🎅A Wave of Filings Crash the Holidays🎅

🤖Are There More #BustedTech Bankruptcies Coming?🤖

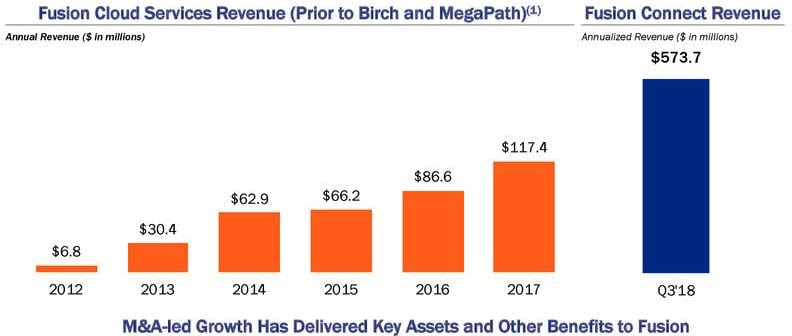

The recent bankruptcies of Fusion Connect (which just confirmed a plan swapping ~$270mm of debt for equity), Clover Technologies, uBiome (which just sold for a small fraction of its valuation), Loot Crate Inc., Juno Inc., Munchery, and Vector Launch Inc. — combined with the recent negative news surrounding WeWork (of course), Faraday Future (founder already in BK), Proteus Digital Health and Wag — signal that restructuring professionals shouldn’t sleep on “tech.” The sector has been surprisingly active in 2019 and there’s likely more to come in 2020 (e.g., RentPath?).

In the wake of the WeWork debacle, there has been a lot of talk about the end of “growth at all costs” thinking and a newfound emphasis on business fundamentals, i.e., unit economics. Indeed, post-WeWork, funding in startups immediately slowed down … for like a second … and people took measure; likewise, in the public markets, many recently IPO’d companies with questionable fundamentals have performed poorly. Time will tell, then, whether WeWork was just a blip on the radar screen or the canary in the coal mine. There are more signs of the former — this week it seems like 8,292,029 companies announced new raises — but might Vector Launch be validation of the latter? Who knows.

As we’ve argued in the past — obviously VERY prematurely — tech “startups” are more mature at earlier stages now than they used to be which very well may require them to sidestep the assignment for the benefit of creditors and launch headfirst into a bankruptcy court — if and when folks again get scared. With the private markets having become the new public markets over the last decade, there are a ton of private tech companies that are well-developed (read: “unicorns”); that have intellectual property (e.g., actual patents as well as brands); that have valuable contracts/leases; that have investors that seek releases. What they don’t appear to have are viable business models. When the tide goes out (read: the money scares), we’ll see who is wearing clothes.

The question is: what would be the catalyst? With interest rates steady or declining, there’s no reason to suspect the end is near for “yield baby yield” psychology and, therefore, the deployment of endless quantities of capital in alternative asset classes. That should bode well for tech.

And, yet, people are fearful. First Round Capital recently released its “State of Startups 2019” and if some of the fears come true, indeed, there will be more action as noted above:

Founders fear the bubble — concerns are at a 4-year high.

This year, over two-thirds of founders who ventured a guess think we are in a bubble for technology companies. It’s the highest number we’ve seen since 2015 — up 12% from 2018 and 25% from 2017.

Spoiler alert:

THIS IS A SUBSCRIBING MEMBER’S POST. TO READ THE REST OF THIS ARTICLE (AND MORE OF OUR KICK@$$ CONTENT) CLICK HERE.