💥What the Bloody Hell is Happening with Evergrande?💥

To read our coverage of The Evergrande Group, please check us out here.

To read our coverage of The Evergrande Group, please check us out here.

The recent bankruptcies of Fusion Connect (which just confirmed a plan swapping ~$270mm of debt for equity), Clover Technologies, uBiome (which just sold for a small fraction of its valuation), Loot Crate Inc., Juno Inc., Munchery, and Vector Launch Inc. — combined with the recent negative news surrounding WeWork (of course), Faraday Future (founder already in BK), Proteus Digital Health and Wag — signal that restructuring professionals shouldn’t sleep on “tech.” The sector has been surprisingly active in 2019 and there’s likely more to come in 2020 (e.g., RentPath?).

In the wake of the WeWork debacle, there has been a lot of talk about the end of “growth at all costs” thinking and a newfound emphasis on business fundamentals, i.e., unit economics. Indeed, post-WeWork, funding in startups immediately slowed down … for like a second … and people took measure; likewise, in the public markets, many recently IPO’d companies with questionable fundamentals have performed poorly. Time will tell, then, whether WeWork was just a blip on the radar screen or the canary in the coal mine. There are more signs of the former — this week it seems like 8,292,029 companies announced new raises — but might Vector Launch be validation of the latter? Who knows.

As we’ve argued in the past — obviously VERY prematurely — tech “startups” are more mature at earlier stages now than they used to be which very well may require them to sidestep the assignment for the benefit of creditors and launch headfirst into a bankruptcy court — if and when folks again get scared. With the private markets having become the new public markets over the last decade, there are a ton of private tech companies that are well-developed (read: “unicorns”); that have intellectual property (e.g., actual patents as well as brands); that have valuable contracts/leases; that have investors that seek releases. What they don’t appear to have are viable business models. When the tide goes out (read: the money scares), we’ll see who is wearing clothes.

The question is: what would be the catalyst? With interest rates steady or declining, there’s no reason to suspect the end is near for “yield baby yield” psychology and, therefore, the deployment of endless quantities of capital in alternative asset classes. That should bode well for tech.

And, yet, people are fearful. First Round Capital recently released its “State of Startups 2019” and if some of the fears come true, indeed, there will be more action as noted above:

Founders fear the bubble — concerns are at a 4-year high.

This year, over two-thirds of founders who ventured a guess think we are in a bubble for technology companies. It’s the highest number we’ve seen since 2015 — up 12% from 2018 and 25% from 2017.

Spoiler alert:

THIS IS A SUBSCRIBING MEMBER’S POST. TO READ THE REST OF THIS ARTICLE (AND MORE OF OUR KICK@$$ CONTENT) CLICK HERE.

As hedge funds continue to get decimated and investor money shifts rapidly to private equity and private credit, the negative news for distressed investors is piling on heading into the new year.

Here is an excellent Financial Times piece about GSO, the massive $142b fund manager that is in the midst of significant senior management transition. Among many interesting tidbits, the article cites the problems that GSO is having trying to keep committed capital as “key man” managers depart and performance suffers:

Blackstone set about trying to persuade investors to keep faith with its $7bn distressed debt fund, but matters were complicated by heavy losses on distressed debt investments linked to GSO’s energy franchise, which Mr Scott used to run. One of the troubled energy companies, Oklahoma-based Tapstone Energy, whose board Mr Scott previously sat on, this month missed an interest payment on its debt.

The setbacks wiped out most of the gains made by investors in Capital Solutions II, a previous fund that investors viewed as similar.

PETITION Note: it probably won’t help matters when Tapstone Energy definitively files for bankruptcy. Tick tock, tick tock…it should be any day now.

What the piece illustrates is that, for many funds, energy-related performance in the middle of the decade has since taken a dramatic turn for the worse — wiping out gains that, at one time, helped (a) make various investors much richer via bonuses and (b) follow-up funds raise cash.

Between June 2013 and the end of 2017, the predecessor fund had notched up annual gains of 14 per cent, securities filings show. By the end of September 2019, however, Blackstone’s portfolio valuation indicated that those profits had all but disappeared, leaving investors with net internal rate of return of just 1 per cent.

The ramifications of this extend beyond having to discount fees in order to maintain funds. Perception risk — elevated by an extraordinary amount of coverage in the mainstream and other media outlets about “manufactured defaults” — is now apparently front-of-mind for GSO.

THIS IS A SUBSCRIBER’S POST, TO READ THE REST OF THIS ARTICLE, SUBSCRIBE TO OUR KICK@$$ BI-WEEKLY NEWSLETTER HERE.

If we were to be accused — and we haven’t really — of being too US-centric we would be…well…GUILTY AF. We admit it: we act like snobby Americans — like the rest of the world doesn’t really exist. Shockingly, though, it does. Who knew?😜

One thing that caught our eye recently is the apparent proliferation of cannabis-related distress in Canada — something that, due to federal law limitations, you couldn’t see…at least in court…in the United States.

On December 2nd, an Ontario-based company called AgMedica Bioscience Inc. filed a CCAA proceeding to give itself some breathing room and access much needed DIP capital. The company obtained a $7.5mm DIP credit facility from a Canadian lender, Hillmount Capital Inc., and seeks to use the bankruptcy to restructure several tranches of secured and unsecured debt.

