🔫New Chapter 11 Filing - Sportco Holdings Inc. (United Sporting Companies Inc.)🔫

SportCo Holdings Inc. (United Sporting Companies Inc.)

June 10, 2019

Callback to four previous PETITION pieces:

The first one — which was a tongue-in-cheek mock First Day Declaration we wrote in advance of Remington Outdoor Company’s chapter 11 bankruptcy — is, if we do say so ourselves, AN ABSOLUTE MUST READ. The same basic narrative could apply to the recent chapter 11 bankruptcy filing of Sportco Holdings Inc., a marketer and distributor of products and accessories for hunting, which filed for bankruptcy on Monday, June 10, 2019. Sportco’s customer base consists of 20k independent retailers covering all 50 states. But back to the “MUST READ.” There are some choice bits there:

Murica!! F*#& Yeah!!

Remington (f/k/a Freedom Group) is "Freedom Built, American Made." Because nothing says freedom like blowing sh*t up. Cue Lynyrd Skynyrd's "Free Bird." Hell, we may even sing it in court now that Toys R Ushas made that a thing.

Our company traces its current travails to 2007 when Cerberus Capital Management LP bought Remington for $370mm (cash + assumption of debt) and immediately "loaded" the North Carolina-based company with even more debt. As of today, the company has $950mm of said debt on its balance sheet, including a $150mm asset-backed loan due June '19, a $550mm term loan B due April '19, and 7.875% $250mm 3rd lien notes due '20. Suffice it to say, the capital structure is pretty "jammed." Nothing says America like guns...and leverage.

Indeed, this is true of Sportco too. Sportco “sports” $23mm in prepetition ABL obligations and $249.8mm in the form of a term loan. Not too shabby on the debt side, you gun nuts!

More from our mock-up on Remington:

Shortly after Cerberus purchased the company, Barack Obama became president - a fact, on its own, that many perceived as a real "blowback" to gun ownership. Little did they know. But, then, compounding matters, the Sandy Hook incident occurred and it featured Remington's Bushmaster AR-15-style rifle. Subsequently, speeches were made. Tears were shed. Big pension fund investors like CSTRS got skittish AF. And Cerberus pseudo-committed to selling the company. Many thought that this situation was going to spark "change [you] can believe in," lead to more regulation, and curtail gun sales/ownership. But everyone thought wrong. Tears are no match for lobby dollars. Suckers.

Instead, firearm background checks have risen for at least a decade - a bullish indication for gun sales. In a sick twist of only-in-America fate, Obama's caustic tone towards gunmakers actually helped sell guns. And that is precisely what Remington needed in order to justify its burdensome capital structure and corresponding interest expense. With Hillary Clinton set to win the the election in 2016, Cerberus' convenient inability to sell was set to pay off.

But then that "dum dum" "ramrod" Donald Trump was elected and he enthusiastically and publicly declared that he would "never, ever infringe on the right of the people to keep and bear arms." While that's a great policy as far as we, here, at Remington are concerned, we'd rather him say that to us in private and declare in public that he's going to go door-to-door to confiscate your guns. Boom! Sales through the roof! And money money money money for the PE overlords! Who cares if you can't go see a concert in Las Vegas without fearing for your lives. Yield baby. Daddy needs a new house in Emerald Isle.

Wait? "How would President Trump say he's going to confiscate guns and nevertheless maintain his base?" you ask. Given that he can basically say ANYTHING and maintain his base, we're not too worried about it. #MAGA!! Plus, wink wink nod nod, North Carolina. We'd all have a "barrel" of laughs over that.

So now what? Well, "shoot." We could "burst mode" this thing, and liquidate it but what's the fun in that. After all, we still made net revenue of $603.4mm and have gross profit margins of 20.9%. Yeah, sure, those numbers are both down from $865.1mm and 27.4%, respectively, but, heck, all it'll take is a midterm election to reverse those trends baby.

That was a pretty stellar $260mm revenue decline for Remington. Thanks Trump!! So, how did Sportco fare?

Trump seems to be failing to make America great again for those who sell guns.

