Those pieces are:

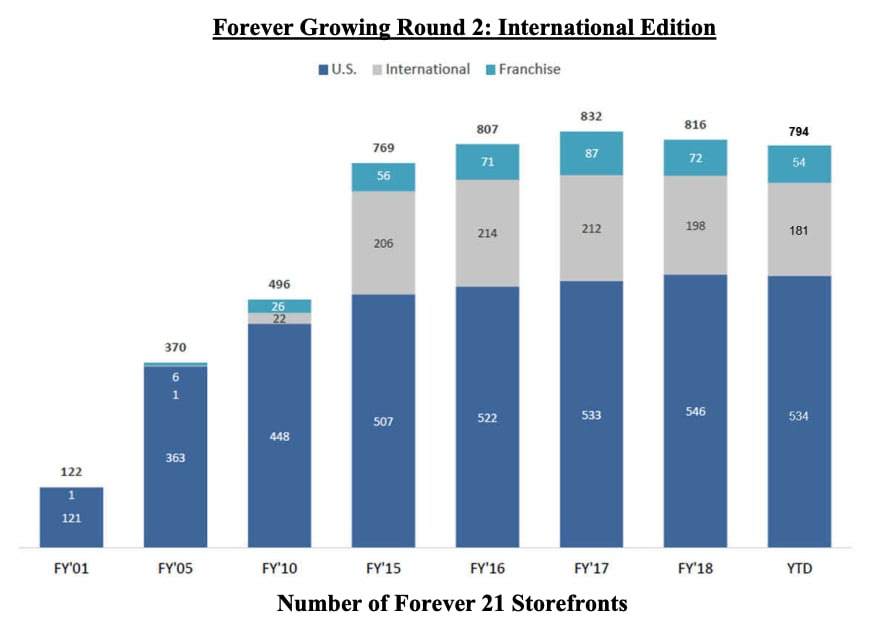

The Footprint. Right-sizing the business by shuttering underperforming locations, domestically and internationally. The company currently spends $450mm in annual rent, spread across 12.2mm total square feet. The company will close 178 stores in the US and 350 in total. In other words, the company is mostly erasing its overzealous expansion; it will focus on selling cheaply made crap to Americans and our southern friends down in Latin America rather than poisoning the clothes racks in Canada, Europe and Asia. The new footprint will be around 600 stores. Or, at least, that’s the plan for now. Let’s pour one out for the landlords. Here is CNBC mapping out where all of the closures are and which landlords are hit the most. Also per CNBC:

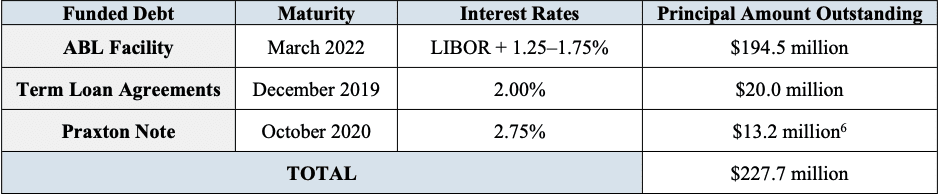

“At one point, two of Forever 21′s largest landlords, Simon Property Group and Brookfield Property Partners, were trying to come up with a restructuring deal where they would take a stake in the company to keep it afloat. It would’ve been similar to when Simon and GGP, which is now owned by Brookfield, bought teen apparel retailer Aeropostale out of bankruptcy back in 2016. But talks between Forever 21 and its landlords fell through, according to a person familiar with the talks. Simon and Brookfield are listed in court papers as two of Forever 21′s biggest unsecured creditors. Simon is owed $8.1 million, while Brookfield is owed $5.3 million, and Macerich $2.7 million.”

Only one of the locations marked for closure, however, belongs to Simon Property Group ($SPG).

The company notes:

To assist with the initial component of the strategy, Forever 21’s management team and its advisors worked with its largest landlords to right size its geographic footprint. Four landlords hold almost 50 percent of its lease portfolio. To date, Forever 21 and its landlords have engaged in productive negotiations but have not yet reached a resolution. The parties have exchanged proposals and diligence is ongoing. Forever 21 looks forward to continuing to work with its landlords to reach a mutually agreeable resolution and proceeding through these chapter 11 cases with the landlords’ support.

In tandem with these negotiations, Forever 21 and its advisors met with nearly all of its individual landlords to discuss potential postpetition rent concessions and other relief on a landlord-by-landlord basis. Many of these smaller, individual negotiations proved more fruitful than negotiations with the larger landlords. Although Forever 21 has not finalized the terms of a holistic landlord deal as of the Petition Date, Forever 21 anticipates that good-faith negotiations with its landlord constituency will continue postpetition, and that all parties will work together to reach a consensual, value-maximizing transaction.

Company counsel asserts that, for landlords, Forever 21 is “too big to fail.” This kinda feels like this: