Airport Revenue Disrupted by Uber & Lyft

Airports (Short Short-Term Parking). Add another revenue stream disrupted by Uber.

Airports (Short Short-Term Parking). Add another revenue stream disrupted by Uber.

Soon there will be additional comps (paywall) available that will demonstrate just how far the value of NYC tax medallions have fallen in the face of Lyft and Uber.

Two weeks ago we asked whether there'd be an uptick in auto distress. We didn't really even touch on to what degree ride-sharing will impact car ownership though we did point out GST Autoleather's assertion in its bankruptcy papers that Uber and Lyft have had an affect on OEM production levels. Well, this doesn't bode well for suppliers then. Take this chart for what it is: a bit of marketing, a bit of projection. After all, it is from Lyft directly and, of course, they want to show "up and to the left." Still, just imagine what this means if true.

Notably, General Motors ($GM) reported numbers this past week that surprised to the upside and the stock popped. They did discount heavily, but whatevs. Significantly, GM also noted a 26% decline in production. That, too, to our point, cannot bode well for the players in the auto supply chain. Keep an eye on auto - 3% GDP growth notwithstanding.

Source: Lyft

Busted Tech? (Long Regulatory Disruption of Disruption). There are, what, 183929 Uber-for-X style companies today offering everything from weed delivery to in-home massages...? Most of these companies - Uber and Lyft included - are built on the 1099-economy where "gig" workers are framed as contractors rather than employees. Given that these companies are struggling to be profitable to begin with, it's especially helpful for these companies to avoid outlays for overtime pay, health insurance, worker's compensation, and other W-2 employee-related expenses. Except now, for the first time, a challenge to this model is seeing its day in court as a GrubHub Inc. ($GRUB) employee is suing for reimbursement of wages. Uber and Lyft have both settled prior (similar) suits out-of-court. Instacart, Caviar and Postmates have also been sued. A similar lawsuit, in part, forced Homejoy LLC into an assignment for the benefit of creditors in August 2015 and Chapter 11 in late-2015.* Which is to say that many companies - of GrubHub's status and otherwise - will be watching this fight closely as it has potentially existential ramifications for the gig economy going forward. Sometimes moving fast and breaking things runs into a regulatory roadblock.

* We thought it made sense to dive a bit deeper into what ultimately happened to Homejoy LLC, which, for the uninitiated, was at one time a Y-Combinator darling valued over $1b (after approximately $64mm of funding). Why? Because more often than not companies are celebrated on the way up and quickly forgotten after they come crashing down. It should be noted what happened to the company, its employees, and its assets after the crash. Here is what we know from the bankruptcy filing and otherwise:

Company's Bankruptcy Disclosure Statement, filed 9/15/16.

Clearly this wasn't the ending that Google Ventures, First Round Capital, Andreessen Horowitz and others wanted.

9/17/17 Update. Apparently that gig economy lawsuit with massively disruptive potential didn't get off to a hot start for the plaintiff.

Eventually something will disrupt Uber. Will it be this?

The ubiquitous Uber-for-X designation doesn't seem so ubiquitous anymore. That's because a lot of those companies have failed or are failing. Take Shyp, for instance, an on-demand logistics/shipping service where couriers came to your home, packaged your wares (Ebay anyone?) and shipped them for you. "Came" being the operative word. The company announced that it's retrenching back to SF, abandoning service in Chicago/LA/NYC. Choice quote (after getting $50mm in venture capital from Kleiner Perkins), "'Investors are looking to put capital into businesses that are cash-flow positive." Funny how that works. With so much "tourist capital" (read: sovereign wealth funds, pension funds, Fidelity Investments in the case of Snapchat ($SNAP)) flowing through venture capital, expect a lot more coverage of "busted tech" to come.

Who doesn't like a good dose of Kenny Loggins? Dude is a bada$$. Nothing gets a party going like Footloose. But we digress. Apparently nobody wants to arrive to the party as the "big dog rider" of aHarley Davidson ($HOG) rig anymore. Another victim of Uber and Lyft? US sales were down 3.9% and the company got downgraded this week. We wonder how leather sales are doing.

So Travis Kalanick is out and those of you who actually cared can now switch your corporate accounts back to Uber from Lyft. Congrats. Starwoodspoints! Anyway, ICYMI, mere days after the Amazon/WholeFoods announcement, the CEOs of both Fresh Market and Bi-Lo were replaced. Clearly the Board of Directors at both felt like a shape up was needed for the bloody war to come.

Apparently they've finally gotten the memo on retail (although, as we have well covered, the PE shops seem to be doing okay even while driving their portfolio companies into bankruptcy...but we digress): investments in retail companies are down markedly to 86 globally in 2017 as compared to 300 in each of '15 and '16. Speaking of private equity and retail, gotta love the timing behind the departure of TPG Capital's sole female partner given David Bonderman's ill-timed and inappropriate comments in the Uber boardroom. Notably, one noted potential cause for the separation is that heads needed to roll for the terrible J.Crew investment.

Madoff Comparisons (#DeleteUber aka Short Uber).

