😎The Professionals Weigh In. Part II.😎

Pros opine on the big restructuring themes for 2022.

Source: Getty Images

Last Wednesday — after publishing thousands and thousands of words over the course of 2021 — we finally took a step back and shut the hell up (though we still had plenty to say in Sunday’s a$$-kicking paying subscribers’-only briefing).

Instead, we reached out to a variety of restructuring professionals* and asked:

✅ What would be your selection for the chapter 11 bankruptcy case of the year and why (don't shamelessly list your own)?

✅ What are 2-3 of the biggest restructuring themes to emerge out of 2021?

✅ Given all of the excitement around mass tort cases like Boy Scouts of America, Purdue Pharma and J&J, what do you think Congress will do about venue and third-party releases, if anything? What should be done?

You can see their answers here.

This week we return to our panel with questions about the future. One important note: answers were, for the most part, submitted on December 13th. Enjoy.

PETITION: Put your prediction cap on: what do you think the 2-3 big restructuring themes of 2022 will be?

Pilar Tarry: “Overall, 2022 will be in like a lamb, out like a lion. If we keep clawing back from this pandemic slowly, and all signs are it will continue to be slow, companies in the hospitality and tourism space will start to crumble. The pace of change in monetary policy will be interesting to watch. It’s like a giant game of Jenga once all the obvious pieces are out.”

David Meyer: “Rising interest rates will not have an immediate impact on restructuring activity. But inflation will play a larger role in the latter half of the year coupled with easing of federal assistance together with supply-chain challenges and a decrease in consumer spending. 2022 will largely mirror 2021 with acute and unforeseen situations emerging as the most likely restructuring candidates. Accelerated prepacks will become the norm, and the public announcements about the fastest in-court restructuring ever will cease.”

Brian Resnick: “First, real estate. The pandemic abruptly altered many existing real estate trends. Nobody is really sure where things will go next but investors are placing different bets— return to work vs. hybrid work; whether remote work leads to less office space or the pandemic leads to the need for more space so employees can be sufficiently distanced; finance and tech moving to Florida and Austin; business travel as usual or zoom meetings here to stay; demand for additional workspace in suburbs and warmer remote work destinations; continued growth of residential housing prices; rising interest rates cooling that growth. Real estate bets are usually highly-levered and not all of these predictions can turn out to be right. Next, China. The restructuring world is obviously watching Evergrande and Kaisa closely, given the more than $5 trillion in debt that Chinese developers took on during the country’s recent building boom. Total sales among China’s largest developers have plummeted over 35% year over year. Any restructuring of the country’s major developers could have cascading effects throughout a very large industry and national economy. If the Chinese government allows for restructuring of these distressed businesses or does not successfully manage these economic pressures, the global reverberations can be massive. Lastly, opportunistic recapitalizations. Last year, companies with medium-term debt maturities amended and extended loans to take advantage of favorable rates and market conditions. That trend will probably continue this coming year as companies with 2023-2024 maturities opportunistically look to recapitalize and get additional runway while the getting is good.”

Natasha Labovitz: “I don’t think we’ve seen the end of targeted mass-tort restructurings, or the related focus on third-party releases. As more people understand what the so-called “Texas two-step” really is (hint, it’s really no more or less than a spin-off using 21st century deal technology) I predict some of the furor will die down, but the litigation will remain. Speaking of litigation, we’re also likely to continue to see cases that sharpen the line between what borrowers and majority groups of lenders can – and cannot – do to minority and holdout lender groups in the context of liability management. And, I’ll go way out on a limb and say that 2022 will be a year when some checks come due for businesses whose pandemic-era borrowing dwarfs their post-pandemic business prospects. Lenders’ patience and the era of easy money will not last forever.”

Rachel Albanese: “(1) Will there be large restructurings in 2022? When will the bubble burst? (2) More mass tort action. (3) Your guess is as good as mine!”

Matthew Dundon: “Impact of higher rates, including return of a key credit metric only analysts over 40 remember – EBITDA to interest expense; recency bias luring people into low-priced 2L and unsecured bonds and loans shortly after filings because that was the money-making trade for the past couple of years.”

George Klidonas: “Third party releases, unless the Supreme Court or Congress weigh in sooner rather than later to determine the issue. Out of court restructurings, creditor on creditor violence, and liability management litigation will likely continue, particularly if certain market conditions continue.”