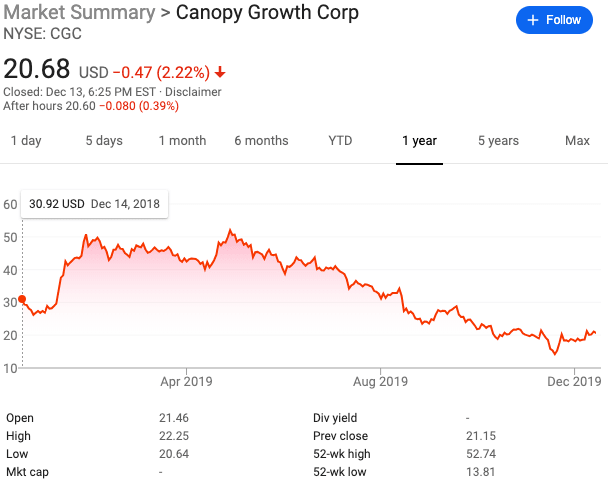

What’s interesting is the timeline. In late 2018, everyone thought cannabis was going to be a 21st century gold rush. Canopy Growth Corporation ($CGC) was reportedly the first federally regulated and licensed cannabis producer to trade on a public exchange in Canada (artfully under the ticker “WEED”) and then went public in the United States in May 2018. The stock opened around $26/share and then rocket-shipped to as high as $52.74. It has since come WAY BACK DOWN TO EARTH and trades here:

Similarly, Tilray Corporation ($TLRY) went public in June 2018, debuting on Nasdaq at $17/share. Here is the chart since then:

TIRED OF SEEING THIS PAYWALL? US TOO, SO CLICK HERE AND GIVE YOURSELF SOME RELIEF (AS WELL AS SOME KICK@$$ INSIGHTS ON EVERYTHING DISRUPTION, DISTRESSED DEBT, AND BANKRUPTCY) BY SUBSCRIBING TO OUR BI-WEEKLY PREMIUM MEMBER’S NEWSLETTER.

DISRUPT YOUR COMPETITION, WITH #PETITION!

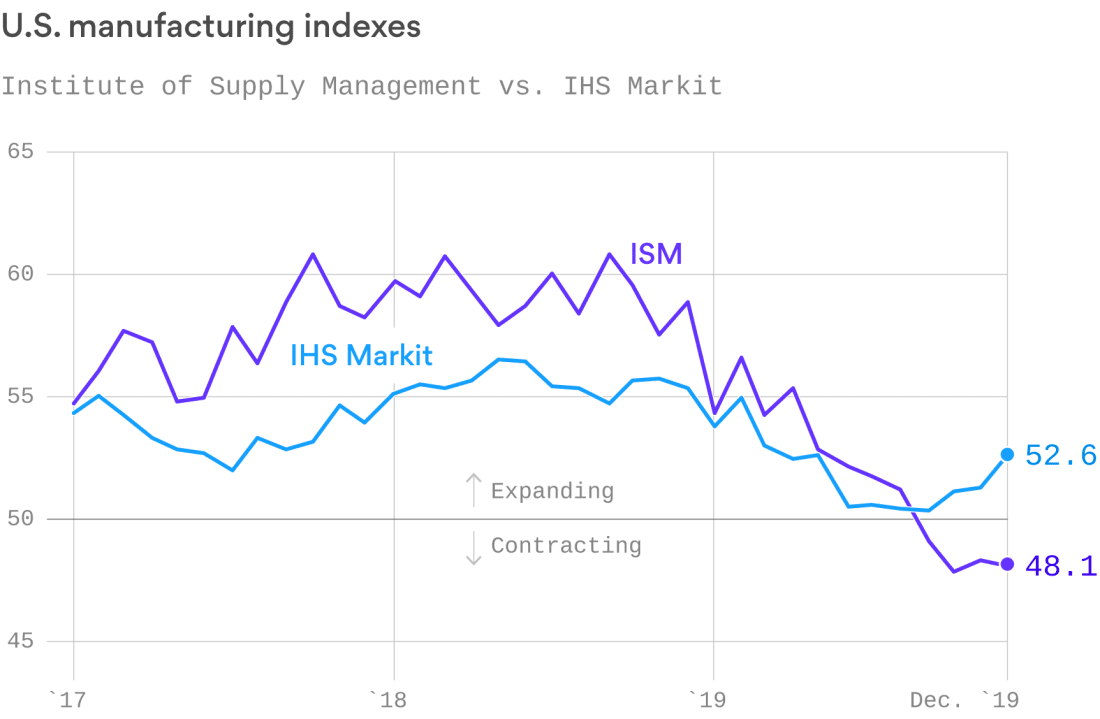

We were surprised to hear certain Representatives boast about US manufacturing growth during the impeachment hearings. We stopped in our tracks: “wait, what?” As we noted on Wednesday, the ISM Manufacturing numbers tell a different story — a contraction story.

But, to be fair, there are other surveys. The recent IHS Markit index painted a different picture. This Axios piece discusses the difference between the two surveys and is worth a quick read. The ISM survey includes fewer participants and “…uses five components, each weighted evenly at 20% — new orders, production, employment, supplier deliveries and inventories.” The IHS survey “…uses a weighted average that gives greater importance to new orders (30%), output (25%) and employment (20%), and lower weighting to suppliers’ delivery times (15%) and stocks of purchases (10%).” The bottom line is that if the former is correct, the US economy may be f*cked; if the latter is more accurate, the economy is expanding.