But don’t take our word for it. Per Sportco:

In the lead up to the 2016 presidential election, the Debtors anticipated an uptick in firearms sales historically attributable to the election of a Democratic presidential nominee. The Debtors increased their inventory to account for anticipated sales increases. In the aftermath of the unexpected Republican victory, the Debtors realized lower than expected sales figures for the 2017 and 2018 fiscal years, with higher than expected carrying costs due to the Debtors’ increased inventory. These factors contributed to the Debtors tightening liquidity and an industry-wide glut of inventory.

Whoops. Shows them for betting against the stable genius. What are these carrying costs they refer to? No gun sales = too much inventory = storage. Long warehousemen.

Compounding matters, the company’s excess inventory butted with industry-wide excess inventory sparked by “the financial distress of certain market participants.” This pressured margins further as Sportco had to discount product to push sales. This “further eroded…slim margins and contributed to…tightening liquidity.” Per the company:

Many of the Debtors’ vendors and manufacturers suffered heavy losses as a result of the Cabela’s-Bass Pro Shop merger, Dick’s Sporting Good’s pull back from the market, and the recent Gander Mountain and AcuSport bankruptcies. Those losses adversely impacted the terms and conditions on which such vendors and manufacturers were willing to extend credit to the Debtors. With respect to the Gander Mountain and AcuSport bankruptcies, the dumping of excess product into the marketplace pushed prices—and margins— even lower. The resulting tightening of credit terms eroded the Debtors’ sales and further contributed to the Debtors’ tightening liquidity.

The company also blames some usual suspects for its chapter 11 filing. First, weather. Weather ALWAYS gets a bad rap. And, of course, the debt.

Riiiiiight. About that debt. When we previously asked “Who is Financing Guns?,” the answer, in the case of Remington, was Bank of America Inc. ($BAC), Wells Fargo Inc. ($WFC) and Regions Bank Inc. ($RF). Likewise here. Those same three institutions make up the company’s ABL lender roster. We’re old enough to remember when banks paid lip service to wanting to do something about guns.

One other issue was the company’s inability to…wait for it…REALIZE CERTAIN SUPPLY CHAIN SYNERGIES after acquiring certain assets from once-bankrupt competitor AcuSport Corporation. Per the company:

The lower than anticipated increase in customer base following the AcuSport Transaction magnified the adverse effects of the market factors discussed above and resulted in a faster than expected tightening of the Debtors’ liquidity and overall deterioration of the Debtors’ financial condition.

The company then ran into issues with its pre-petition lenders and its vendors and the squeeze was on. Recognizing that time was wearing thin, the company hired Houlihan Lokey Inc. ($HLI) to market the assets. No compelling offers came, however, and the company determined that a chapter 11 filing “to pursue an orderly liquidation…was in the best interest of all stakeholders.”

R.I.P. Sportco.

*****

But not before you get in one last fight.

The glorious thing about first day papers is that they provide debtors with the opportunity to set the tone in the case. The First Day Declaration, in particular, is a narrative. A narrative told to the judge and other parties-in-interest about what was, what is, and what may be. That narrative often explains why certain other requests for relief are necessary: that is, that without them, there will be immediate and irreparable harm to the estate. The biggest one of these is typically a request for authority to tap a committed DIP credit facility and/or cash collateral to fund operations. On the flip side of that request, however, are the company’s lenders. And they often have something to say about that — objections over, say, the use of cash collateral are common.

But you don’t often see an objector re-write the entire frikken narrative and file it prior to the first hearing in the case.

Shortly after the bankruptcy filing, Prospect Capital Corporation (“PCC”), as the second lien term loan agent, unleashed an objection all over the debtors. Per PCC:

Just a few years ago, the Debtors were the largest distributor of firearms in the United States, with reported annual revenue of in excess of $770 million. Contrary to the First Day Declaration filed in these cases, the Debtors’ demise was not due to outside forces such as the “2016 presidential election,” “disruptions in the industry” and “natural disasters. Rather, as a result of dividend recapitalization transactions in 2012 and 2013, the Debtors’ equity owner, Wellspring Capital, “cashed out” in excess of $183 million. After lining their pockets with over $183 million, fiduciaries appointed by Wellspring Capital to be directors and officers of the Debtors grossly mismanaged the business and depleted all reserves necessary to weather the storms and the headwinds the business would face. In a short time, the business went from being the largest firearms distributor in the United States to being liquidated. As a result of years of mismanagement and the failure of the estates’ fiduciaries to preserve value, the Second Lien Lenders will, in all likelihood, recover only a small fraction of their $249.7 million secured loan claim. Years of mismanagement ultimately placed the Debtors in the position where they are in now….

