New Chapter 11 Bankruptcy Filing - Novum Pharma LLC

Novum Pharma LLC

February 3, 2019

Another day, another pharma company that has filed for bankruptcy. Curious, too: we don’t recall seeing any restructuring professionals predicting that pharma would be the hot restructuring industry of choice. But we digress.

Here, Chicago-based Novum Pharma LLC, a special pharmaceutical company which owns and manufactures a portfolio of topical dermatology products, filed for bankruptcy in the District of Delaware. The company’s bankruptcy papers are interesting in that they provide a solid overview of the distribution channel for pharma products from the manufacturer to the end user. Disgruntled with all of the players taking a piece of revenues along the way, Novum Pharma attempted to disrupt the status quo by deployment of an alternative business model. Clearly it didn’t achieve the result it had hoped for.

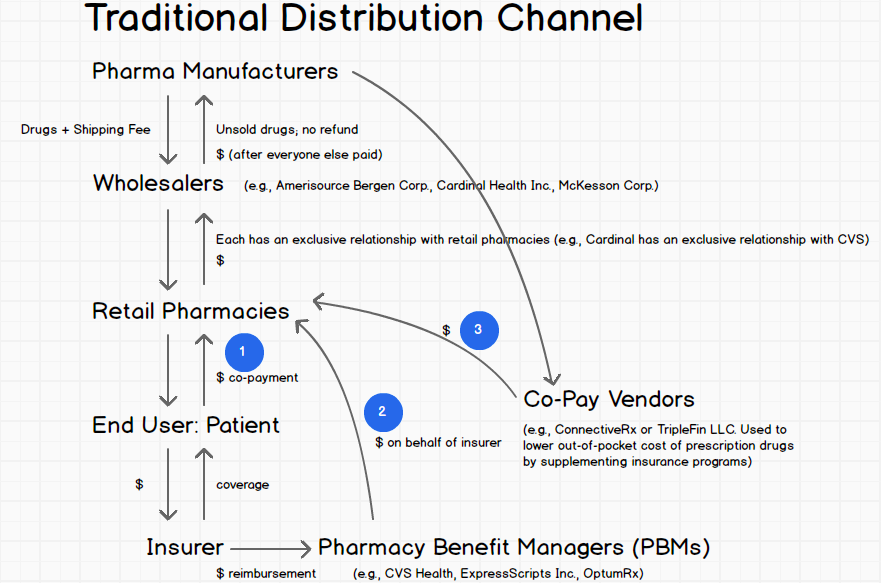

Per the company, here’s how the “traditional” distribution channel typically works:

Source: PETITION LLC

As you can see, the PBMs have a significant amount of leverage on account of their ability to determine which pharmaceuticals will be covered by insurance and which won’t. As a result, the company attempted its alternative. This model was predicated upon the concepts of “enhanced patient access” and “hassle free” access. It doesn’t appear that the company achieved that. Here’s how it would work:

Once the healthcare professional writes a script, the patient could get their prescription through one of three ways:

Via a nationwide network of specialty pharmacies like Cardinal Health 105 Inc., a specialty pharmacy division of Cardinal Health Inc., that the company sells its products to and that have agreed to comply with the company’s guidelines;

If 105 Inc. or the other specialty pharmacies cannot fill the prescription because a PBM denied coverage or otherwise, the pharmacy could transfer the prescription to a “consignment hub,” which is a specialty pharmacy that stocks the Debtor’s products on a consignment or bailment basis and will fill a prescription for a nominal fee (paid by the Debtor); or

If a patient seeks to fill the prescription at a pharmacy that doesn’t participate in the company’s network and the PBM denies coverage, the patient will receive the drug for free.

As you might imagine, prescribing physicians are encouraged to provide patients with a hotline number where, no doubt, patients, are encouraged to go route #1. Why? Because the company earns revenue from the specialty pharmacies (read: from Cardinal Health). But, per the company:

In contrast, when a prescription is filled by a pharmacy, the Debtor expends funds to facilitate the transaction. In particular, when a healthcare plan covers some or all of the cost of a Dermatology Product prescription, the Debtor, through its Co-Pay Vendors, pays the amount that is not covered by the healthcare plan. Alternatively, when a healthcare plan rejects a Dermatology Product prescription, the Debtor facilitates the transfer of that prescription to one of its consignment hubs so that the prescription can be filled and mailed to the patient, at no cost to the patient.

Anyone else see the problem with all of this?!? Don’t know about you, but the added friction of calling a hotline and finding some random specialty pharmacy rather than going to the neighborhood CVS is far from “hassle free.”

All of these gymnastics created a company with $19.4mm in assets, the lion’s share of which is its intellectual property. In addition, there are some consulting and sales support contracts and A/R. On the liability side of the balance sheet, the company has $15.2mm due and owing on a secured basis to lender RGP Pharmacap LLC (at a prime plus 9.75% or 14% interest rate, payable in monthly principal installments), and $2.8mm in lease obligations that are secured, in part, by a $500k letter of credit issued by The Huntington National Bank.

Per the company, among the factors that precipitated the company’s bankruptcy were…

…among other things, (i) manufacturing hurdles leading to production delays and product “stock-outs”; (ii) a dispute with Cardinal and CVS regarding the price at which the Dermatology Products can be returned to the Debtor; (iii) managed care actions leading to increased prescription rejection rates for the Dermatology Products; and (iv) market dilution and decreased total prescriptions due to unauthorized generic alternatives being introduced into the market.

In response, the company implemented cost-cutting measures like outsourcing its “back office” function, downsizing its sales force and entering into a more cost-effective lease. But these measures didn’t address the fundamental business challenges confronting the company. The company continued:

The Debtor’s historically low prescription approval rates, compounded by (i) the Debtor’s persistent manufacturing issues which directly damaged the Debtor’s business because the Debtor’s sales force was unable to distribute sample products during a critical product growth period and HCPs were forced to prescribe alternative medications, (ii) the Debtor’s working capital shortages stemming in part from the Cardinal/CVS product return dispute and (iii) generic drug competition (which the Debtor believes is unlawful), led the Debtor to the inevitable conclusion that its business was no longer sustainable and that a restructuring and refinancing of the business would be necessary.

The chapter 11 filing is meant to preserve the company’s assets and provide it with a forum through which to conduct a bankruptcy sale process of the dermatology products to maximize value for the company’s creditors. Based on the various disputes the company has with Cardinal/CVS, there may be some litigation here for an as-of-yet-unformed Creditors’ Committee to pursue as well.

Jurisdiction: D. of Delaware (Judge Carey)

Capital Structure: $15.2mm of secured debt, $2.8mm in lease obligations

Company Professionals:

Legal: Cole Schotz PA (David Hurst, Patrick Reilley, Jacob Frumkin)

Independent Director: Thomas J. Allison

Financial Advisor: CR3 Partners LLC (Thomas O’Donoghue, Layne Deutscher, Cynthia Chan)

Investment Banker: Teneo Capital (Chris Boguslaski)

Claims Agent: KCC (*click on company name above for free docket access)

Other Parties in Interest:

Official Committee of Unsecured Creditors

Legal: Sills Cummis & Gross P.C. (Andrew Sherman, Boris Mankovetskiy) & (local) Klehr Harrison Harvey Branzburg LLP (Morton Branzburg, Richard Beck, Sally Veghte)

Financial Advisors: Goldin Associates LLC (Gary Polkowitz)

Updated 3/9/19