Damian Schaible: “Bootstrap A&Es – As many have discussed, we have added tremendous leverage to the market and capital structures over the past couple of years, and financing documents have gotten looser and looser. As a result, there are often no traditional triggers, so capital structures can more easily persist through poor performance with liquidity issues or maturities being the only practical limitations. With investors currently interested in keeping money to work wherever possible and obvious uncertainty in the future with respect to how long this remains the case, sponsor portfolio companies and public companies alike are looking for ways to extend maturity runways by multiple years. Wherever traditional refinancings can be used, they will be. Where leverage or performance issues mean that’s not on the table, companies are engaging with existing creditors to seek maturity extensions in exchange for new junior capital and/or better documents and/or terms. We will see this dynamic accelerate until rising rates begin to bring people to the table more naturally.

Liability Management - As you’ve often reported, docs are now looser than ever before, and when you add to that investors looking desperately for things to do, you get lots of liability management opportunities for companies that would be distressed in normal times. We will see lots of liability management exercises in 2022 as a result.

Inflation and rising rates - It’s no longer “transient” and it’s the only thing likely to stop the music at this current all-night market rager…. Inflation is the one thing the Fed can’t really manage away, and it would lead to rising interest rates that would stop the party for a lot of severely over-levered balance sheets. (How is that for mixing metaphors?!) Who knows if it will happen in 2022 or later, but rising rates could change the game.”

Chris Ward: “First, I could have used this as a 2021 theme as well, but the continued downturn in the restructuring industry. It will undoubtedly change, but the start of 2022 will continue with the entire industry continuing its sabbatical. I believe my ’21 prediction was when is the wave coming? Unfortunately, the answer may once again be – next year. Second, scrutiny. Whether its third-party releases, independent directors, conflicted professionals, the enhanced scrutiny on the legal profession will again be a prominent part of our practices. And, third, out of court alternatives. Given the state of the economy and liquidity available to PE firms, the biggest trend may be what happens outside of bankruptcy courts. There are still plenty of distressed companies and there are still many deals being done. We have seen an uptick in Article 9 sales, distressed M&A deals being done out of court, and state law alternatives like ABCs and Receiverships. When times are tight, people want to do the deal and not have to pay the costs of a full chapter 11 process. I think this trend will continue into ’22.”

Navin Nagrani: “First, just technically speaking - interest rates rising in 2022 coupled with the Fed plans for tapering will generally cause market and asset valuations to come down and the cost of indecision and inaction to increase (as it relates to loans in workout). Second, I think we will see more private equity sponsor backed loans in workout amongst traditional banks and non-bank lenders (BDCs, private credit groups, SBICs, etc.). Lastly, real estate in general is a slow moving asset compared to other assets like inventory or receivables.. There are some fundamental issues going on with certain types of real estate right now like office that will eventually make its way onto the restructuring scene as rents roll over and/or debt comes due.”

Steven Korf: “Third-party releases and venue shopping will continue to be hot topics into 2022. As a healthcare advisor, I would be remiss if I didn't mention the themes we are predicting in the healthcare industry in 2022. With temporary stimulus funding drying up from the CARES Act, the financial strain on hospitals and health systems will no longer be masked. While we expect hospitals may receive limited funding from the various federal infrastructure and support packages going forward, it will only provide a short-term solution to long-term operational problems and extend the timeline for entities that would otherwise be absorbed by larger systems, file for bankruptcy, or close.”

PETITION: What is the disruptive innovation trend that you’re most curious about and why?

Natasha Labovitz: “I’m interested to see what happens next in the so-called “Great Resignation”. Is this a short-term pandemic-driven phenomenon, fueled by media hype and a very catchy name, or is it in fact a societal shift that has been long in coming, which ultimately will rebalance the economic power between employers and employees and reshape the definition of career success?”

Chris Ward: “Hybrid court hearings. Rightfully so, much ado is made about the cost of bankruptcy. However, virtual court hearings can drastically reduce the cost of professional fees for cash strapped debtors. Hybrid hearings would allow the soccer team that some firms send to the first day hearing to stay home and virtually participate. We are approaching two years of virtual hearings and the courts and the entire restructuring industry have not missed a beat. This trend should continue, with the caveat that some evidentiary hearings and case events must be in person to delve into the veracity of the witnesses, but this is a positive trend that benefits everyone.”

