*****

The key question for CXW is what happens to the private prison industry now that those in power are focused on shutting it down. On January 26, 2021, the Biden White House distributed a fact sheet and statement outlining the President’s vision and agenda for advancing racial equity. Included in that agenda is reforming private prisons. Per the fact sheet:

“This afternoon, President Biden will outline his vision and new elements of his agenda for advancing racial equity for Americans who have been underserved and left behind…President Biden will sign four executive actions this afternoon to advance racial equity and take first steps to root out systemic racism in housing and criminal justice…The President will sign an Executive Order to end the Department of Justice’s (DOJ) use of private prisons.” (emphasis added)

The fact sheet elaborates further:

“Reform our Incarceration System to End the Use of Private Prisons. More than two million people are currently incarcerated in the United States, and a disproportionate number of these individuals are people of color. Mass incarceration imposes significant costs on our society and communities, while private prisons profiteer off of federal prisoners in less safe conditions for prisoners and correctional officers alike. President Biden is committed to reducing mass incarceration while making our communities safer. That starts with ending DOJ’s reliance on private prisons. The Order directs the Attorney General not to renew Department of Justice contracts with privately operated criminal detention facilities.” (emphasis added)

CoreCivic’s stock fell from a pre-election high of $7.51/share on November 3rd to $6.00 on November 6th but trades at $7.96 today. It jumped nearly 5% on Monday and another 4.3% yesterday. This suggests to us two things: i) it’s possible the market has already priced the Biden Administration order into a base case forecast, and/or ii) the order won’t alter the status quo or create much of a discernible impact on CXW’s business. Said another way, restructuring professionals who go around saying “keep an eye on the private prison space” may very well be sending you on a wild goose chase.

We dug into CXW’s filings and learned that the DOJ has been directing the Federal Bureau of Prisons (BOP) to cut back on private prisons since August 2016. Per the Q320 10-Q:

“In a memorandum to the Federal Bureau of Prisons ("BOP") dated August 18, 2016, the Department of Justice ("DOJ") directed that, as each contract with privately operated prisons reaches the end of its term, the BOP should either decline to renew that contract or substantially reduce its scope in a manner consistent with law and the overall decline of the BOP's inmate population. In addition to the decline in the BOP's inmate population, the DOJ memorandum cites purported operational, programming, and cost efficiency factors as reasons for the DOJ directive.”

But a 2016 change of administration got in the way…

“On February 21, 2017, the newly appointed U.S. Attorney General issued a memorandum rescinding the DOJ's prior directive stating the memorandum changed long-standing policy and practice and impaired the BOP's ability to meet the future needs of the federal correctional system.”

Commentary from the company’s Q320 earnings call suggests that over the past 7 – 8 years, CXW’s management has been anticipating prison reform and positioned the business accordingly:

Joseph Gomes:

“Okay. And kind of big broad from the 10,000 foot…if we look at your guys' stock price with what's been going on here with the election, there is a huge portion of the investor base saying, the feeling is that with -- if Biden was to win the election, that is a huge negative for the company, just based on what's happened to the stock price here…what actually can Biden do from a regulatory standpoint in terms of changing immigration or the U.S. Marshals? I know the Bureau of Prisons has reduced its populations over time. I don't know if that gives them excess capacity, can that allow the government to transfer detainees that are currently being helped by the private sector to the Federal Bureau of Prisons? Are those facilities just not set up to handle detainees versus inmates? It's my understanding, correct me if I'm wrong, please, ICE and the U.S. Marshals own minimal amount of beds at all. So that, again, the alternatives for the federal government to house these detainees is extremely limited.