Now, granted its a small data set but the current trucking situation (see Wednesday’s “🚛Dump Trucks🚛“) seems to reflect, at least in part, a slowdown in manufacturing (among other things, including the effect of tariffs and shipping). But what about the railroads?

In November, rail carloads declined 7.5% YOY, led primarily by coal (⬇️ 14.5%) and primary metal products (⬇️ 15.1%). Per Logistics Management:

TO READ THE REST OF OUR PREMIUM INSIGHTS (AND TO GET THAT EXTRA EDGE) CLICK HERE AND SUBSCRIBE TO OUR PREMIUM NEWSLETTER. YOU (AND YOUR BOSS) WON’T REGRET IT.

Forever21 Inc. is forever filing motions to reject sh*t. On Friday, the company followed up its Store Closing Motion (which, itself, had two supplements) with its fourth rejection motion of non-residential real property leases. By our count, somewhere between 100-150 different lease (or sublease, as the case may be…looking at you Belk Inc.) counterparties have been affected now by the bankruptcy. That’s a lot of landlords and lessors looking for tenants and subtenants, respectively.

Who is bearing the brunt of this? By our count (in approximate numbers):

TO SEE OUR PREMIUM INSIGHTS ON WHICH MALL REITS ARE GETTING SH*T ON BY FOREVER21 & MORE, CLICK HERE TO SUBSCRIBE (ISN’T TIME YOU GOT AHEAD? DISRUPT YOUR COMPETITION WITH PETITION!)

Ah, the fourth quarter. The fourth quarter is critical for retailers as they play out the “holidays” option and hope to stave off bankruptcy. How’s that working out for them?

U.S. retail sales increased less than expected in November as Americans cut back on discretionary spending, which could see economists dialing back economic growth forecasts for the fourth quarter.

The Commerce Department said on Friday retail sales rose 0.2% last month.

Surveys had predicted a 0.5% retail sales acceleration.

Excluding automobiles, gasoline, building materials and food services, retail sales edged up 0.1% last month after rising by an unrevised 0.3% in October.

The so-called core retail sales correspond most closely with the consumer spending component of gross domestic product. Consumer spending, which accounts for more than two-thirds of U.S. economic activity, grew at a 2.9% annualized rate in the third quarter.

The breakdown is as follows:

Auto sales ⬆️ 0.5%;

Gasoline ⬆️ 0.7%;

Online/Mail-Order Retail ⬆️ 0.8%;

Electronics/Appliances ⬆️ 0.7%; and

Furniture ⬆️ 0.1%.

On the negative side, however:

Apparel ⬇️ 0.6%;

Restaurants/Bars ⬇️ 0.3%; and

Hobby/Music/Book Stores ⬇️ 0.5%.

It gets worse for apparel. The Bureau of Labor Statistics’ latest CPI report revealed weakness for November — which, significantly, includes Black Friday and Cyber Monday. 😬

Men’s and women’s apparel decreased by 0.9% and 3.6% YOY, respectively, while boys’ and girls’ apparel decreased 3.9% and 2.2%. Said another way, there’s an epidemic of markdowns/discounts. That can’t bode well for retail’s bottom line.

Indeed, several retailers acknowledged that markdowns are a significant issue. American Eagle Outfitters Inc. ($AEO) CEO Jay Schottenstein* noted “the challenging environment promotional activity increased relative to our expectations,” a theme that was reiterated by management teams at Urban Outfitters ($URBN), Francesca’s ($FRAN), Children’s Place ($PLCE) and Designer Brands ($DBI). Gamestop Corp’s ($GME) CEO George Sherman — while reporting dogsh*t numbers — noted:

“At this stage, we've entered the commoditization phase of the console cycle, where promotional pricing is driving sales. And if you're out shopping or doing store checks over Black Friday or Cyber Monday you likely saw a clear example of [those] discount stands.”

The problem is that retailers need to draw foot traffic and when your retail experience is commoditized and your product sucks sh*t, how do you do that?

TO READ THE REST OF THIS KICK@$$ ARTICLE, CLICK HERE AND SUBSCRIBE (AND GET SO MUCH MORE, DISRUPT THE COMPETITION, WITH PETITION)

This is a story about S’well. It illustrates just how vicious competition is today. And made even more vicious by (i) “signaling” and ease of discovery (lots of likes on Instagram), (ii) shady-AF Chinese manufacturers (producing legit product by day, extra off-the-truck product by night), and (iii) Amazon Inc.’s ($AMZN) failure to police third-party sellers. Choice bit:

Counterfeiting is an old game: In ancient Rome, counterfeiters knocked off authentic Roman coins. In recent decades, counterfeits of luxury products like handbags, watches, and sneakers have become commonplace. Now, though, online marketplaces like Amazon and social-media sites like Facebook and Instagram are enabling a new copycat ecosystem that’s become a hall of mirrors for both brands and shoppers. It’s never been easier for makers of knockoffs to reach consumers, project authenticity, and make money — and it’s never been harder for the real companies to regain control.

This is crazy:

…less than a year into starting the business, Kauss realized she had a big problem. Kauss and her then-boyfriend Jeff Peck (now her husband and the company’s president) were heading to S’well’s factory in China when they stopped for a couple days’ vacation in Hong Kong. Kauss saw there was a trade show and insisted on stopping by. When she arrived, it appeared that S’well had a significant presence at the show, with bottles displayed in a case and a ribbon flaunting an award it had apparently won. “A man came over to me and gave me his business card, very properly, and said he was from S’well,” she says. His card had S’well’s logo on it, with the little TM for ”trademark.”