David Meyer: “Zoom and 5G/increased high-speed connectivity. Will facilitate work-from-home trends, change the way we do business (all in favor of Zoom first-day hearings raise your hand), how we shop, how we interact with each other, and how we manage our teams and optimize our culture at our respective firms. It is inescapable that all restructuring professionals have a different work experience than they did just a few years ago, and this is arguably most impacted at the more junior levels. The impact is at its earliest stages and will have long-lasting consequences.”

Brian Resnick: “In recent years, particularly in 2021, direct lending has increased precipitously in number of funds (to over 700), capital (to over $300 billion) and deal size (some recent ones exceeding $2 billion). A common direct lending unitranche structure, where a single lender (or small group) holds the debt (sometimes a single lien, first out / second out structure) without syndication, has been a major selling point for direct lenders to act more like partners invested in the borrower’s success. This structure allows a borrower that becomes distressed to negotiate with one or a small group of lenders. The large-scale direct lending market did not exist prior to the 2008 crash, and it will be interesting to see how direct lenders manage the next downturn. In the current borrower’s market, lenders competing hard for deals often try to market themselves as having a collaborative and flexible client-service reputation. If defaults start to increase, direct lending funds will have to make tough calls to balance their drive to compete for new loan origination (to deploy significant accumulated capital) with the need to minimize losses from existing portfolios. Direct lending transactions typically (though not always) still include leverage ratio-based financial maintenance covenants, so those lenders have more ability to push for restructuring than under the “covenant-lite” term loans that have become the norm across the broadly syndicated market. Direct lending structures also often include additional powerful lender protections, like pledge rights allowing lenders to replace boards. The documentation used in direct lending transactions has not yet been tested as extensively as for more traditional loan market structures.”

Rachel Albanese: “Activist “stonk” investors. For example, will Macy’s cave to the recent demand to create a Tesla showroom in its flagship stores and start accepting crypto? How will AMC’s new popcorn business fare? Will any CEO of a public company actually show up at an investor conference sans pants and, more importantly, how would it affect the company’s stock?🚀 🚀 “

Damian Schaible: “SPACs…. In 2021, we saw tremendous numbers of both early stage and potentially distressed companies go public through SPACs. I am interested to see how these companies perform longer term and what the market implications will be. Traditionally, for companies to go public, the companies and their governance, financial reporting and other systems had to be much more mature than many SPAC companies are – the traditional IPO underwriters would want to see late stage, seasoned companies looking to go through a traditional IPO process. There obviously isn’t a lot of debt on these companies, so it is unlikely to lead to large numbers of traditional restructurings, but I am interested to see how they operate longer term and what regulatory and litigation impacts may develop.”

Navin Nagrani: “WFH has created massive ripples in the way people work and interact with others. What is our new normal? Decentralized finance is happening - what are the downstream implications and opportunities for restructuring professionals?”

George Klidonas: “Although I am not necessarily certain if, how and when cryptocurrency will completely disrupt the system it was intended to, i.e., replacing fiat or government-issued currency. But one thing is for sure. Cryptocurrency is infiltrating our everyday life more and more, e.g., Overstock, PayPal, Etsy, Starbucks, Dallas Mavericks, and the more mainstream it becomes, the more likely we are to see disruption in both the industries it is accepted in, as well as the financial institution sector as a whole.”

Ryan Preston Dahl: “No idea what “disruptive” even means anymore. I’m not a millennial.”

Steven Korf: “I am interested to see how Artificial Intelligence (AI) and machine learning, as well as new entrants to traditional healthcare delivery, will continue to disrupt the industry.

AI and machine learning are future disruptors that cryptocurrency analysts and Elon Musk, Disrupter-In-Chief, are suggesting will reframe life over the next decade. Both will be backbones to support predictive modeling for global health trends, climate change, and geographic displacements, which could contribute to economic upheaval.

Large commercial corporations and private equity firms have entered the healthcare market and are providing new channels of care and disrupting current providers. While this may be painful for many existing traditional organizations, I predict that we will see improvements to the delivery of care at more cost-effective rates with the new entrants.”

Pilar Tarry: “Well if you must know, crypto. Because I just don’t get it. Now that Gwyneth is officially in the game though, maybe I should circle back on that.”

Matthew Dundon: “Restructuring professionals and distressed investors have no idea of the informality of – or absolute absence of – corporate organizational structures and financial records in even quite large blockchain / crypto / defi companies (or “companies” in some cases). Failures of those entities will be extremely challenging in every sense (conceptual, execution, etc.).”

