Retail Fallout on CMBS Continues $SHLD

One word: Sears

One word: Sears

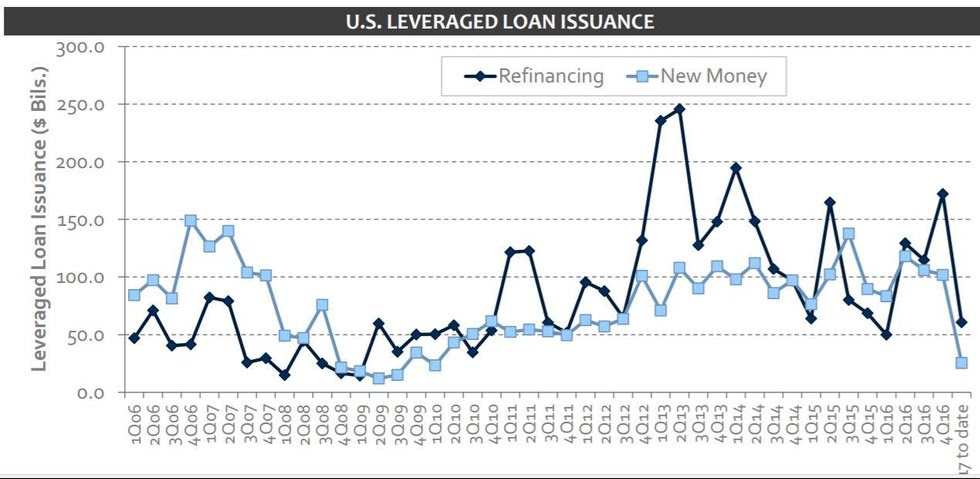

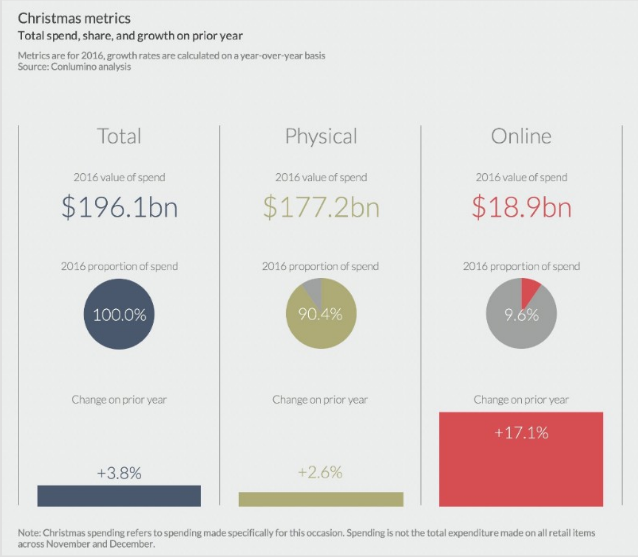

Toy's R' Us YOY down $33mm and comp stores down 4%. Neiman Marcus, meanwhile, reported that it is terminating its proposed sale process. Hudson's Bay Co., considered a buyer, is suffering itself and apparently the two parties couldn't figure out what to do with Neiman's $4.8b of debt. Now the company has to fend for itself. Speaking of bigbox, Sears Canadalooks like the first domino to fall in the Sears empire and its former CEO isn't pulling any punches vis-a-vis ESL. Ascena Retail Group ($ASNA) announced that it's closing 25% of its stores. And now the game of chicken between retailers and malls is at full force with restaurants bouncing around to the Sam Cassell big balls dance (c'mon, you know the reference). Finally, Walmart bought Bonobos and the retail race is on: WMT vs. AMZN!

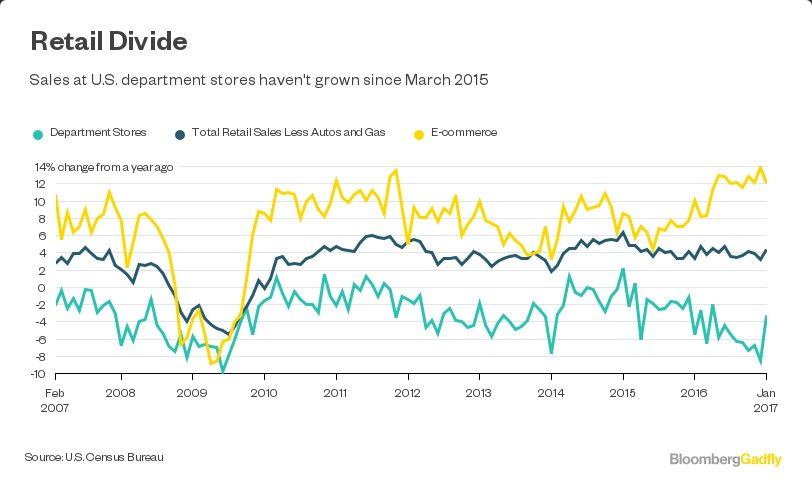

Retail (At Least They're Consistent). Chico's FAS Inc. ($CHS) reported numbers and despite a profit increase, its other numbers looked a bit shaky - consistent with the rest of the apparel industry. Net sales, revenue and same store sales were all down with guidance indicating additional same store sales declines. In the face of challenging millennial spending habits, decreased tourism and President Trump, Tiffany & Co. ($TIF) reported a 3% same store sales decline which sent the stock tumbling nearly 6%. Some data on decreased tourism from FourSquare here. Sears Holding Corp. ($SHLD) revenue fell 20% and same store sales fell nearly 12% - and yet the stock initially popped showing the disconnect between reality and markets these days. Serious, WTF.

Ok, c'mon. Seriously. What is this? "We don't need more customers. We have all the customers we could possibly want." - Eddie Lampert.