Things clearly aren't going your way when, on top of ALL of the other negative news to trickle out on seemingly a daily basis, you're compared to Bernie Madoff and a ponzi scheme.

Bankruptcy Code Section 4:20. Just kidding...the bankruptcy code isn't available for folks who make money off of weed.

Busted Tech. Answers.com takes a stray bullet in this piece about IAC's plans to shut down About.com. The fact that About.com has actually still been running this whole time renders us - yes, even us - speechless. Meanwhile, more busted tech is coming...soon. On the flip side, Quora is now a unicorn so who the hell really knows?

Canada. Housing is looking like an oncoming disaster - particularly in Toronto - and blood is appearing in the water.

Casual Dining. Quietly, a NYC mainstay is disappearing.

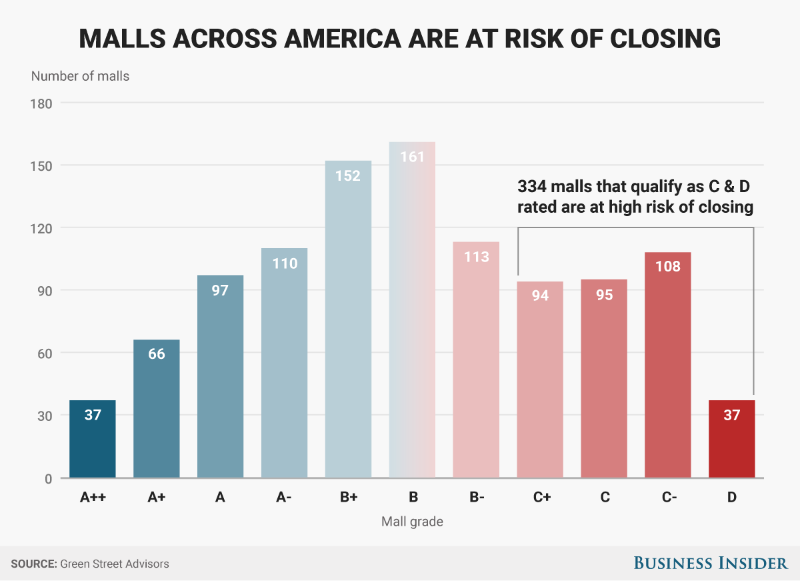

Dead Malls/Investing. David Simon's optimism notwithstanding (see above), everyone is all over the "short the malls" thesis - now even extending it to the "A Malls" that, prior to recently, were generally considered to be impervious to this retail malaise (note: there's over $1b of short interest on SPG currently). And this guy from Alder Hill Management LP is the poster child. (Let us know if you want his report: PETITION has it.) Some are throwing shade all over this hype. Finally, according to this, maybe we should all be doing a better job to ensure that algorithmic shopping doesn't gain more ground and malls actually DO survive.

Oil & Gas. Nothing like a good old corruption allegation that embroils multiple law firms and a private equity shop to help push a company (here, Cobalt International Energy) closer to bankruptcy (paywall).

Oil & Gas II. Wait. So now we're at an oil and gas deficit?!

Retail II (Jamming like a Boss). While Gibson Brands was able to refinance its debt and push out issues, Guitar Center is looking increasingly troubled. Given that the company is private equity-owned, undoubtedly there is an over-leverage story here (like with all other PE-owned retail), but we wonder whether the show-room trend is particularly applicable to this kind of business. We asked our artsy friends and one of them openly admitted to strapping in at the local GC and then purchasing on Amazon. The pricing was the same and he didn't have to worry about lugging it home. We find the in-store lessons narrative dubious as well. There are countless online resources for learning guitar - YouTube, most notably. Meanwhile, we enjoyed this decidedly millennial take on the death of retail.

Retail (Canadian Lumber Edition). Kidding, more like Canadian cashmere. Washable cashmere company Kit and Ace is restructuring in an additional acknowledgement that brick-and-mortar retail is tough - even if you're a VERY proven founder of successful apparel companies (in this case, Lululemon). Choice quote within: "Really it was just another store." Something tells us "Just another store" won't be part of the restructured company's marketing strategy.

Solar. SunEdison. Sungevity. Suniva. Verengo. SolarCity. Okay, just kidding about the last one but who knows what would've happened sans Elon Musk's Tesla/Solarcity merger shenanigans. Now Heliopower. We know many of you know the solar story: too much subsidy, too much debt, flooded supply from China pressuring margins, yadda yadda yadda. But we wonder if any of you have a notion with respect to a potential successful business model. We're serious: we're crowdsourcing your view here...

Taxis. Calling for a bailout.

The Profit. That's what Marcus Lemonis calls his CNBC show and now we'll get to see whether he can make some with the Camping World-led purchase of select portions of the Gander Mountain business in bankruptcy.

Fast Forward (Beauty). Uh oh. We noted last week that beauty category has been largely e-commerce resistant. Well, maybe not.

Rewind I (Bueller, Bueller). Get on with it already. Takata has become the new Westinghouse. Lots of noise. Just a matter of when. And, shocker! iHeartMedia's proposed subscription service with Napster - YES, NAPSTER - hasn't helped generate enough revenue to counteract $20b of debt.