Dan Dooley: “Back to the Future Supply Chains. It’s already started but you will see significant resourcing back to North America from the Pacific Rim and especially China as the labor cost differential is not nearly as great as it was 10 years ago, the pandemic has exposed the logistics risks of over-the-ocean sourcing and the relatively new political risks with sourcing specifically in China and perhaps in Taiwan as well.”

PETITION: What are you “short” going in to 2022 and what are you “long”?

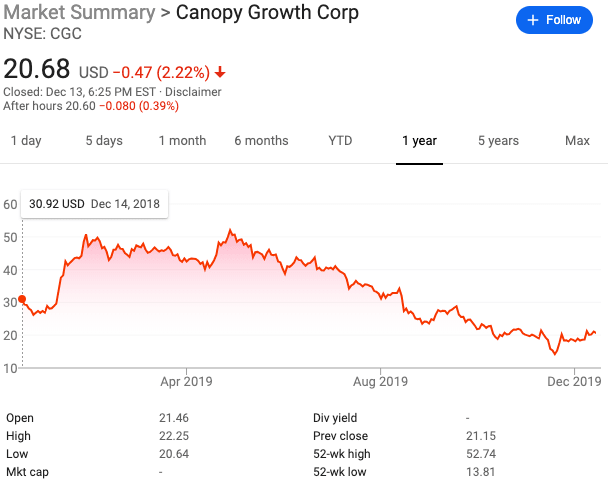

Steven Korf: “In 2022, I’m "short" China based on the evolving but unresolved Evergrande situation (multiple defaults and the Chinese government’s recent lowering of capital ratio requirements for its banks which seems to hint at something more serious) and recent IPOs for overvalued tech and direct to consumer retail companies.

LONG: ??? I am a restructuring professional.”

Natasha Labovitz: “Short the ski season in my Southern Vermont homeland, where the lack of snow makes it feel anything like Christmas-time as I type this. Long party dresses, airplane tickets and Broadway, as pent-up demand seems to be overcoming all fear of COVID variants. Omicron who??”

Chris Ward: “Long – Restructuring professionals. Conservatively, $4 TRILLION was pumped into the U.S. economy during the pandemic. Not to mention the recent $500 MILLION infrastructure bill. Inflation is already running rampart. Omicron (and whatever the next variant will be) are threatening closures again. The supply chain may never recover. This economy will crumble faster than Kevin Spacey in House of Cards. Like dragons in Game of Thrones, restructuring professionals will resurface and rule Westeros once again! Short your 401(k). See the foregoing.”

Brian Resnick: “Short predictability. Major freefall chapter 11’s have become fewer and farther between, but market conditions have put pressure on the usual tools that lenders and potential acquirers use to try to keep prearranged and prepackaged cases streamlined. Stalking horse protections are less likely to deter competing bidders when valuations can rise rapidly. Lenders looking to use a fulcrum security to acquire a debtor will continue to face the high-class problem of payment in full as more junior creditors or even shareholders take a large share of exit ownership. A growing number of sophisticated players are under intense pressure to find strategic advantages in a smaller number of cases, leading to increasingly creative and aggressive strategies. Out-of-court lender-on-lender violence in liability management transactions (uptierings and drop-down financings) has become increasingly common. A “first lien” piece of paper doesn’t assure a lasting first lien position the way it used to. More than ever, stakeholders need to look carefully around every corner to anticipate non-obvious arguments and angles that could weaken their position and leverage in a restructuring.

Long volatility and major disruption. The world feels like it is going through the most rapid rate of change in my lifetime, in both positive and negative ways. We’ve seen a surge in development of new potentially-transformative industries based on technologies like artificial intelligence, the metaverse, blockchain and cryptocurrencies, electric (and maybe self-driving) cars. At the same time, there is increased focus on growing wealth-disparity, social polarization, climate-based risk, inflation and other collective challenges. Aggressive fiscal policy has so far allowed the US economy to dodge the economic shocks of the pandemic, and it is hard to predict what will disrupt the current equilibrium or when that will happen. Upcoming efforts to tighten today’s easy money fiscal policies during a credit-fueled market boom will require the federal reserve to walk across a shaky tightrope with lots of risk for a misstep.”

Rachel Albanese: “I’m “short” low orbit “space” travel (it’s like going to The Four Corners and saying you’ve been to each state). I’m “long” DTC – not necessarily the existing brands (Allbirds!) but the concept – and malls too.”

