💥It's Over: Hertz is Already Deal of the Year💥

⚡️Update: Hertz Global Holdings Inc., LOL.⚡️

It all comes back to Hertz Global Holdings Inc. ($HTZGQ), the unofficial poster child for COVID-19 era markets.

Let’s recap the bona fides:

The company filed for bankruptcy in May 2020 after the pandemic sparked governments around the world to shut down air travel. No business trips and vacations quickly destroyed the rental car market as revenue fell off a cliff. The precipitous decline in sales triggered a margin call on debt backing the Hertz Debtors’ car fleet — a margin call that they could not satisfy. In other words, the chapter 11 bankruptcy filing was in no way tied to near-term structural business reasons that merely got uber-accelerated (word choice purposeful) by the pandemic (like many other bankruptcy filings at the time); it was as pure a COVID-19 filing as they came at the time.

The entire capital structure capitulated but a month later the stock mysteriously rose to over $6/share. The markets were incredulous and lots of really smart people using decades of historical precedent cast shade on Robinhood bros and memers for being dumb enough to buy shares in a bankrupt company with loans trading at levels (30 cents) that reflected significant impairment higher up in the capital structure. In other words, Hertz became sort of like an analog meme stock before more-digitally oriented meme stocks (e.g., GameStop Inc.) became a thing.

Needing additional funding, the Hertz Debtors sought to capitalize on the good fortune conferred upon them by WallStreetBets and partake in an at-the-market equity offering, a strategy viewed by most as a cynical maneuver to take advantage of willing fools. This sent the Twittersphere into a tizzy but ultimately (and predictably) got approved by the Delaware Bankruptcy Court. Shortly thereafter, however, the SEC put the kibosh on this plan which probably had something to do with the Hertz Debtors acknowledging that they were knowingly and intentionally feeding pigs what they reasonably thought to be sh*t. The Hertz Debtors did squeak out a small allocation of shares, though (at just over $2/share).

Hertz then flooded the market with used cars as it sought to raise cash in a depressed travel environment; from June 1, 2020 through December 31, 2020, Hertz disposed of more than 199,000 vehicles.

During that time, there was a torrent of car purchases as people were wary of air travel. Meanwhile, auto OEMs had to curtail production — first because of COVID-19 and then due to semiconductor shortages (PETITION Note: production cuts of new cars now total a reported 1.2mm vehicles). Large customers like Hertz also ceased volume orders. Used car prices quickly recovered. As just one way of illustrating the “torrent” point, take a look at Carvana Co’s ($CVNA) revenue:

Fast forward to a miraculous economic recovery (Jay POW-ell!) and as borne out by Avis Budget Group Inc. ($CAR), car rentals came back. Consequently, the Hertz Debtors decided to put the pedal to the metal and get the hell out of bankruptcy. Who knew whether this would all last? Better to take advantage of this momentum now, the thinking went.

You know about the back-and-forth by this point. First there were one group of plan sponsors (Knighthead Capital Management LLC and Certares Opportunities LLC) and then there was a “pivot” (a group consisting of Centerbridge Partners L.P., Warburg Pincus LLC, Dundon Capital Partners LLC and an ad hoc group of the Hertz Debtors’ unsecured noteholders) and then another “pivot” and then another “pivot” and then a 36-hour auction and, ultimately, the initial sponsors, supported by reinforcements (Apollo Management Group), ended up back on top. Each time the outlook for general unsecured creditors and, more importantly, shareholders improved. Some noteholders absolutely crushed it.

Now — NOW! — shareholders are the big winners too! The mainstream media tripped all over itself to declare the memers the victors and the shadecasters as pessimistic boomers who didn’t understand the recovery potential (though some also pointed out the luck involved). And there’s probably some truth to the latter though we highly doubt that 99% of the former were running complex recovery analyses enough to know whether the equity had value.

But some well-known public market money managers were! And they combined with Knighthead and Certares to push through with the winning bid. The media celebrated $8 a share.

