⚡️Notice of Appearance - Lisa Donahue, AlixPartners⚡️

This week we welcome a notice of appearance from Lisa Donahue, the Global Co-Lead of Turnaround and Restructuring Services at AlixPartners. She is based in New York.

PETITION: Westinghouse. PREPA. Purdue Pharma. You’ve been attached to some big name deals over the last several years. Congratulations. There are some additional names still kicking around in the opioid space. What do you see happening there in 2020? Will there be additional big pharma bankruptcy filings? What do you make of the recent uptick in biopharma and biotech bankruptcy filings?

Thanks. The last few years have been a bit crazy and definitely challenging. On the opioid and pharma front, we’re seeing lots of activity. Some of this of course is due to litigation like the Purdue situation, but other matters are drive by major (structural) changes and perhaps some unintended consequences of those changes.

The pharma industry has changed based on:

Customer consolidations which lead to lower bargaining power, increasing fees, rebates and less favorable terms. We don’t see this letting up any time soon as Walmart, Costco, and Amazon enter the retail pharmacy market.

Beginning in late 2017 [Generic Drug User Fee Amendments] made it cheaper and faster to get [Abbreviated New Drug Application] approvals. This was intended to lower prices for the consumer with the theory of faster approval processes. What it actually did was allow more competition into the market in the form of manufacturers from India, and then it led to worsening competitive behavior including deeper discounting.

We are seeing generic companies rationalizing product portfolios — some balancing Generics and Branded. The strong will survive but many will have to sell — either in or out of court.

There also is a significant litigation overhang from the DOJ investigation into price fixing as well as the opioid situation.

PETITION: In Westinghouse, the DIP came under fire from the bench in the beginning of the case. We recently wrote about a new academic study entitled, “Rent extraction by super-priority lenders.” What did the authors get right about DIP dynamics and what did they miss? When you think about DIP-sizing these days, are there any considerations you need to take into account that didn’t exist, say, 10 years ago?

The article that you reference makes some interesting points, but they aren’t addressing what the bench was questioning with the Westinghouse DIP. Because of the global pooling and treasury system of Westinghouse, the DIP required the ability to lend funds from the DIP to non-debtor entities. The side-by-side structure and relationship of the Debtor entities and the EMEA entities that needed the cash made granting collateral outside of the estate for the DIP lenders quite complicated.

As far as DIP considerations are concerned, frequently speed and flexibility are of paramount importance when determining the ultimate DIP provider. Int he case of Westinghouse, we needed flexibility on covenants, timing to deliver a business plan, and ability to lend to EMEA affiliates.

I think as businesses are more global and supply chains are more complicated, companies need a funding source that can be flexible to their operational needs in order to allow the management teams and professionals to maximize their time in chapter 11. As a result, sometimes companies are willing to pay a bit more for that flexibility.

PETITION: What do you make of the increasing role that private equity is playing in restructuring?

I think that is the natural progression of more and more companies being owned by PE firms. We’re seeing differing roles being played by some fo the more traditional PE players. They are often involved at many levels of the capital structure and strategically looking to hedge their positions. As a result, they have a more active role from a turnaround perspective.

As professionals, we are partnering with PE firms more and more — not only as trusted advisors — but also as interim management, providing finance transformation, and sometimes we provide short-term interim management. It is great for the companies, as it frequently gives them liquidity options that they may not have otherwise had.

PETITION: Governance, generally, appears to be a bigger and bigger issue in bankruptcy today. Alta Mesa is a great example. How can clients better think about governance going forward?

I think strong governance is important for every board, regardless of level of distress. It becomes even more important when a company is facing crisis. As management, you can be making value-impacting decisions that will change the trajectory of the business and ultimately impact creditor recovery. When constituents don’t agree, that is when the lawsuits and litigation starts. Having gone through a thoughtful and robust analysis, an independent view can help to insulate the management from liability.

I think have a diverse board is critical I don’t mean just gender diversity, of course that is important, but also ethnic and experience diversity. Diversity of thought should be the goal. Different perspectives are important when things are going smoothly; it becomes imperative when things get rocky.

PETITION: There has been increasing attention on the role of independent directors in bankruptcy. It has become the latest cottage industry in the restructuring space. What are the pros and cons of seeing the same revolving door of men (because, yes, they are mostly men) across multiple deals?

All independent directors are not created equal. I have worked with some great and very constructive, capable guys, because yes, they do tend to be men, and I have endured some that are a bit tougher to understand why they are there. A board needs to ask the question: What is the value add from a management and process perspective?

I think that you need to assess the situation and understand the need. Simply being independent is not enough. The director should actually bring a skill set that is helpful to the situation.

PETITION: What are some concerns you’re hearing from clients that not enough people are talking about? What themes do you expect to prevail in 2020? Will it be more of the same, e.g., retail and energy, or will other industries be a notable trouble zone? In other recent interviews, you’ve highlighted auto….

Your timing is perfect! We have just completed our 15th annual turnaround and restructuring survey.

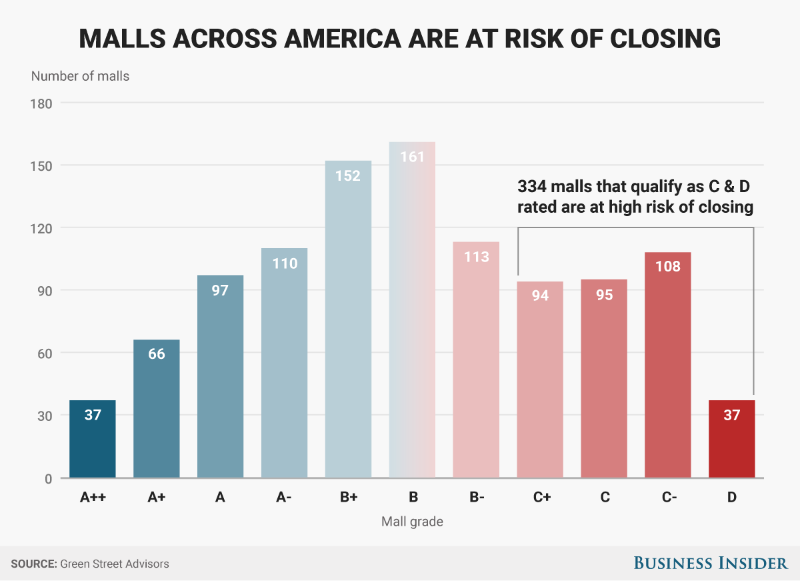

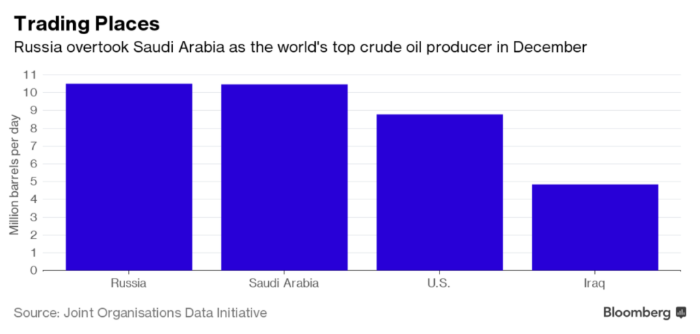

As expected, retail will continue to suffer, as will oil and gas and power. I think globally we will see challenges in the auto sector, and in fact we are already seeing signs of stress in the supply chain.

Interestingly, the pressure points for turbulence are less liquidity and more disruption and uncertainty.

We have completed a year of uncertainty and expect another one for 2020. This year is one that may finally see the UK’s departure from the EU, a bruising Presidential election amid multiple US trade wars, and the threat of recession sweeping both the Americas and Europe.

Consumer behavior is a huge driver of the global economy and continued uncertainty will challenge even the most optimistic consumer.

The Automotive Industry also continues to show signs of significant distress in 2020, we are expecting continued technological innovation to be the largest disruptive factor for the Automotive Industry (cited by 70% of our survey respondents), as electric and hybrid technology continues to challenge traditional manufacturing practices and established supply chains.

PETITION: There, sadly, aren’t a lot of women in the restructuring industry. What can the industry as a whole do to be more diverse? What is AlixPartners doing?

The lack of women in restructuring is terrible. Unfortunately, the lack of women in leadership positions is not limited to the turnaround industry. At AlixPartners, we have the most women certainly as the senior level, and likely at all levels. We have hired, developed and supported women consistently for many years. The simple fact is that organizations need to recognize that it is different to be a woman in this industry — understanding and flexibility are paramount. It should be treated as a positive, not a negative. Having women and diverse people in high profile and leadership positions is the best demonstration of support that an organization can have.

I like to think that we are doing all we can, but we can always do better. We offer sabbaticals, flexible work arrangements, Employee Resource Groups (ERGs) that offer support for not just women, but other affinity groups as well.

We are very focused on Diversity and Inclusion (D&I) as a Core Value of the firm, and every leader in the organization has development goals that are aligned with our D&I goals.

PETITION: What is the best advice that you received that’s helped you in your career? If you were just starting out your career today, what would you do to position yourself for success? Give us some gems.

Wow — pressure to provide gems.

From my parents — No matter where you end up, always remember where you came from. I think of this as you can be confident, and you should be, but also remain humble and always be respectful.

From one of my first bosses, Sonny Monosson — In a negotiation, things are rarely as simple as they seem. Look beyond what is presented on the surface. There is always a reason that someone is doing what they are doing. Figure that out, and it will help you determine how to handle it.

From one of my partners here at AlixPartners, Larry Ramaekers (after I worked myself into exhaustion on the Umbro case) — This life is a marathon, not a sprint. Health and balance are extremely important and are what will make you successful.

From my older self to my younger self — Don’t be afraid to put yourself out there. Try for the promotion, ask for the difficult task, speak up in the meeting if you have something to say.

PETITION: Have you read any books or listened to any podcasts that you think our community of investors, advisors, bankers, and lawyers would find interesting? What’s piquing your curiosity these days? Keep in mind: we have a lot of students who read us too.

I am one of those people that read several books at the same time. I also re-read books. So, with that said, I am currently reading “Thinking, Fast & Slow” by Daniel Kahneman, “The Plot Against America” by Philip Roth (this is a re-read) and on Audible — newest thing while I walk to the office, I am listening to “Where the Crawdads Sing” by Delia Owens.

They each serve different purposes for me. The Kahneman is thought-provoking and helps me consider why people do what they do and how they form opinions. This is very helpful when dealing with seemingly unreasonable people!

The Delia Owens books is a sweetly written story of love, with some prejudices and a little bit of mystery thrown in. It’s an easy escape type novel.

And the Roth because he is such a genius and it is so well written. His books are always worth revisiting, in my opinion.

PETITION: What do you do to blow off steam when you’re not in the office?

We have a ski place out in Utah. Being on the slopes and hanging with my family and friends give me perspective on what really matters in the end.

PETITION: Amen to that. Cheers, Lisa.