🍿Sears = The Gift That Just Keeps Oooooon Giving🍿

The Sears estate and Eddie Lampert are at it again

Oh, Sears. We just can’t quit you.

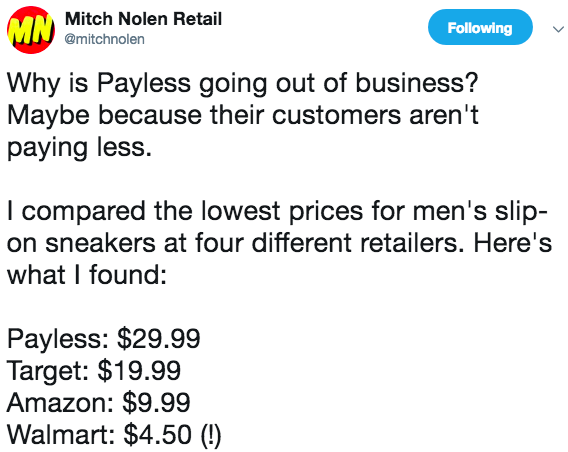

On Sunday in “Sears is Such a Drama Queen (Long Contract Interpretation Issues),” we discussed how — SHOCKER!! — there are already problems brewing between Transform Holdco (ESL’s buyer entity) and the debtors’ estate (the seller). Transform Holdco delineated a laundry list of beefs it had with the estate and filed a motion seeking mediation — a thoughtful strategy given that White Plains already foreshadowed how it might come out on any APA interpretation issues. Knowing full well that we were only getting one side of the story — and Eddie Lampert being Eddie Lampert — we hedged a bit:

Given all of the evidence pointing towards administrative insolvency to begin with, any obstreperousness on the part of the sellers (if true, as alleged) is wildly counter-productive: again, the estate is more likely than not administratively insolvent!! It would seem, then, that mediation would be a no brainer (though we reserve judgment for when the sellers respond — which we’re sure will be an entertaining dig at how much they think Lampert is retrading on certain parts of the deal…time to ramp up those PR machines again!!).

Now was that an easy call or was that an easy call?

On Monday night, the debtors responded with a motion to enforce the APA (and the automatic stay) and compel turnover of estate property — the main crux of which is the debtors allegation that Transform Holdco is in breach “by refusing to deliver $57.5 million that are the property of the Debtors….” They allege:

The Buyer’s request for mediation is nothing more than an attempt to delay turning Estate property over to the Debtors by conflating unrelated post-closing disputes (to which the Debtors have fully responded) with the Buyer’s refusal to deliver $57.5 million that plainly belongs to the Debtors per the APA, despite the Debtors’ repeated demands.

And jab:

…the Buyer is well aware of the extent to which the Debtors have limited resources to engage in protracted litigation. The $57.5 million in funds improperly retained by the Buyer are critical to maintaining administrative solvency and the Buyer is jeopardizing the Debtors’ ability to timely file a chapter 11 plan by withholding these funds. Rather than simply turn over the Estate assets, or seek guidance from this Court (which is intimately familiar with the APA and its terms), the Buyer instead conflates its obligation to turn over Estate property with a litany of unsubstantiated claims of misrepresentations and breaches by the Debtors, and requests a mediation that would, at best, delay resolution of any of these issues by more than a month.

And jab, cross:

…if there is a dispute, the Debtors would prefer to keep these issues front and center with this Court, which is most familiar with the APA and the issues facing the Debtors and their Estates, as well as the dynamics currently affecting the Estates. The Motion to Mediate should be seen for what it is: the Buyer’s transparent attempt to delay the transfer of Estate assets to gain leverage in its ongoing effort to sidestep the liabilities which Buyer assumed under the APA, including the $166 million in assumed accounts payable that this Court previously indicated the Buyer would be very unlikely to avoid.

There it is: the ever-controversial $166mm in assumed accounts payable. Can someone please pass the butter for our popcorn?

Is there any wonder that the estate would like to keep any and all disputes in White Plains? The judge’s fingerprints are all over this deal; he’s incentivized to make sure that it proceeds without dispute, that a plan of reorganization gets filed, and that creditors get some sort of shot at a recovery — a shot that diminishes each day given the magnitude of fees that are accumulating in this case. Case and point:

Still, we can’t help but to question certain of the Debtors’ decisions here. This bit was…imprudent…maybe?:

Prior to the time of Closing, the Buyer advised that it had not done the work necessary to implement its own cash management system or to set up its own bank accounts. Meghji Decl. at ¶ 6. As a concession to the Buyer—in order to alleviate the risk to Closing and in an effort to help facilitate a seamless transition of the going-concern business in the interests of, among others, the Debtors’ employees and key stakeholders—the Debtors agreed to give the Buyer possession and control of the Debtors’ cash management system, including its bank accounts as of the Closing Date. Id. ¶ 7.

What is that old cliche about possession and the law? And that one about the road to hell being paved with good intentions? How is it that ESL hadn’t done the work necessary to set up bank accounts? HE HAD TEN FRIKKEN YEARS.

Anyway, to be fair to the debtors, they thought they had contracted around the issue, putting into place a protocol for the repayment of pre-closing-accrued funds that landed in the cash management account post-closing. Nevertheless, apparently ESL and their financial advisors, E&Y, be like:

And so money is apparently due and owing on both sides and the debtors want their money and ESL wants clarification on certain liabilities and trust has apparently broken down in the process. ESL — knowing that Judge Drain will be none-too-pleased — wants a mediator and all the while cash registers are ringing and the estate becomes more and more administratively insolvent.

Like we said on Sunday, “Like…does ANYTHING ever go easy for Sears?”