But is it really $8 a share? Or even “near $8/shr?” Bloomberg’s Matt Levine pays this point short shrift though at least, to his credit, he does note that there’s more there there:

“That $8 number isn’t quite real — you have to decide how much you value the warrants and reorganized equity — but certainly the equity is getting something. And if you believe, or partly believe, the $8 post-bankruptcy valuation, then $6.25 a year ago was a bargain. If you bought Hertz stock at $6.25 last June, that was a reasonable bet. Not necessarily a great bet — you’re down about 20% over the last year, and of course you’d have been better off buying Dogecoin — but a reasonable one, and if a few more things break your way you’ll have a nice little profit. And if you paid under $3 for Hertz — which is where it traded for most of last June — you did great.”

But that’s the thing. The entry point matters. And the details matter. Shareholders will get (a) $239mm in cash, (b) common stock representing 3% of the shares of the reorganized Company (subject to dilution from warrants and equity issued under a new management incentive plan); and (c) 30-year warrants for 18% of the common stock of the reorganized Company (subject to dilution by a new management incentive plan) with a strike price based on a total equity value of $6.5 billion, or the opportunity, for eligible shareholders, to subscribe for shares of common stock in the $1.635 billion rights offering at Plan equity value. As if that doesn’t sound complicated enough, shareholders could also elect to participate in the rights offering but, kinda sorta not. Instead, they could sell their rights pursuant to an auction and receive their pro rata share of proceeds of the rights sale instead of warrants. Thoughts and prayers to the retail investor trying to figure what the bloody hell that actually means for them.

So what does it mean? It means — NOT INVESTMENT ADVICE, DO YOUR OWN WORK! — $1.53 in cash per share. It means, with the 3% piece, another $1 per share. So, ~$2.53 is a guaranteed recovery. Beyond that, it depends upon what the shareholder opts to do and how they might value the warrants. And on that point we say, “good luck with that.” Why are we so flippant? Because this entire analysis depends on how you run your — 😳gulp 😳— Black-Scholes model (lol), which, among other inputs, requires an assessment of volatility (LOL). This volatility assessment could get you anywhere between $2/share to $5.50/share (LOL!!) and so going shorthand with $8/share isn’t exactly telling the whole story (despite making a good story). The Hertz Debtors note a volatility range of 50-65%. At its midpoint, the warrant value comes to ~$769mm or $4.92/share. Applying additional inputs might get you to $5.47/share. You could be forgiven for thinking that some Managing Director was spinning around in his chair ordering an analyst to somehow “land around $8/share” and then some excel monkey made some magic happen (adding an extra penny at the end to make things look more optically kosher). The bottom line is that along with entry points and details, the inputs matter too. And so there must be a whole lot of people running some B/S models this week (LOL!!!):

Of course, that’s a whole bunch of nuance that today’s equity market doesn’t exactly have time for. But 🤷♀️.

*****

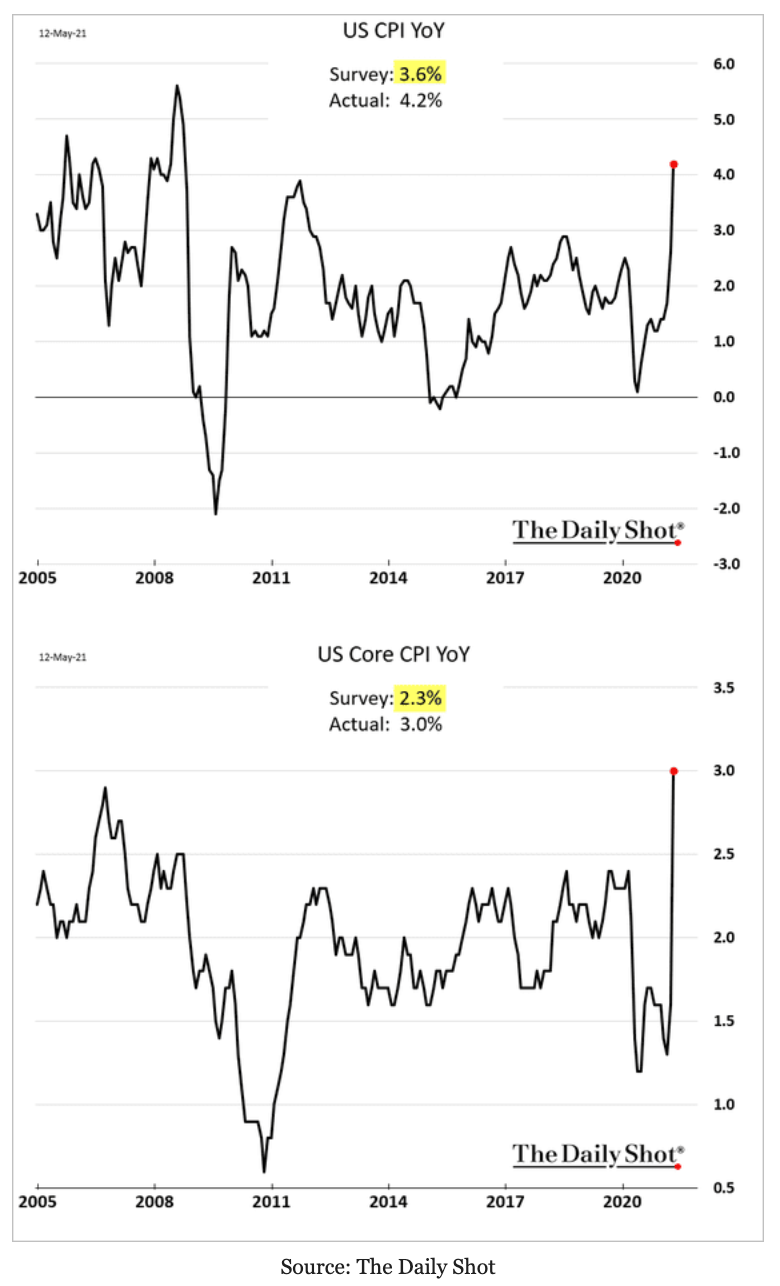

On Wednesday, Consumer Price Index data pushed the market into a swoon with CNBC coming about an inch away from this:

Headline year-over-year inflation came in around 4.2%, a somewhat misleading number since it factored in oil prices that, on a relative basis, were over $100/barrel higher than the year before.

Drilling down further into core CPI (excludes volatile food and energy) and the clear outlier is used car prices. Per the U.S. Bureau of Labor Statistics:

In other words, while other indices also increased, used cars/trucks were the largest contributor to the CPI number that freaked everyone the hell out.

Which brings us back to Hertz. The company is out in the market trying to stock back up on cars pushing prices up in a supply-constrained auto environment. It would be the greatest irony of all time if inflation fears decimated the personal trading accounts of all of the new retail entrants into the market on the same day that they experienced a win on their Hertz stock. The Lord giveth and the Lord taketh away.

Taking this a step farther, it would be amazing if the Fed felt compelled by inflation or perceived inflation to tighten monetary policy (read: raise rates) in part because Hertz vomited nearly 200,000 cars into the market and then, months later, had to go back to that market and buy its sh*t back. (PETITION Note: the inflation argument sure didn’t spook markets for long as momentum swung back fast and furious to the upside on Thursday and Friday. Markets today are fickle AF.).

Regardless of what happens with the Fed and inflation later, Hertz has already established itself as a founding member of a lot of special clubs all at the same time:

✅the pandemic-induced bankruptcy club;

✅the meme stock club; and

✅the inflation club.

Which makes us wonder: what’s next for Hertz? Is it going to NFT something? Or will it announce that it plans to carry Bitcoin on balance sheet? How long until it issues new debt into the market for the sole purpose of paying Knighthead and Certares a big fat dividend?

Nothing would surprise us at this point.