stores. The Kroger transaction took place at that time and then — BOOM! — a private equity growth mentality appears to have mysteriously overtaken the debtors. By the end of that year, the debtors’ footprint was up to 20 stores; by the end of 2017, it was 26 stores; 33 stores by the end of 2018; and 39 stores by the end of 2019. Florida was a primary focus.

The timing was pretty bad. Per the debtors:

…the Company’s expansion in Florida coincided with, among other things, increased competition in the grocery industry, including expansions from competing chains such as Sprouts Farmers Market, Fresh Thyme Farmers Market and Earth Fare. As a result, notwithstanding the growth in sales, the portfolio of Company stores was unable to achieve sustainable four-wall profitability.

Note the mention of Earth Fare ⬆️. Get ready for Dirty Dancing 2: Havana Nights gifs, people.

There’s more:

Most recently, fiscal year-to-date through January 4, 2020, the Company had approximately $22 million of store operating losses and approximately $100 million net loss. Additionally, fiscal year-to-date through the week ended January 18, 2020, the Company had a 10.6% reduction in comparable store sales versus the prior year-to-date period.

Suffice it to say, that growth strategy diiiiiiiidn’t work out so well.

And so now it’s all being unwound. The debtors began winding down 32 of their 39 stores pre-petition and, obviously, terminated plans for 19 leased but unopened locations.

Absent closure, the debtors note, they’d be on the hook for $30mm in operating losses for fiscal year ‘20. Now they’re selling furniture, fixtures and equipment from, and transferring leases of, 26 stores to third-party purchasers. They have an asset purchase agreement with Aldi for six FL locations while they continue to operate 7 locations while the marketing process progresses.

The debtors will use Kroger’s cash collateral to fund these cases.

Jurisdiction: (Judge Dorsey)

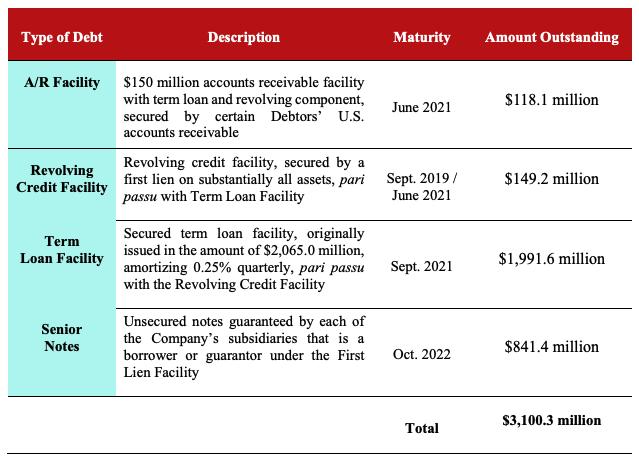

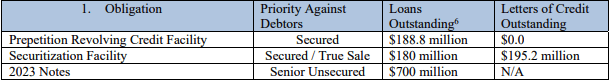

Capital Structure: $301.1mm secured loan (Kroger Inc.), $5.9mm New Markets Tax Credit Loan (BBIF Subsidiary CDE 3 LLC, guaranteed by Kroger Inc.)

Professionals:

Legal: Polsinelli PC (Christopher Ward, Liz Boydston, Caryn Wang)

Financial Advisor: Alvarez & Marsal LLC

Investment Banker: Peter J. Solomon

Liquidation Consultant: Great American Global Partners LLC

Claims Agent: Omni Agent Solutions (*click on the link above for free docket access)

Independent Director: William Transier

Other Parties in Interest:

Large Equityholder (55%): Kroger Inc.

Legal: Weil Gotshal & Manges LLP (Garrett Fail, Moshe Fink) and Richards Layton & Finger PA (Zachary Shapiro, Brett Haywood)