The problem: Kauss at that point was running S’well from her apartment. It had no presence in Asia. Nor did it have a sales rep there. And it had no employees besides Kauss. She had barely gotten the company off the ground, and her bottles were being knocked off.

What. The. Hell. Read the piece. It’s long. And nuts.

But that’s not all. This is a horribly pervasive problem:

Last year, when the Government Accountability Office bought 47 consumer products like cosmetics and travel mugs online from third-party sellers on sites including Amazon.com and Walmart.com, it determined that 20 of them were fakes.

Here’s the problem from another vantage point (also very much worth reading):

I've been talking to a friend who's a cofounder at a womenswear ecommerce startup about their content strategy. I searched around to see what kind of stuff is out there about them (press mentions, reviews, etc.), and stumbled upon something odd. On a Bustle.com top ten sex toys list, it had listed a product from their brand. They do not sell sex toys. I clicked through, and it led to an Amazon site with their company’s branding. They do not sell on Amazon.

It turned out a China-based seller had “hijacked” their brand. This is apparently a regular thing.

A few days later, when visiting my friend's office, I found out that they had one staff member dedicated to monitoring Amazon for exactly these situations. There was a big spreadsheet where they tracked various culprits. There was a specific contact at Amazon they would call when they found shady stuff like this. They had a lawyer they billed, and a process in place to deal with this. It cost time and money and it was a never-ending game of whack-a-mole. It had become such an increasingly frequent problem over the past few years, yet they seemed fairly blasé about it. It was just business as usual.

I understand counterfeiting has always been a problem in retail, but this felt different. Amazon was their competitor. It had launched a private label brand that directly competed, undercutting them on price and shipping speed. Yet, Amazon also sold counterfeit items of theirs (well, Amazon “facilitated” it) and the startup bore the cost of cleaning up the trillion dollar company’s platform. I guess this was how ecommerce worked in 2019.

The article goes on to explain that this is the natural side effect of Amazon’s concerted efforts to court Chinese sellers to its platform. It explains the lack of quality control and…..

THIS IS A SUBSCRIBER’S POST, TO READ THE REST OF THIS ARTICLE, SUBSCRIBE TO OUR KICK@$$ BI-WEEKLY NEWSLETTER HERE.

Restoration Hardware Inc. ($RH) reported earnings this week and blew it out of the water in every possible way. Not all retail is a hot mess, apparently. When you crush it like they did — 6+% revenue increase and doubled profits — we suppose that gives you some license to sh*t on LITERALLY EVERYONE UNDER THE SUN. This is savage:

DAAAAAAAAAMMMMN. DTC DNVBS and standard brick-and-mortar retailers just got run over by the Restoration Hardware bus. And rightfully so:

LIKE WHAT WE HAVE TO SAY SO FAR AND WANT TO READ THE REST? YOU CAN, BY SUBSCRIBING TO OUR PREMIUM BI-WEEKLY KICK@$$ NEWSLETTER, HERE.

PG&E Corp. has reached a settlement with victims of the wildfires that pushed California’s largest utility into bankruptcy, agreeing to pay them $13.5 billion in damages.

The pact removes a significant obstacle to PG&E’s emergence from chapter 11 protection and includes reforms meant to address criticism that the company enriched shareholders while leaving customers exposed to danger from aged, unsafe equipment.

PG&E bowed to demands for more money for fire victims and gave in to pressure from California Gov. Gavin Newsom to improve its corporate governance and implement stricter safety protocols.

The best part: the settlement is payable half in cash and half in stock. All we have to say is:

LIKED OUR ARTICLE SO FAR? CLICK HERE AND SUBSCRIBE TO OUR PREMIUM @$$KICKING BI-WEEKLY NEWSLETTER ON DISRUPTION FROM THE VANTAGE POINT FROM THE DISRUPTED. YOU (AND YOUR BOSS) WON’T REGRET IT.

Some numbers: the US now produces 13mm barrels per day and exports 3mm bpd. Per Reuters:

But the outlook for 2020 comes with growing skepticism from those inside the industry - and should growth fall short, it could shift the balance of power in world supply back to the Organization of the Petroleum Exporting Countries.

An increase in U.S. crude output by 1 million bpd would satisfy nearly all of the 1.2 million bpd increase in world demand next year, the International Energy Agency expects. [IEA/M]

That would keep a lid on prices, pressure OPEC to extend production cuts and leave shale producers still trying to achieve elusive profits. As a result, most industry executives and consultants said they expect slower U.S. shale growth.

Apropos, layoffs are starting to mount in the Permian. Austerity measures are now taking hold in the Eagle Ford. Per Bloomberg:

In the wake of the oil price crash that began in 2014, new drilling in the Eagle Ford dwindled as management teams cut budgets, and output in the region is now down about 20% from pre-crash levels.

That austerity finally began to pay off this year as the Eagle Ford as a whole generated free cash flow for the first time, according to IHS Markit.

And things may only get worse.* The state of Texas is expected to double its solar electricity output next year and again the following year. This would obviously have a negative impact on natural gas demand and prices.

Nevertheless, the Trump administration intends to bring MORE drilling online! Per The Houston Chronicle, the administration…

THIS IS A SUBSCRIBER’S POST. CLICK HERE, TO SUBSCRIBE AND READ THE REST OF THIS ARTICLE. DISRUPT THE COMPETITION WITH PETITION.

We’ve spent a considerable amount of time discussing the possible and/or actual second order effects of disruption. For instance, waaaaaaay back in December 2016, we queried to what degree the scanless technology that Amazon Inc. ($AMZN) had then launched in its AmazonGo concept might affect grocers and quick service restaurants. We noted the following possibilities:

[Our] list of losers: manufacturers of conventional scanners...plastic separator bricks...cash registers...conveyer belts; landlords (maybe? - less square footage required without the cashier and self-checkout stations); print media/candy manufacturers/gift cards - all things that benefit from lines and impulse buys at checkout; human capital; people on the wrong end of income inequality.

Three years later, you don’t hear much about AmazonGo. Sure, it’s grown: there are now reportedly 20 locations with more on the way, but it hasn’t exactly taken the world by storm and caused mass disruption to either grocers or QSRs. It’s still worth watching though: the possible second order effects are countless.

An example of actual second order effects is Cenveo Inc., which filed for bankruptcy in February 2018. At the time we wrote:

…it's textbook disruption. Per the company,

"In addition to Cenveo’s leverage issues, macroeconomic factors, including the introduction of new e-commerce, digital substitution for products, and other technologies, are transforming the industry. Consumers increasingly use the internet and other electronic media to purchase goods and services, pay bills, and obtain electronic versions of printed materials. Moreover, advertisers increasingly use the internet and other electronic media for targeted campaigns directed at specific consumer segments rather than mail campaigns."

Ouch. To put it simply, every single time you opt-in for an electronic bank statement or purchase a comic book on your Kindle rather than from the local bookstore (if you even have a local bookstore), you're effing Cenveo.

To close the trifecta, we’ll again highlight the recent pain in the SMA space. Catalina Marketing and Acosta Inc. both became chapter 11 filers while Crossmark Holdings Inc. narrowly avoided it. Why? Because CPG companies are taking it on the chin from new and exciting direct-to-consumer e-commerce brands, among other things, and have therefore shifted marketing strategies.

So, on the topic of second order effects, imagine being in the C-suite of a company that, among other things:

Prints signage, displays, shelf marketing and other promotional-print-material for brick-and-mortar retailers including the likes of, among others, struggling GNC Inc. ($GNC), Gap Inc. ($GPS), and GameStop Inc. (GME), all of which are shrinking their brick-and-mortar footprint;

Creates menu boards, register toppers, ceiling danglers and more for QSRs and fast casual restaurants who are competing with food delivery services more and more every day; and

Services consumer packaged goods companies by creating end cap promotions, shelf marketing, floor graphics and more.

Uh….YEAAAAAAAAAH. Some high risk exposure areas right there, folks.😬 And, so you’ve got to imagine that revenues of this “hypothetical” C-suiter’s company are declining, right? Particularly given that print is a highly competitive price-compressed industry?

Luckily, you don’t have to stretch the imagination too far.

LIKE THIS SO FAR AND WANT TO READ THE REST? YOU CAN, BY SUBSCRIBING TO OUR PREMIUM BI-WEEKLY KICK@$$ NEWSLETTER, HERE.

n “💩Acosta = Not a Good Look, Carlyle💩,” we noted how FS KKR Capital Corp ($FSK), a publicly-traded business development corporation placed its Acosta Inc. loan “on nonaccrual” because it was, well, clearly sh*tting the bed. Ultimately, after riding the mark down to the basement, FSK offloaded the position. It wasn’t the only stain in its portfolio. In fact, as of the end of the third quarter, approximately 1.7% of the portfolio was on nonaccrual, up from 1.2% at the end of Q2. While this, in and of itself is hardly alarming, it does mean that there are other potential restructurings sitting on FSK’s books. Indeed, one loan contributing to this uptick was to a company called Art Van Furniture.

Founded in 1958, Michigan-headquartered Art Van Furniture is a furniture retail store chain with approximately 190 company-owned stores in nine states operating, thanks to various tack-on acquisitions, under various brands: Art Van Furniture, Art Van PureSleep, Scott Shuptrine Interiors, Levin Furniture, Levin Mattress and Wolf Furniture. The tack-on acquisitions were, presumably, part of the company’s growth strategy after being acquired by private equity overlords Thomas H. Lee Partners.

The Columbus Dispatch recently reported on Art Van’s strategy annnnnnnd it’s definitely a bit counter-intuitive:

THIS IS A SUBSCRIBING MEMBER’S ARTICLE, TO READ THE REST, CLICK HERE.

Paypal Inc. ($PYPL) made a big splash this week when it agreed to a $4b cash and stock acquisition of Honey, an LA-based deal-finding browser extension and mobile app. Yes, $4 BILLION. The company had only raised $49mm in funding soooooo…a lot of people just made one crazy return on investment.

Speaking of crazy, the company reportedly made “more than $100 million in revenue last year and it was profitable on a net income basis in 2018.” Profitably for a startup these days is crazy enough, we suppose, but THAT MULTIPLE. Holy

TO READ THE REST OF WHAT WE HAD TO SAY ABOUT HONEY, JUST CLICK HERE AND SUBSCRIBE.