Damian Schaible: “Short Traditional Restructurings - Until inflation and rising rates call the police on the party, there won’t be a lot of traditional restructurings. As discussed above, sponsors and public companies will use market refis, SPACs, additional leverage, liability management and bootstrap A&Es to delay the inevitable as long as possible, and traditional equitizations will be fewer and further between.

Long Liability Management and Bootstrap A&Es — Loose docs and free flowing money will lead to more liability management and “bootstrap” amend and extend transactions to buy runway for sponsors, equity and junior debt.”

Ryan Preston Dahl: “My views on “short” remain completely unchanged since I last had the chance to chat with you fine fellas—although I do wish Mr. Springsteen a happy holiday. In terms of 2022, I’m very long Amazon’s new “Second Age” series derived from the Lord of the Rings legendarium. My fellow nerds in the PETITION readership know exactly what I’m talking about.”

Dan Dooley: “Short technology and the internet companies who are struggling to be cash flow positive. This bubble will burst just like the technology sector did in the year 2000 for Y2K. Long anything Mexico, which will be a big winner from the pandemic.”

David Meyer: “I am “short” on returning to the office (and business travel) returning to pre-pandemic practices. The world has changed and there is no such thing as “a return to normal”. I am “long“ that 2022 will present further opportunities to balance the best in-person aspects of our work with the lessons learned over the last 20+ months to create a better, more enjoyable, and more efficient working environment – firms that do this well will be able to create stronger cultures that will generate sizable benefits over the long term compared to those who get left behind.”

Navin Nagrani: “‘Short’: I generally think the “metaverse” and most cryptocurrencies are in somewhat of a hype bubble - too many get rich stories/schemes. There is no easy money over long periods of time and I think this principle will play out here as well. ‘Long’: I continue to believe that relationships and health compound with energy, intention and time just as much as money does. I am “long” on focusing on what’s really important in 2022.”

George Klidonas: “Short Auto Sector. The auto sector is likely to see short term stress particularly at a time when high demand for semiconductors and global bottlenecks throw supply chains into disarray. These supply chain constraints could lead to decreased revenues, which in turn, challenge the ability for companies to deal with funded debt (especially at a time when the industry has taken on more debt). And it is unclear whether higher car prices can fully offset reduced sales volumes. Beyond 2022? The industry’s migration toward autonomous vehicles could lead to long term distress for certain players in the auto industry. But time will tell.

Long Financial Institutions. With the Federal Reserve signaling that they are going to raise interest rates in 2022, banks and financial institutions are likely to see an increase in revenues. And with banks sitting on a ton of cash, they are likely redeploy capital back into the system. I believe financial institutions (e.g., retail, commercial and investment banks, as well as brokerages) and FinTech are going to be big winners in 2022 if raise start to go up.”

Pilar Tarry: “Long: Cybersecurity firms/technologies as privacy and security concerns increase with higher use of technology and living more of life online. Short: Hospitality, tourism and urban mobility. Long: E-logistics companies. Short: the ultra-short case, except where the business consequences are truly disastrous. Long: Anyone who can successfully navigate the growing divide between high and middle income countries and poor countries, and similar divisions in families here at home. Short: 2nd years, after almost two years of trying to learn how to do this work in a WFH environment, it’s not surprising they’re looking at their options.”

🤔

* Pilar Tarry is a Managing Director at AlixPartners. Damian Schaible is a Partner at Davis Polk & Wardwell LLP. Rachael Albanese is the Vice-Chair of the Restructuring Group and a Partner at DLA Piper. Dan Dooley is a Principal and CEO at MorrisAnderson. Ryan Preston Dahl is a Partner at Ropes & Gray LLP. Chris Ward is a Partner and Practice Chair at Polsinelli. Brian Resnick is a Parter at Davis Polk & Wardwell LLP. Navin Nagrani is an Executive Vice President at Hilco Real Estate. Natasha Labovitz is a Partner and the Co-Chair of Debevoise & Plimpton’s restructuring group. Steven Korf is a Senior Managing Director at and Co-Founder of ToneyKorf Partners. Matthew Dundon is a Founder and Principal of Dundon Advisers LLC. David Meyer is a Partner and Co-Head of Vinson & Elkins’ Restructuring and Reorganization group. George Klidonas is a Partner at Latham & Watkins LLP.