⚡️Notice of Appearance⚡️ - Gregory Segall, Chairman and CEO of Versa Capital Management LLC

This week we welcome a notice of appearance from Gregory Segall, the Chairman and CEO of Versa Capital Management LLC.

PETITION: Everyone is talking about "too much money chasing too few deals." Can you enlighten us a bit as to your experience looking to acquire or invest in middle to lower middle market companies (in or out of bankruptcy)?

Can safely say the conventional ‘distress cycle’ has been hyper-extended by the combination of low interest rates, multiplying sources of non-bank lending sources and economic strength. We track the outcome of all deals we do not buy and our number one competitors at the moment are either “liquidated” (i.e., too sick to save) or “refinanced” (i.e., found someone who let them kick can down road...again). But at the end of the day, the cycle has been delayed, not denied, so our mantra remains “Distress 2020!” (unless it’s 2021...)

PETITION: Given how disruptive technology has become and how quickly "change" appears to be occurring, how do you evaluate management teams and scrutinize their projections today? Have you changed any methodologies from, say, 10 years ago?

I see two layers to the question, one being the effects on a business of technology and how that impacts projection reliability, and then management competency in making projections. On the former, most everyone’s crystal ball has been off both in identifying where technology may be applied to or disrupt a given business’s expectations. On the latter, the quality of management projections, whether 13 week cash flows or 5 year valuation models, is usually a function of how long a given companies business cycle is (ie fast food has pretty good short term insight but pretty foggy about 1 or 2 years out, vs. building locomotives usually cannot do much about short term but can have pretty good visibility over the medium-longer term given the procurement cycle). Sprinkle all this with the question of management’s competency and command of the business, both from the forest and the trees, and that will tell you something about projection reliability.

PETITION: Versa owns Avenue Stores since its 2012 bankruptcy. The company once had 500 stores and now, according to its website, it has 262. What lessons have you guys applied to that business and what continued evolution is in store? Where do you see retail in 5 years? 10 years?

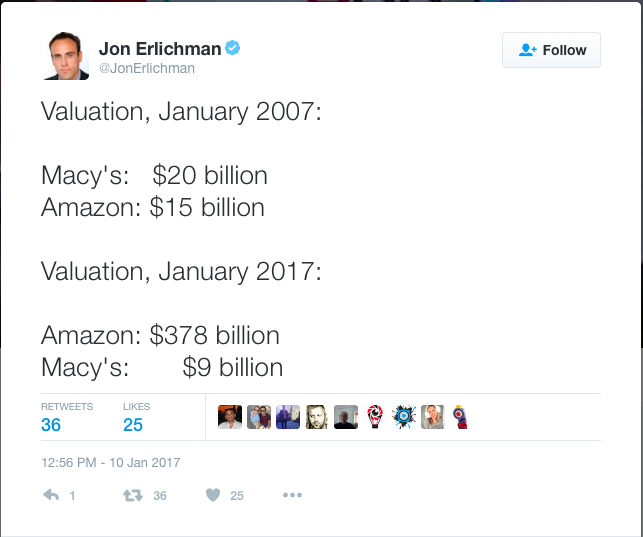

When we acquired Avenue its store base was immediately pared to about 300, and over the last few years the company has been letting leases roll off where stores are less productive; fortunately Avenue has always had a strong and sizable eComm/direct business (~33%) so the store roll off gets offset by ecomm growth, and going forward where possible a retailer like Avenue can operate in a much smaller footprint (ie 3,000 sqft instead of 5-6,000) and therefore more profitably so they are executing that shift wherever they can. Retail will continue to transition for years to come, and it is somewhat helpful that landlords are starting to become more realistic about the need to make accommodations or lose tenants. “Retail” has always been a rough neighborhood; I expect it always will be whether 5 years or 10 years out, will just be a new set of challenges.

PETITION: The bankruptcy business has changed considerably in the years you've been in the space. What is the biggest issue you see today with the bankruptcy process and what's your remedy to solve it?

Aside from the bankruptcy code looking like the tax code in terms of all the “special interests” getting their fingers in the pie going back to the BAPCPA amendments, there used to be a much greater emphasis on seeing debtors reorganize. I won’t be the first to observe that most mid-market debtors “can’t afford to go bankrupt” given the cost and other pressures including timing and all the parties who keep trying to elevate their priority resulting in rapid administrative insolvency. Since “high costs” are certainly a difficult issue but almost impractical to reduce to a fixable sound bite here, If I had to choose one or two remedies it would be getting rid of or extending the shortened deadlines for lease assumption or rejection, as well as reducing the number and kind of pre-petition creditors that can elevate their claim priority.

PETITION: In addition to a lot of accomplished, senior folks like yourself, we have a great number of junior professionals and students that read PETITION. What is your advice for them? What is the best book you've read that's helped guide your career?

When starting out early in your career, don’t every view any task as being beneath you - add value by being seen as a go-to resource, make yourself like fly paper and things will stick to you, increasing your role and experiences in your organization. As for a book (or four), gIven how often it is cited It seems almost passe to reference Sun Tzu, but it is a great book on strategy and tactics; also recommend “How to Win Friends and Influence People” by Dale Carnegie, another classic - success in this business, or really in any, is often all about working with people. Regardless of your politics, “Rumsfeld’s Rules” is also a terrific summary of common sense management techniques from a guy who has had enormous public and private sector experiences. And finally from the standpoint of bankruptcy, I highly recommend “Feast for Lawyers” by Sol Stein - if you can find it, a great if slightly dated primer on the reorganization process, and a great read - more like a novel though based on true stories.

PETITION: Thanks, Greg.