"It is likely that other retailers may commence chapter 11 cases in the near term." - Girisha Chandraraj, CEO of Marbles Holdings LLC

How do you know when the retail industry is truly effed? We'll spare you the suspense: when even the big nerds from "The Brain Store" can't find a path to retail sustainability.

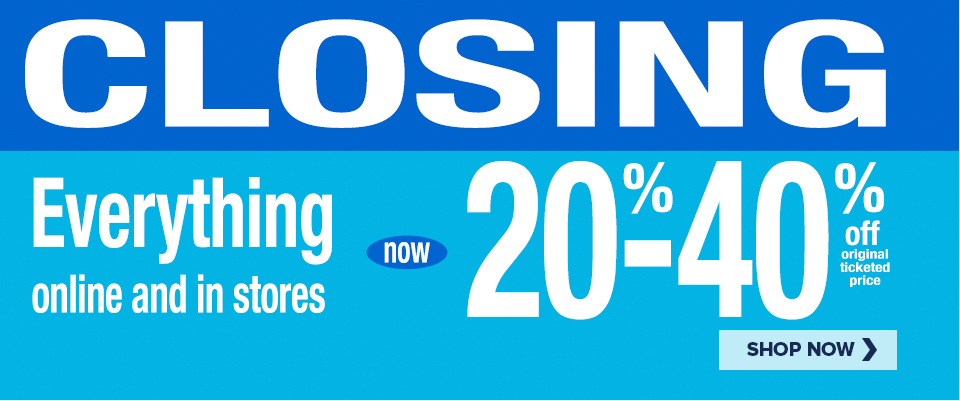

This past week, Marbles Holdings LLC, the entity behind "Marbles: The Brain Store," a specialty retailer that sells games, puzzles, books and software for kids (and memory-juicing adults) filed for bankruptcy. The company operates 37 retail stores in 13 states (and a store-in-store concept within 6 Macy's locations); it also maintains e-commerce and wholesale channels. It's on the smaller side of retail which is why it likely didn't get as much attention as the headlines surrounding Eastern Outfitters LLC, Payless or Sears. But like those others and "[d]espite years of popularity," the company simply couldn't overcome declining mall traffic and burdensome rents. So now what? Liquidation.

We'd, frankly, never even heard of this company. But there are some interesting bits in their papers that merited highlighting:

- The shame of it. The games this company make seem to be games that this country needs. As the US falls behind in the STEM fields, providing kids access to "Maker Brains" games "focused on capturing the engineer in everyone" seems to be just what the doctor ordered. With this in mind, hopefully some of the company's concepts will find a home.

- The World Trade Center. We've been to the new shopping center there. Thousands of people have been there. And thousands of people leave carrying no shopping bags. We've noted it. You've probably noted it too. "The Debtors believed that the mall owner of WTC could transform the Financial District into an iconic shopping center in Manhattan with significant customer foot traffic, thereby justifying the capital expenditure." This is curious. Either management is projecting their own shortcomings or the mall owner engaged in a classic case of over promising and under delivering. Maybe both. The WTC location contributed to 50% of the company's sales shortfall. There is a commentary here about the World Trade Center shopping center that probably merits entirely separate coverage. See "New Yorkers may not be shopping at the $4b transit hub...." Regardless, this is a big league #fail.

- The "A Malls". The Company earmarked 21 stores for closure prior to filing for bankruptcy. 18 of the 21 stores are with landlords generally associated with "A Malls" - Simon Property Group, General Growth Properties and Westfield LLC. These are the malls that are purportedly safe because their tenants are high end. Hmmmm.

One final note: this business was seemingly as omni-channel as the come. Physical presences, e-commerce, catalogues, etc. And yet it still fell under the weight of secular and cyclical trends befalling all of retail. The bulletpoints above are important: they show the trickle-down effect of this wave of failing retail. How much exposure do A Malls have to a further decline in retail? How about the City of New York? Or other municipalities dependent upon commercial retail rents? It doesn't take a mind-bending puzzle-junkie to understand that Mr. Chandraraj is on point: there will DEFINITELY be other near-term retail bankruptcies. Are the effects of that anywhere near fully known?