This sh*t just got much more interesting: y’all know we love dividend recapitalizations. Anyway, PCC went on to object to the fact that this is an in-court liquidation when an out-of-court process would be, in their view, cheaper and just as effective; they also object to the debtors’ proposed budget and use of cash collateral. The upshot is that they see very little chance of recovery of their second lien loan and want to maximize value.

Of course, the debtors be like:

The numbers speak for themselves, they replied. They were $X of revenue between 2012 and 2016 and then, after Trump was elected, they’ve been $X-Y%. Plain and simple.

So where does this leave us? After some concessions from the DIP lenders and the debtors, the court approved the debtors requested DIP credit facility on an interim basis. The order preserves PCC’s rights to come back to the court with an argument related to cash collateral after the first lien lenders (read: the banks) are paid off in full (and any intercreditor agreement-imposed limitations on PCC’s ability to fight fall away).

Ultimately, THIS may sum up this situation best:

It’s genuinely difficult to pick the most villainous company in this story. Is it the company selling guns who made a big bet on people’s deepest fears and insecurities and then shit the bed? The private equity company bleeding the gun distributor dry and then running it straight into the ground? Or the other private equity company that is now mad it likely won’t get anything near what it paid out in the original loan to the distributor? Folks...let them fight.

Jurisdiction: D. of Delaware (Judge Silverstein)

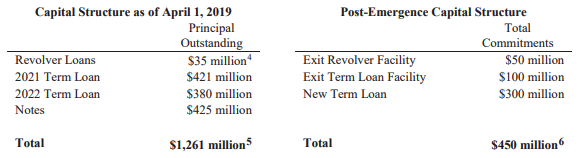

Capital Structure: $23.1mm ABL, $249mm term loan (Prospect Capital, Summit Partners)

Professionals:

Legal: McDermott Will & Emery LLP (Timothy Walsh, Darren Azman, Riley Orloff) & (local) Polsinelli PC (Christopher Ward, Brenna Dolphin, Lindsey Suprum)

Board of Directors: Bradley Johnson, Alexander Carles, Justin Vorwerk

Financial Advisor/CRO: Winter Harbor LLC (Dalton Edgecomb)

Investment Banker: Houlihan Lokey Inc.

Claims Agent: BMC Group (*click on the link above for free docket access)

Other Parties in Interest:

DIP Agent: Bank of America NA

Legal: Winston & Strawn LLP (Daniel McGuire, Gregory Gartland, Carrie Hardman) & (local) Richards Layton & Finger PA (John Knight, Amanda Steele)

Agent for Second Lien Lenders: Prospect Capital Corporation

Legal: Olshan Frome Wolosky LLP (Adam Friedman, Jonathan Koevary) & (local) Blank Rome LLP (Regina Stango Kelbon, Victoria Guilfoyle, John Lucian)

Prepetition ABL Lenders: Bank of America NA, Wells Fargo Bank NA, Regions Bank NA

Large equityholders: Wellspring Capital Partners, Summit Partners, Prospect Capital Corporation

Official Committee of Unsecured Creditors (Vista Outdoor Sales LLC, Magpul Industries Corporation, American Outdoor Brands Corporation, Garmin USA Inc., Fiocchi of America Inc., FN America LLC, Remington Arms Company LLC)

Legal: Lowenstein Sandler LLP (Jeffrey Cohen, Eric Chafetz, Gabriel Olivera) & (local) Morris James LLP (Eric Monzo)

Financial Advisor: Emerald Capital Advisors (John Madden)

Update 7/7/19 #115