Rewind II (Literally): We are as guilty as anyone hyping up the potential of autonomous cars but if anything is indicative of the wholesale difficulty to achieve 100% adoption, it's this piece about surviving Blockbuster franchises. Suffice it to say, there won't be driverless cars rocking the streets of Alaska anytime soon.

Rewind III (Shipping): We all know that the shipping industry hasn't been immune to its fair share of troubles the past year or so. Notably, Hanjin, Toisa, Daewoo, Ezra, and International Shipholding have all seen themselves in bankruptcy court. And, of course, Algeco Scotsman restructured as did Modular Space Corporation, as container companies, naturally, have also felt the effects. So, we thought this use case for surplus modular containers was interesting and we're dying for one of our readers in, say, Texas, to get one of these and report back.

Rewind IV (Apologies...More on the Retail Apocalypse): Last week we highlighted Jeff Jordan's early 2014 call on retail. Subsequently, he dove into the mall scene: you can read it here. The below excerpt should be particularly interesting to PETITION readers as we've been saying for some time that restructuring pros who continue to claim that Bonobos and Warby Parker will fill the retail void are, quite plainly, making a$$es out of themselves. As are, quite notably, REIT CEOs. Nothing has changed since JJ wrote this...

A lot of ink has been spilled on how difficult it is for American companies (like Uber) to infiltrate China. Well, it appears that difficulty runs both ways. To point, LeEco sounds like an absolute horror show.

Natural gas price projections.

Filings down this week so packing in the news...

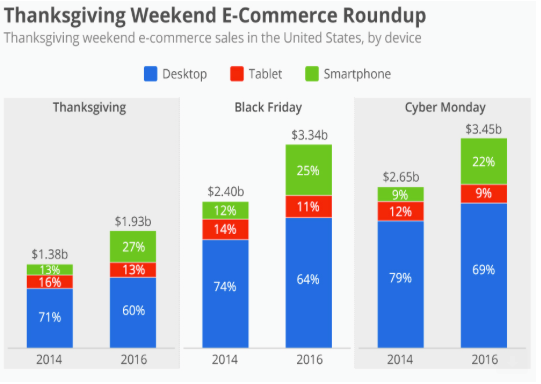

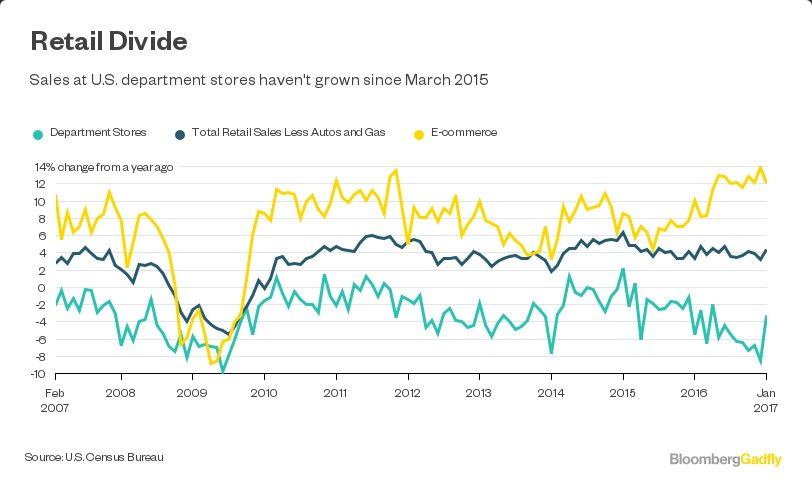

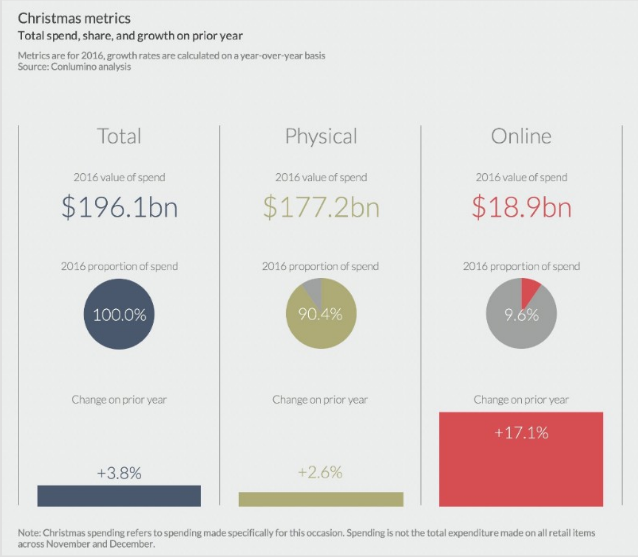

Chart of the Week II: Nike. The sneaker manufacturer announced this week that it would skip conventional wholesale channels like Dicks Sporting Goods, Foot Locker and others and sell its self-tying $720 HyperAdapt sneakers BtoC via its Nike+ app and at the NYC retail store. Clearly, Nike is paying attention to these recent consumer trends: