Notable (Cov Lite Loans, Delaware Bankruptcy Filings & More)

More = Busted Tech, Investment Banks & REITS

Biglaw. Summer Associate satisfaction surveys (firewall). In case anyone actually gives a sh*t.

Busted Tech. A view that recent IPOs will never make money. Meanwhile, Toys R Us is a harbinger of, you guessed it, BUSTED TECH.

Canadian Retail. Also looking increasingly ugly.

Cov Lite. We're old enough to remember when people said it was dead and would never come back. Memories are short AF.

Delaware. This article about retail bankruptcy cases avoiding filing in Delaware misses the mark widely. Like, way outside. Any DE practitioners want to opine - without attribution - on this?? Email us here.

Investment Banking. Jefferies can't trade for sh*t but advisory fees baby. Given these advisory fees, it looks like UBS wants to get back into the restructuring advisory game. Again. For, like, the 283th time.

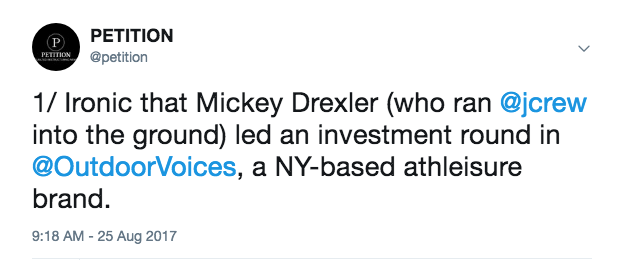

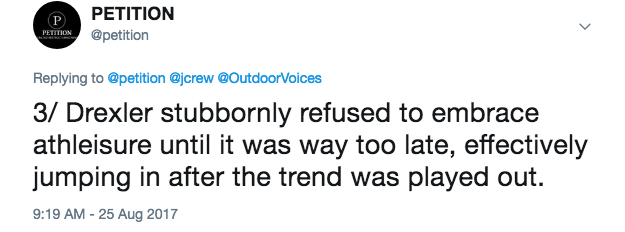

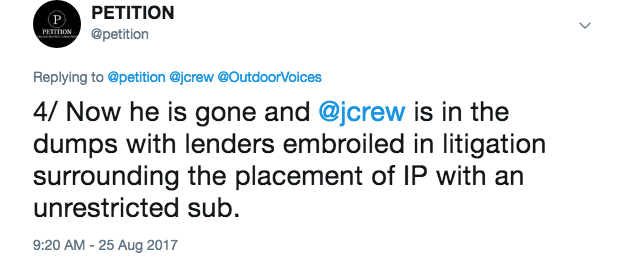

J.Crew. Investors are pissed.

New York. Is it in danger of becoming Detroit?

Puerto Rico. The hits just keep on coming. Sad, really.

REIT Investments. This is an interesting piece about alternative investments by REITS. Simon Property Group ($SPG) looks particularly active.

Retail (Taxes). When you're industry is in secular decline, fight for scraps. Here, tax changes.