Starting in 2016, Juno USA LP, a NY-centric ride-hailing company was able, in just 3.5 years, to become the third largest ride-hailing business in New York, counting 50k contracted drivers and 50k rides per day as key business drivers (pun intended). Now it is kaput. The company filed for bankruptcy earlier this week.

At its inception, the company differentiated itself by offering drivers restricted stock units (“RSUs”) “with the expectation that such an approach would result in an overall enhanced driving experience for drivers and, in turn, riders.” This is interesting because, obviously, it incentivizes drivers to be more attentive to Juno rides than Lyft and/or Uber but it obviously doesn’t address the demand side of the marketplace function. 50k rides per day sounds like a lot. Yet, it pales in comparison to its competition: according to the Taxi and Limousine Commission, in 2018, Uber Inc. ($UBER) tallied 400k trips per day in NYC and Lyft Inc. ($LYFT) collected 112k trips per day. Moreover, NYC taxis typically make about 300k trips per day. In total these are staggering numbers — even more so when you consider that taxis are going bankrupt in record-breaking numbers and Uber and Lyft are losing money like crazy (Uber’s loss, ex-stock-based compensation, was $800mm last quarter!). Ultimately, that differential compelled a merger of rivals: Israel-based GT Forge, d/b/a Gett, acquired Juno in Q2 ‘17 and transferred its riders to Juno. At the same time, Juno cashed out the driver RSUs, using other incentives (read: higher commissions of 10%) to maintain its supply-side.

As we all now know from the WeWork debacle, financial metrics for high growth startups are different than what restructuring professionals are used to. EBITDA is a foreign concept here: “success” is measured by revenue growth. Here’s Juno’s revenue trend:

$218mm in 2017;

$269mm in 2018 (23% growth) 😀; and

$133mm in 2019. 😬

Juno does not, however, indicate what its operating costs and expenses were; it merely serves up excuses about early stage capital requirements and the need for monthly cash infusions from Gett. Over time, however, the operating expense burden coupled with “burdensome local regulations and escalating litigation defense costs” led to a 2019 YOY revenue decline of 34%. What the net loss was, however, is left unsaid in the company’s bankruptcy papers.

The litigation runs the gamut. The company has been sued by (a) former drivers for the termination of the RSU program (read: securities fraud); (b) riders for personal injuries allegedly caused in accidents during active Juno rides; (c) competitors for patent infringement; and (d) drivers, alleging that they are employees rather than independent contractors. It’s pretty hard to grow a business when you’re getting sued into oblivion and have poor business fundamentals. 👍

The City of New York really didn’t help those fundamentals. The company’s bankruptcy papers elucidate ride-hailing economics after NYC imposed mandatory minimums of $17.22/hour regardless of the number of rides undertaken during that time (something that Uber and Lyft continue to combat, including by freezing drivers out of the apps during low-demand times, something that irks the hell out of Bill De Blasio, apparently). Here’s how it works:

Drivers are entitled to a minimum of $0.58/mile + $0.27 per minute. “Each of these figures is separately divided by a so-called “utilization rate,” which is calculated based on the frequency that a TNC sends trips to drivers while they are available for work. The current industrywide average utilization is 58%.” (Petition Note: this also means that 42% of the time, drivers are just moving around clogging up NYC streets).

So, for a 10-mile trip that takes 30 minutes, you end up with:

TO FINISH THIS KICK@$$ ARTICLE, SUBSCRIBE HERE.

Governor Mark Gordon released his Wyoming State Budget for 2021-2022 earlier this week and — whoa boy — he cuts right to the chase:

It is a budget intended to prepare our state to meet the coming storm head-on.

For most of the last century, Wyoming’s abundant coal, natural gas, oil, and other minerals have been the drivers of our economy; employing thousands; funding schools and government services; and stabilizing our state’s communities. Energy development, minerals, and the sovereign wealth they have bequeathed to our children have kept taxes low for citizens. But times are changing. Over the past few years we have witnessed an upheaval in the way energy is being generated, used, and developed. These changes seem to be accelerating and are not generally favorable to some of our most cherished industries. (emphasis added)

He then goes on to highlight some pretty hefty headwinds (pun intended) — things that should be no surprise to a restructuring community that has watched coal company after another file for chapter 11 bankruptcy:

Coal production in Wyoming has declined by 35%.

Natural gas companies are halting drilling there.

38 states have established renewable and carbon-free standards which hurts demand.

Wyoming has an oil and gas energy but low oil prices will offset whatever hedge this provides against declining coal.

"Even if we get out of this current downturn with oil bailing us out, the economy becomes more and more dependent on oil, which is the most volatile of all of the commodities and the one that we are least confident with forecasting into the future," said Robert Godby, director of the University of Wyoming Center for Energy Economics and Public Policy.

To point, Chesapeake Energy Corp. ($CHK), a large presence in Wyoming, issued a going concern warning earlier this month:

TO READ THE REST OF THIS ARTICLE, CLICK HERE AND SUBSCRIBE TO OUR BI-WEEKLY KICK@$$ NEWSLETTER.

Yeah but someone is making money from all of this doom and gloom, right? You bet your a$$. The real estate consultants/advisors!! Using Houlihan’s for illustration purposes, let’s dive into what these guys do.

Before we do, let’s establish some ground rules: we’re going to MASSIVELY over-simplify how this works just to extract some number out of the abstract figures and give folks some semblance of an idea of how this works. So, please spare us the righteous indignation about incomplete calculations, okay?

In the Houlihan’s bankruptcy case, the debtors seek to engage Hilco Real Estate LLC as its real estate consultant and advisor. For the uninitiated, Hilco Real Estate counts countless bankrupted companies as clients, e.g., A&P, Fred’s, Gander Mountain, Furniture Brands, Garden Fresh Restaurant Corp., hhgregg, Hostess Brands, Ignite Restaurant Group, Logan’s Roadhouse, Payless Shoesource. You get the idea. Perversely, these guys kill it when you don’t (spare us the spin, y’all).

According to the agreement between Houlihan’s and Hilco, Hilco will, among other things, (a) meet with Houlihan’s to ascertain its goals, objectives and financial parameters (read: wherewithal); (b) mutually agree with Houlihan’s on a strategic plan for restructuring, assigning or terminating leases; (c) negotiate with third parties landlords in furtherance of the agreed-upon strategy; (d) provide updates on progress; and (e) assist Houlihan’s in closing the relevant lease restructuring, assignment, and termination agreements. The contract is exclusive. Said another way, Houlihan’s has agreed to convey over to Hilco all responsibility for negotiating with landlords for purposes of extracting concessions.

Of course, Hilco doesn’t do this sh*t for free. They have a variety of ways to make money.

First, it’s important to note that the Bankruptcy Code requires that debtors decide what to do with non-residential real property leases within 120 days from any filing. Consequently, many distressed companies engage real estate consultants long in advance of bankruptcy to get a handle on the real estate portfolio, help devise a strategy, and kickoff negotiations with landlords. Accordingly, any assigned or terminated lease pre-petition is eligible for 6% of Lease Savings (back to this in a minute). If a lease is modified rather than terminated, Hilco gets a flat fee of $1,500 + 5.25% of the savings. Post-petition, Hilco gets 6% for assignments/terminations/sales of leases — if there are any at that point that return cash value.

Houlihan’s is a sale case so what happens if the leases are assumed and assigned pursuant to a sale of all or substantially all of the assets? Per the Agreement,

“…any Lease that is assigned or sold to a purchaser of all or substantially all of the Company's or a division of the Company's assets shall not, in and of itself, be considered an Assigned/Sold Lease (but may still be a Restructured Lease).”

Wait, what? The agreement doesn’t even define what an “Assigned/Sold Lease” is? But, it appears the intent of this language is to carve out leases that simply transfer to a buyer. No fee for Hilco there — that is, unless there is an agreed modification to the lease prior to assumption and assignment. (Note to Hilco: tighten up your sh*t). This makes sense.

Of course, all of this might as well be written in Dothraki:

THIS IS A SUBSCRIBING MEMBERS POST, TO VIEW THE REST OF THIS ARTICLE, CLICK HERE.

There are a lot of venture investors operating under the hypothesis that audio is the next frontier in wearables and that the Apple AirPods were just the opening salvo. Amazon Inc. ($AMZN) is apparently working on pods that double-up as fitness trackers. This is a space worth watching.

Elsewhere in fitness, we’re writing this particular section midweek and yet we literally just walked by someone rocking his NYC Marathon medal. Seems a bit aggressive to still be wearing that thing 72 hours post-race but, whatevs. To each his own.

Here’s a piece from Reess Kennedy about fitness and marketing, discussing the rise of the Nike Vaporfly 4%, a running shoe that Nike Inc. ($NKE) alleges will enhance performance by…wait for it…4%. Regarding the NYC marathon, he writes, “I’d safely wager that 70% of the men and women running under 3:10 were wearing it.” He adds:

“…Sunday all I was thinking was, “Why and how did Nike win so hard here?! They’ve gobbled up significant market share and achieved one of the most successful product adoption feats in the history of footwear—possibly in the history of product adoption!—and, at $250, they’ve also set a new off-the-chart, ‘luxury’ price point for racing shoes in the process!’”

He concludes that much of the adoption is attributable to FOMO: if your competitors are juicing with the Vaporfly, you should be juicing too. He writes:

“I think the far more powerful demand ignitor was actually the brazen insertion of a precise performance gain right into the name of the actual product: The Vaporfly 4%.”

“For the first time in history, a shoe company is making a clear ROI claim to buyers. This is the real reason they’ve sold so many.”

“Many runners really struggle over many marathon attempts to break three hours—often, tragically, missing it by only a few minutes on each attempt. A 4% improvement for these folks hovering around three hours would mean about a seven-minute gain! If you’re on the edge of a lifetime goal is it worth it to pay $250 to achieve it? Yeah, probably. “

This begs the obvious question: how long until the release of the “Brooks Boss 6%,” the “Adidas A$$-kicker 7%” or the “Saucony Supersonic 9%”? Will we start seeing distressed players engage in marketing schemes like this to drive traffic? Should we?*

Why aren’t restructuring firms using this tactic?

THIS IS A PREMIUM MEMBERS POST, WANT TO READ THE REST OF THIS ARTICLE AND ALL OUR PREMIUM KICK@$$ CONTENT? GET AHEAD OF THE CURVE ALREADY AND SUBSCRIBE HERE!

