Interesting News (Weed, Quora, Dead Malls & More)

Bankruptcy Code Section 4:20. Just kidding...the bankruptcy code isn't available for folks who make money off of weed.

Busted Tech. Answers.com takes a stray bullet in this piece about IAC's plans to shut down About.com. The fact that About.com has actually still been running this whole time renders us - yes, even us - speechless. Meanwhile, more busted tech is coming...soon. On the flip side, Quora is now a unicorn so who the hell really knows?

Canada. Housing is looking like an oncoming disaster - particularly in Toronto - and blood is appearing in the water.

Casual Dining. Quietly, a NYC mainstay is disappearing.

Dead Malls/Investing. David Simon's optimism notwithstanding (see above), everyone is all over the "short the malls" thesis - now even extending it to the "A Malls" that, prior to recently, were generally considered to be impervious to this retail malaise (note: there's over $1b of short interest on SPG currently). And this guy from Alder Hill Management LP is the poster child. (Let us know if you want his report: PETITION has it.) Some are throwing shade all over this hype. Finally, according to this, maybe we should all be doing a better job to ensure that algorithmic shopping doesn't gain more ground and malls actually DO survive.

Oil & Gas. Nothing like a good old corruption allegation that embroils multiple law firms and a private equity shop to help push a company (here, Cobalt International Energy) closer to bankruptcy (paywall).

Oil & Gas II. Wait. So now we're at an oil and gas deficit?!

Retail II (Jamming like a Boss). While Gibson Brands was able to refinance its debt and push out issues, Guitar Center is looking increasingly troubled. Given that the company is private equity-owned, undoubtedly there is an over-leverage story here (like with all other PE-owned retail), but we wonder whether the show-room trend is particularly applicable to this kind of business. We asked our artsy friends and one of them openly admitted to strapping in at the local GC and then purchasing on Amazon. The pricing was the same and he didn't have to worry about lugging it home. We find the in-store lessons narrative dubious as well. There are countless online resources for learning guitar - YouTube, most notably. Meanwhile, we enjoyed this decidedly millennial take on the death of retail.

Retail (Canadian Lumber Edition). Kidding, more like Canadian cashmere. Washable cashmere company Kit and Ace is restructuring in an additional acknowledgement that brick-and-mortar retail is tough - even if you're a VERY proven founder of successful apparel companies (in this case, Lululemon). Choice quote within: "Really it was just another store." Something tells us "Just another store" won't be part of the restructured company's marketing strategy.

Solar. SunEdison. Sungevity. Suniva. Verengo. SolarCity. Okay, just kidding about the last one but who knows what would've happened sans Elon Musk's Tesla/Solarcity merger shenanigans. Now Heliopower. We know many of you know the solar story: too much subsidy, too much debt, flooded supply from China pressuring margins, yadda yadda yadda. But we wonder if any of you have a notion with respect to a potential successful business model. We're serious: we're crowdsourcing your view here...

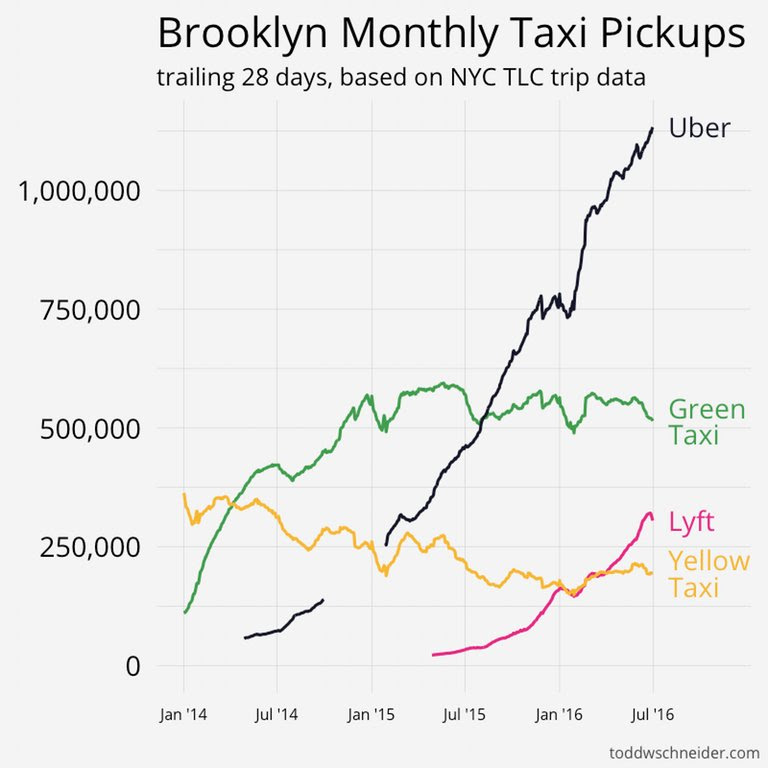

Taxis. Calling for a bailout.

The Profit. That's what Marcus Lemonis calls his CNBC show and now we'll get to see whether he can make some with the Camping World-led purchase of select portions of the Gander Mountain business in bankruptcy.

Fast Forward (Beauty). Uh oh. We noted last week that beauty category has been largely e-commerce resistant. Well, maybe not.

Rewind I (Bueller, Bueller). Get on with it already. Takata has become the new Westinghouse. Lots of noise. Just a matter of when. And, shocker! iHeartMedia's proposed subscription service with Napster - YES, NAPSTER - hasn't helped generate enough revenue to counteract $20b of debt.

Rewind II (Literally): We are as guilty as anyone hyping up the potential of autonomous cars but if anything is indicative of the wholesale difficulty to achieve 100% adoption, it's this piece about surviving Blockbuster franchises. Suffice it to say, there won't be driverless cars rocking the streets of Alaska anytime soon.

Rewind III (Shipping): We all know that the shipping industry hasn't been immune to its fair share of troubles the past year or so. Notably, Hanjin, Toisa, Daewoo, Ezra, and International Shipholding have all seen themselves in bankruptcy court. And, of course, Algeco Scotsman restructured as did Modular Space Corporation, as container companies, naturally, have also felt the effects. So, we thought this use case for surplus modular containers was interesting and we're dying for one of our readers in, say, Texas, to get one of these and report back.

Rewind IV (Apologies...More on the Retail Apocalypse): Last week we highlighted Jeff Jordan's early 2014 call on retail. Subsequently, he dove into the mall scene: you can read it here. The below excerpt should be particularly interesting to PETITION readers as we've been saying for some time that restructuring pros who continue to claim that Bonobos and Warby Parker will fill the retail void are, quite plainly, making a$$es out of themselves. As are, quite notably, REIT CEOs. Nothing has changed since JJ wrote this...