Damon Hininger, CEO of CoreCivic:

“Absolutely, Joe. Thank you for the question. So yes, let me give a little color on all three federal partners. Let me start with the Federal Bureau of Prisons. So that was…about 10 years ago…15% of our revenue...This year, on the safety side, it's going to be about 2%. So we started a conversation with our Board about 7, 8 years ago, noting that the need and the trends for the BOP was going to change because they, at that time, were going through some sensing reform and changed some policies on sensing for different criminal offenses. And so we went through a process to -- as we saw contracts come up, exploration most notably, the most recent one here, Adams County, just thinking about maybe alternatives for those facilities. So that 15% revenue from the BOP back in 2010, now it's down to 2%. So we think if there is a change in policy directed towards the BOP about utilization of the private sector, again, we think our risk is pretty minimal there just because we're down to one contract.” (emphasis added)

Further, it appears that CoreCivic benefits from the fact that neither the U.S. Marshals nor U.S. Immigration and Customs Enforcement (ICE) own any of their own facilities, and rely completely on private prison service providers such as CXW. Mr. Hininger explains the setup:

“Going to ICE and Marshals Service…[both] those agencies are law-enforcement focused. And so Marshals Service do not have any facilities they own or they operate. So unlike the BOP, where they've got 100 facilities around the country that they own and they operate, Marshals Service doesn't have that luxury. And so they have no alternative. They either rely on us, the private sector or city and counties for space. So if they are asked to look at either buying or building a new capacity, that will be a very large capital commitment and probably would take anywhere from 5 to 10 years to happen. So obviously, it's not something they could affect overnight. And again, depending on what the leadership is within the Congress that obviously would require also some concurrence with Congress on federalizing the workforce to operate those facilities. So several different steps that also they would have to take. So we think our 40 years' work with the Marshals Service and with ICE, too, we have been able to be very closely aligned with the mission, which has changed over time, provide high quality, good solutions that are very efficient for their mission.” (emphasis added)

And from what we gather, it’s not just about having an empty prison that’s important, but also having the right ancillary facilities in the right locations. Mr. Hininger continues on the Q320 call:

“Notably, and again, it goes a little bit of question about BOP potentially providing capacity to those agencies, the capacity has to be in the right location. So for example, our city in San Diego, which is about 1.5 mile from the Southwest border, that facility has not only capacity, but it's got court rooms, it's got space for lawyers and for case managers, and that BOP doesn't have anything nearby that could support them. So our facilities are not only efficient from a design perspective, but they're very strategically located that makes the mission of both agencies, Marshals and ICE, very, very, very effective. So that's an important point on that piece.”

Lastly, Mr. Hininger describes how standard government operating procedure has turned the U.S. Marshals into price takers:

“Marshals Service…[has] to provide capacity anytime a federal judge directs into holding federal prisoner. So they -- regardless of the budget situation, U.S. attorney, if they're prosecuting someone and the judge says, this person needs to detain, and they produce this individual to the Marshals Service, they have to house that individual. They don't have the luxury to say, they don't have the dollars or maybe the policy to house that population. So they're, again, beholden to what's being directed by the Federal Judiciary….“

And despite all the negative headlines, CXW cites that ICE funding over the past 15-years and 3 different administrations has “either been flat or has grown.”

“…again, you've got 3 different administrations, and you've had multiple changes in leadership, both on the House and the Senate side. So we think that indicator is probably a pretty good sign of kind of regardless of what the outcome here of this week's election, ICE mentioned is they have a need for capacity, they rely on the private sector or local facilities, and funding has been either stable or has grown over the last 15 years. And we have constantly shown not only a high-quality solution in strategic locations, but also we've continued to apply and advocate that ICE continue to raise the standards, have appropriate oversight so all these different reforms and improvement in standards and quality of operations we've advocated for, and we've met the bar.” (emphasis added)

CXW also appears to have a bit of a moat around its business:

“Our facilities meet what they call the performance-based national detention standards that the alternative in a public sector facility, where they house them in county jails, just oftentimes cannot meet those facilities because of physical plant limitations. So where our facilities, our newer facilities, they meet all of those standards. In many cases, the alternative use in a public sector facility just can't meet those standards because of the physical plan. And then last point…I'd make is, many of our facilities also have courts within the facilities.And…we have hundreds -- literally hundreds of ICE officials that when they get up in the morning, they report to their place of work. It's at one of our facilities that -- in the case where they have courts, is an extremely efficient -- much more efficient use of the space when -- as opposed to having to round them up from county jails and get them to court. So a lot of critical needs we provide within our real estate that's very challenging to replicate. (emphasis added)

*****

A concern for any debt-laden company with contracted revenue is how quickly the business is able to replace contract churn with newly signed business. While revenue in Q2 and Q3 2020 was primarily lower due to COVID-19 accelerating the reduction in inmate populations, CoreCivic had several facilities moved to “idle” status as states struggled to manage their prison budgets. So far, CXW management appears to be on top of the situation.

During Q320, CXW and the State of Oklahoma agreed to idle the 1,692-bed Cimarron Correctional Facility and the 390-bed Tulsa Transitional Center However, on its earnings call, CXW’s management highlighted three new contracts representing the potential for an incremental utilization of approximately 3,000 beds. The Cimarron Correctional Facility in Oklahoma, the 1,896-bed Saguaro Correctional Facility in Idaho, and the 289-bed Turley Residential Center in Tulsa all entered into new contracts with various government agencies, while utilization at the 494-bed Reentry Opportunity Center in Oklahoma City was projected to increase.

While reduced inmate population in recent quarters has been a key risk to CXW’s underlying business, commentary on the earnings calls suggests some of these contracts were below historic operating margins, and this new incremental business “approximates the average CoreCivic safety operating margin” with potential for upside as utilization scales.

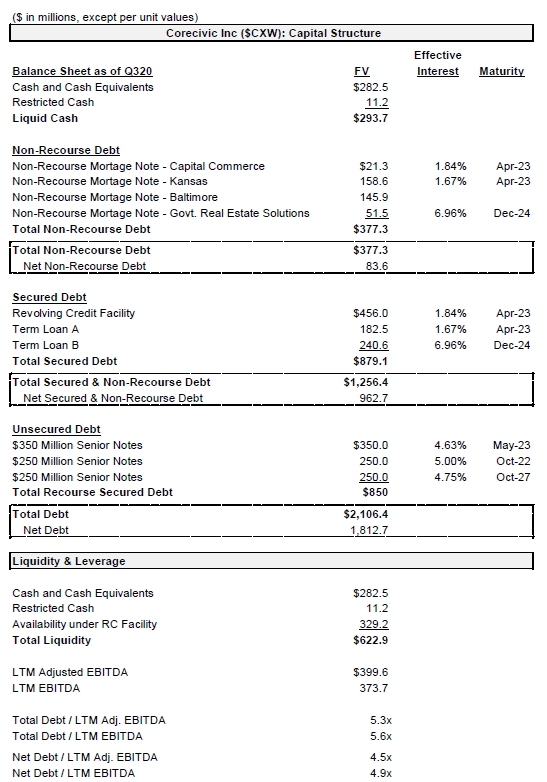

The other key concern for CoreCivic is managing its debt stack. CXW’s largest maturity wall is 2023, where more than half of its funded debt comes due. Per the company’s Q320 earnings call, management is focused on debt paydown:

Damon Hininger, CEO of CoreCivic:

“Last quarter, we announced our intention to revoke our election as a real estate investment trust or REIT and convert to a taxable C corporation effective January 1, 2021. Revoking our REIT election provides us much more flexibility in how we allocate our substantial free cash flow. This was evident in our third quarter because we were able to allocate $107.2 million of net cash provided by operating activities in the quarter to debt reduction. We're paying over $100 million of net debt during the quarter, bringing our total recourse debt net of cash down to approximately $1.4 billion. We believe continued on this path of prioritizing debt reduction with a target total leverage of 2.25x to 2.75x will meaningfully improve our overall credit profile and lower our cost of capital.” (emphasis added)

While public outcry and renewed government efforts to shut down private prisons may rattle the cages, it doesn’t appear like CoreCivic’s business is going away anytime soon. CoreCivic reports its Q420 earnings at market close on February 10, 2020. We anticipate the market will be particularly focused on management’s commentary on the first few days of the Biden Administration, as well as any new contract wins or inroads.