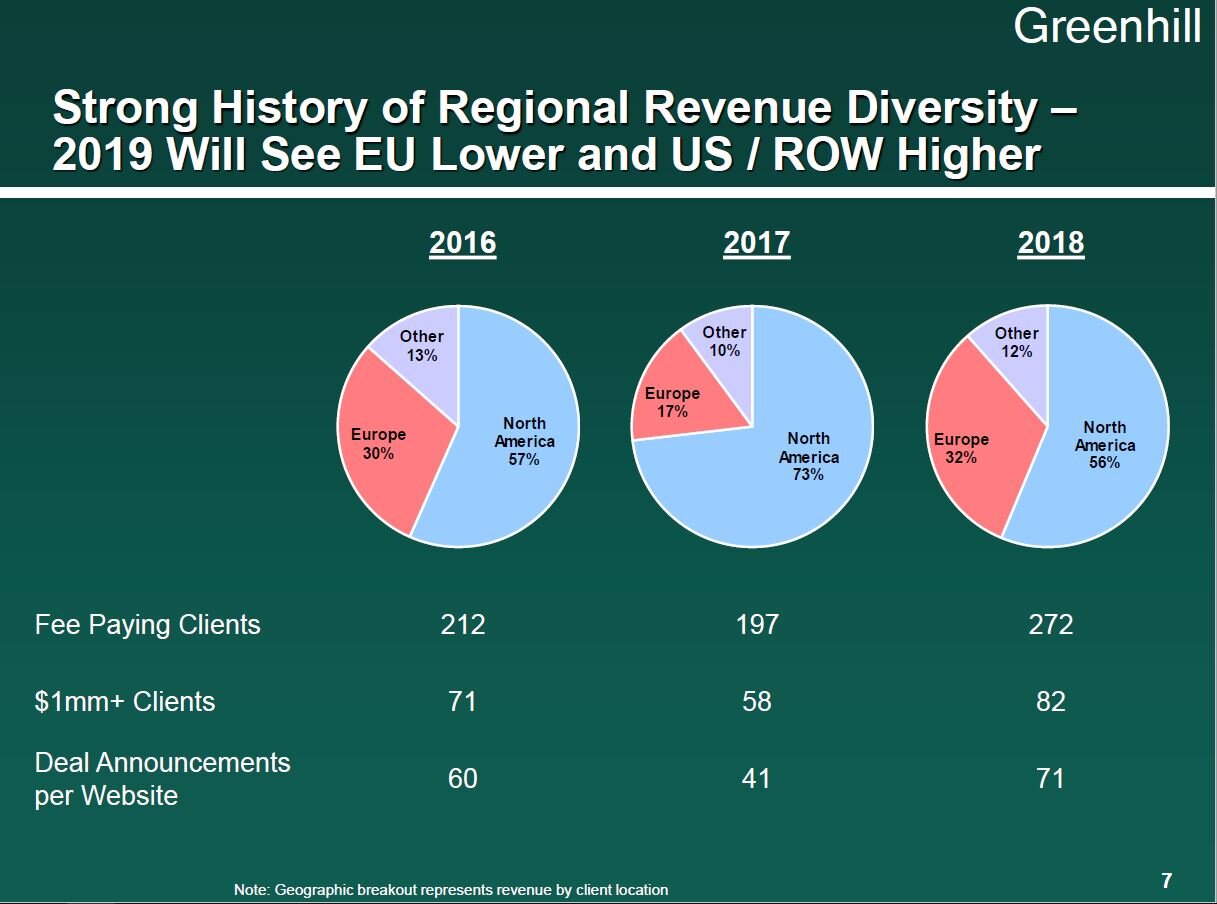

Greenhill & Co. Inc. ($GHL) reported Q3 earnings earlier his week and, well, they weren’t great. The company had $87mm of revenue for the quarter (flat YOY) and $194.3mm in revenue year-to-date. The latter is down 26% on the back of a poor first half.

Why the poor performance? The company largely blamed “a very low level of activity in European M&A.” It then asked the analyst community to deploy some Pym Particles and take a time travel trip back to rosier times: 2016-2018. The company’s earnings presentation listed (a) fee paying clients and (b) $1mm+ clients for each of those years but, curiously, did not disclose those numbers for 2019.

Despite the lack of transparency, the firm is nevertheless “[s]till expecting solid full year revenue performance,” particularly with its capital advisory business. Curious how that works. 🤔

As for restructuring, the firm touted its expanded team and noted….

TO READ THE REST OF THIS ARTICLE, SUBSCRIBE TO OUR PREMIUM KICK@$$ NEWSLETTER HERE.

We’ve often highlighted how distressed retailers may be in for a rude awakening if they think deploying influencer-based social marketing on platforms like Facebook Inc. ($FB) and others will be the cure-all to their woes. And be easy. It won’t be and it’s not. The campaigns require significant expertise to execute and the cost of such campaigns has been on the rise. Until recently, it seems. In Facebook’s recent earnings call, CFO Dave Wehner said:

“In Q3, the number of ad impressions served across our services increased 37% and the average price per ad decreased 6%. Impression growth was primarily driven by ads on Facebook News Feed, Instagram Stories and Instagram feed.”

Surprisingly, Facebook appears to be driving a large part of that impressions growth rather than Instagram Stories and the Instagram Feed. This means ads are reaching more people on the platform and, yet, the average price of ads decreased. While it’s not clear from the company’s SEC filings nor its earnings call why this is the case, this is a potential positive for retailers looking to deploy social ads.

TO READ THE REST OF THIS PREMIUM ARTICLE, CLICK HERE.