💥Good Retail Numbers. Bad Malls.💥

⚡️Update: CBL & Associates Properties ($CBL)⚡️

We did a deep dive into Tennessee-based CBL & Associates Properties ($CBL) back in March’s “Thanos Snaps, Retail Disappears👿” and, in the context of Destination Maternity’s bankruptcy filing, followed-up in an October update. To refresh your recollection, CBL is a real estate investment trust (REIT) that invests primarily in malls based in the southeastern and midwestern US. At the time of the aforementioned “Thanos” piece, the REIT’s stock was trading at $1.90/share; its ‘23 unsecured notes were priced around $80 and its ‘24 unsecured notes around $76. In case you haven’t noticed — all Black Friday ($7.4b in online sales, $2.9b via mobile ordering) and Cyber Monday (a record $9.2b) talk about gangbusters retail sales notwithstanding — the malls haven’t particularly fared much better since Q1. To put an exclamation point on this, early reports are that brick-and-mortar stores saw an overall 6% decline in sales over Black Friday.

When it reported Q3 earnings at the end of October, CBL’s numbers weren’t pretty. Revenue fell approximately $20mm YOY, net operating income declined 5.9% YOY, and same-center mall occupancy, while up on a quarter-by-quarter basis, was down 200 basis points YOY.

On Monday, the company announced that “it is suspending all future dividends on its common stock, 7.375% Series D Cumulative Redeemable Preferred Stock and 6.625% Series E Cumulative Redeemable Preferred Stock.” The company’s CEO, Stephen Lebovitz said:

“We anticipate a decline in net operating income in 2020 as a result of heightened retailer bankruptcies, restructurings and store closings in 2019. Offsetting these declines by retaining available cash is necessary to maintain the market dominant position of our properties and to reduce debt. CBL has also made significant efforts over the past 18 months to reduce operating costs, including executive compensation and overall corporate G&A expense, as well as execution of a strategy to utilize joint venture and other structures to reduce capital expenditures. Ultimately, we believe these actions will allow the Company to return greater value to its shareholders.”

Given the above, it’s worth revisiting the alleged benefit of REITs to investors. Among them are that:

post 1960, REITs provided small investors with an opportunity to benefit from commercial property rental streams; and

they are, typically, high dividend payers — considering that by law, they must distribute at least 90% of their taxable income to shareholders as dividends.

WOMP. WOMP. Not so much these days, it seems. But, we bet you’re asking: how can it terminate its dividend while maintaining its REIT status? From the company:

“The Company made this determination following a review of current taxable income projections for 2019 and 2020. The Company will review taxable income on a regular basis and take measures, if necessary, to ensure that it meets the minimum distribution requirements to maintain its status as a Real Estate Investment Trust (REIT).”

Umm, that doesn’t portend well. The answer is: it may not have “taxable income.” B.R.U.T.A.L.

How did the market react?

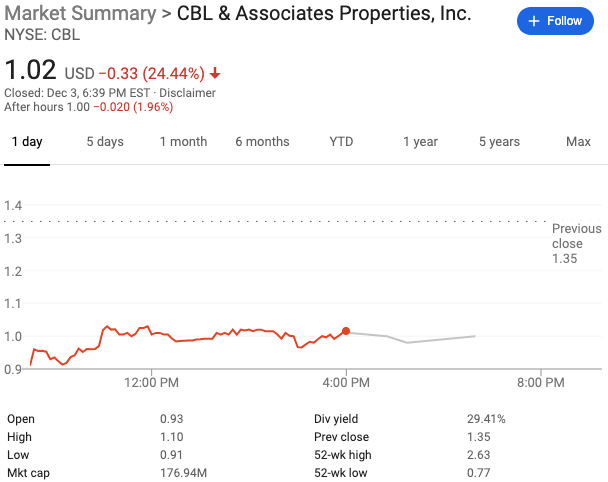

The stock market puked on the news. The stock was down 6% with a general market drawdown, but after-hours, upon the announcement, the stock gave up an additional ~30% on Monday and closed at $1.02/share on Tuesday:

Meanwhile, the preferred stock also obviously traded down (lots of Moms and Pops chasing yield, baby yield, getting burned here), and the ‘23 unsecured notes and the ‘24 unsecured notes, at the time of this writing, last sold at $72.75 and $64.1, respectively.

The GIF above says it all about this story. And, worse yet: it may get uglier.